Simplify Payroll, Amplify Your Impact

Overwhelmed by spreadsheets or costly payroll services? With TaxBandits, our sister product, we simplify payroll for nonprofits

making a difference, so that you can focus on your mission.

Save Time on Payroll Management

Maintain Accurate and Organized Records

Generate Paystubs

Anytime

Secure Direct

Deposit

Effortless setup for nonprofits

- Quick Start: Set up your nonprofit payroll in minutes — no lengthy configurations or delays.

- Smart Onboarding: Add employees manually or invite them to complete their own profiles securely.

- Built-in Form Requests: Request and collect W-4 and W-9 forms digitally with instant e-sign options.

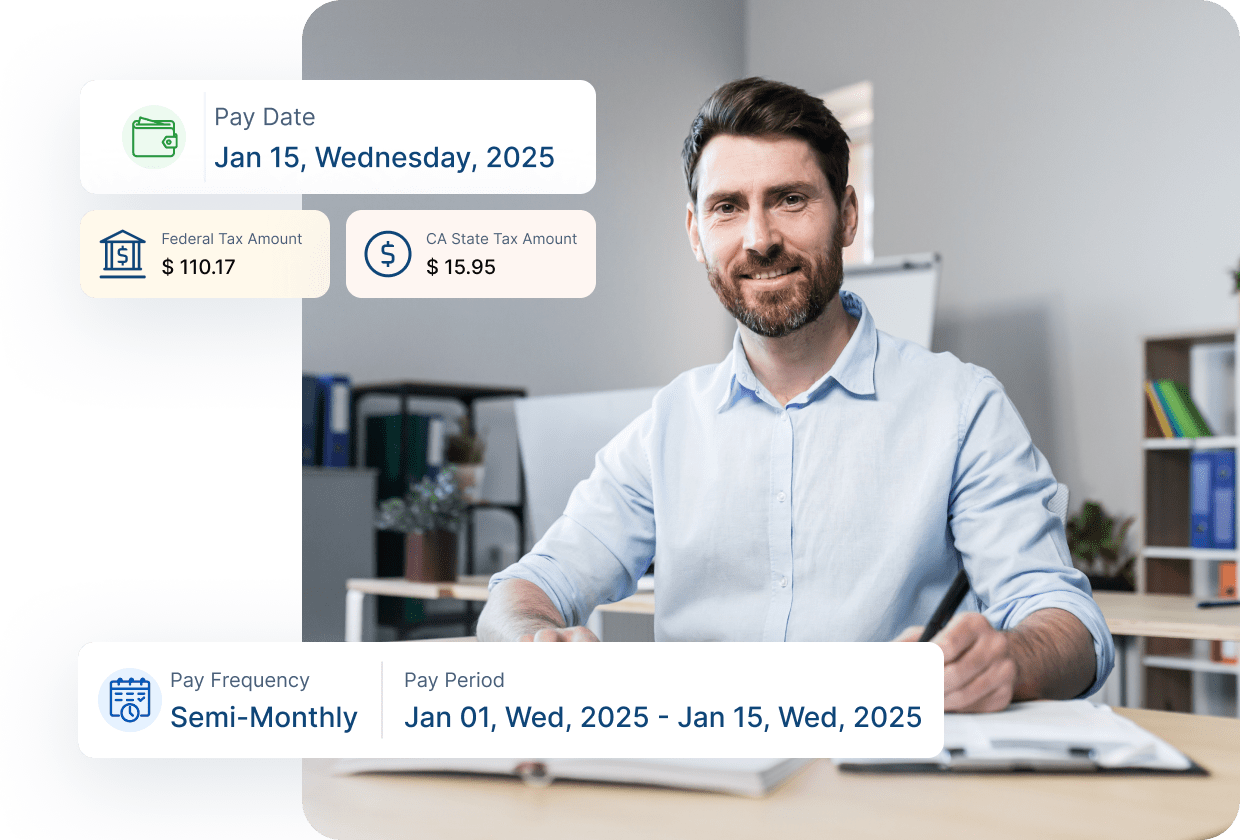

Run payroll your way

- Unlimited Payroll Runs: Process payroll for any number of employees and contractors, anytime you need.

- Instant Pay Stubs: Generate detailed pay stubs automatically for each pay period.

- Integrated Retirement Contributions: Add and track SIMPLE IRA or other plan contributions directly within payroll.

Always accurate, always compliant

- Automatic Tax Calculations: Taxes are calculated precisely for every run — no manual updates required.

- Real-Time Tax Rate Updates: Stay compliant effortlessly with automatic federal and state rate adjustments.

- Trusted Payroll Engine: Built on a proven payroll tax system designed specifically for nonprofits.

A secure space for every employee

- Self-Service Portal: Employees can update details, access pay history, and download year-end tax forms (W-2 or 1099).

- E-Sign Convenience: Allow employees to sign payroll and tax forms electronically in seconds.

- 24/7 Access: Employees can securely view their pay information and tax forms anytime, from any device.

You Don’t Need Another Platform for Payroll Tax Compliance

Federal payroll filing and payments are on us — state compliance is just as simple to add. Expand your free payroll solution with optional state filing and payment services that make end-to-end compliance effortless.

Federal Filings & Payments

Your federal payroll tax forms (941, 940, 943, and 944) and payments are automatically prepared, calculated with precision, and submitted directly to the IRS — free of charge when you have filed with Tax990.

State Filings & Payments

Extend your coverage with optional state-level filing and payment support. We ensure timely submission and compliance with each state’s unique requirements.