Form 990-PF Instructions - How to Fill Out Form 990-PF?

- Updated August 30, 2024 - 2.00 PM - Admin, Tax990

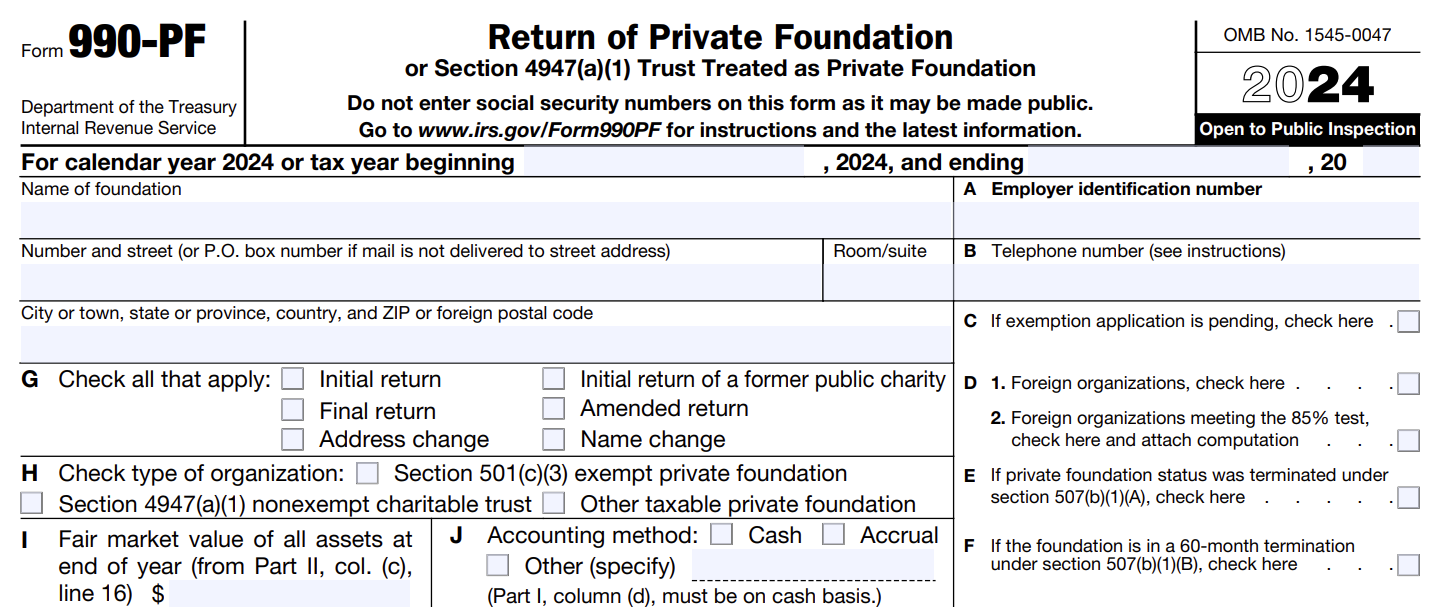

Form 990-PF is an IRS form that private foundations must file annually to report their financial information and activities during the corresponding tax year.

Generally, Form 990-PF is due by the 15th day of the 5th month from the organization's accounting period ending. For organizations following the calendar tax year, the 990-PF deadline is May 15. If you need more, you can file Form 8868 now to get a 6-month automatic extension.

Tax990 offers a simple solution to e-file your 8868 extension with ease. E-file 8868 Now

This article comprises step-by-step instructions on how to fill out your Form 990-PF.

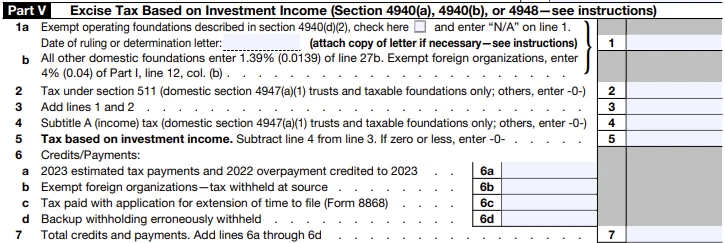

Part V - Excise Tax Based on Investment Income

Complete this section only if your private foundations is subject to excise tax under Sections 4940(a), 4940(b), or 4948.

-

Lines 1a and 1b:

For exempt operating foundations described in section 4940(d)(2), check the box and enter "N/A" on Line 1. For all other domestic foundations, enter 1.39% (0.0139) of Line 27b. For exempt foreign organizations, enter 4% (0.04) of Part I, Line 12, Column (b).

-

Lines 2 - 5:

Enter the amount of tax under section 511 and the tax based on the investment income.

-

Lines 6a to 6c:

Report estimated tax payments and credits, tax withheld for exempt foreign organizations, tax paid with extension applications, and backup withholding that was erroneously withheld.

-

Lines 7 to 11:

Enter the data regarding the total credit payment, penalty, tax due, and overpayment.

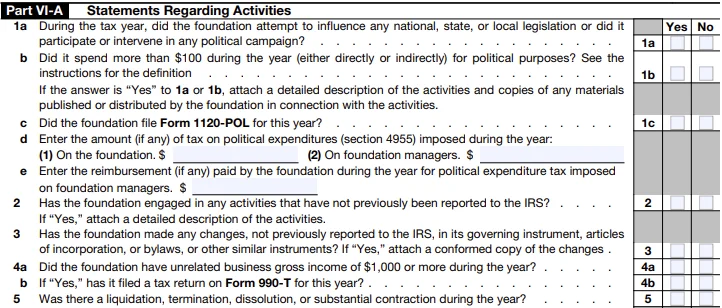

Part VI-A - Statements Regarding Activities

This section determines your organization’s additional filing requirements based on your financials and activities.

-

Lines 1 to 16:

- Answer the questions regarding your foundation’s political activities and expenditures, unrelated business income, substantial contributors & other information.

- Mention whether your foundation filed Form 1120-POL or Form 990-T for this year.

- Also, enter the states to which the foundation reports or with which it is registered.

When to File Form 990-T?

If your foundation has a gross income of $1,000 or more from unrelated businesses for the tax year, you must

file Form 990-T.When to File Form 1120-POL?

If your organization has any kind of political taxable income, you should file Form 1120-POL

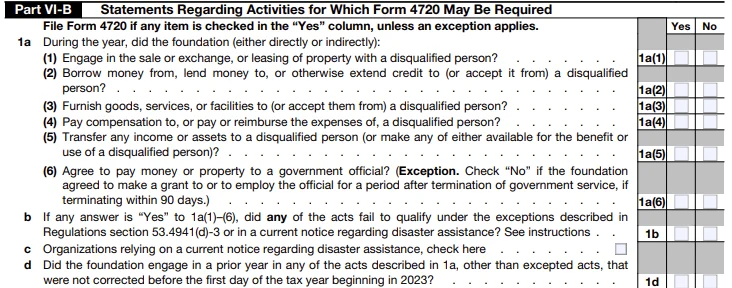

Part VI-B - Statements Regarding Activities for Which Form 4720 May Be Required:

This section determines whether your foundation needs to file Form 4720.

-

Lines 1 to 8:

Answer "Yes" or "No" to the questions regarding your foundation’s activities. If you answer "Yes" to any question, you must file Form 4720 to report and calculate any taxes imposed under sections 4941, 4942, 4943, 4944, and 4945 unless an exception applies.

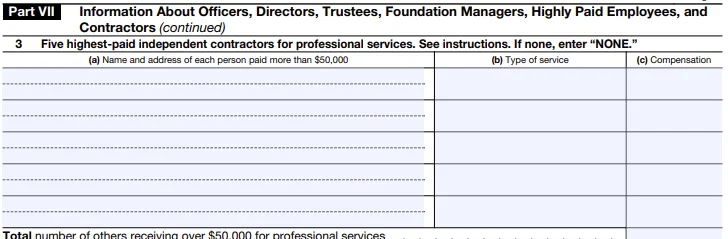

Part VII - Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors

This section requires details of your foundation’s Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors.

-

Line 1:

- Provide the following details for each officer, director, trustee, and foundation manager:

a. Name and Address

b. Title and Average Hours Per Week

c. Compensation

d. Contributions to Employee Benefit Plans and Deferred Compensation

e. Expense Accounts and Other Allowances

-

Line 2:

- Add compensation details for the five highest-paid employees, excluding those reported in Line 1. If there are no additional employees to report, enter "NONE".

-

At the bottom of the table, you need to enter the total number of employees who are paid more

than $50,000.

-

Line 3:

- Enter the following details for the five highest-paid independent contractors who provided professional services, excluding those reported above. If none, enter "NONE".

a. Name and address of each independent contractor paid more than $50,000.

b. Type of Service

c. Compensation

- Enter the total number of other contractors receiving over $50,000 at the bottom.

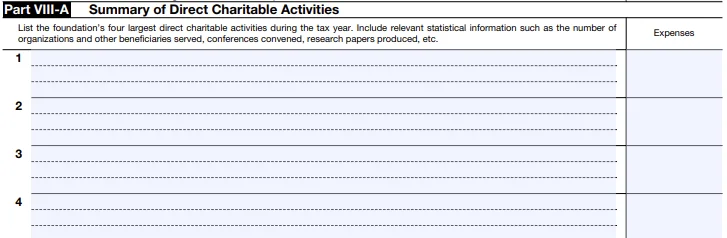

Part VIII-A - Summary of Direct Charitable Activities

Include a description of the foundation’s four largest direct charitable activities conducted during the tax year. Include relevant statistical information, such as the number of organizations and other beneficiaries served. For each activity, add the expenses made in the corresponding fields.

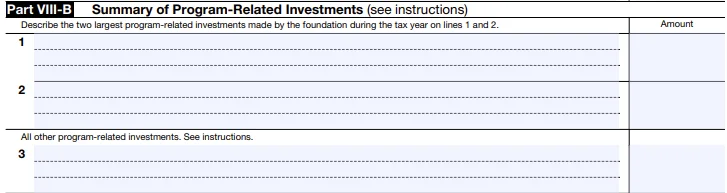

Part VIII-B - Summary of Program-Related Investments

Report the two largest program-related investments made during the tax year. Provide details that demonstrate how these investments further the foundation's exempt purposes. Enter the invested amount on each program. At the bottom, enter the total amount invested, adding through each line.

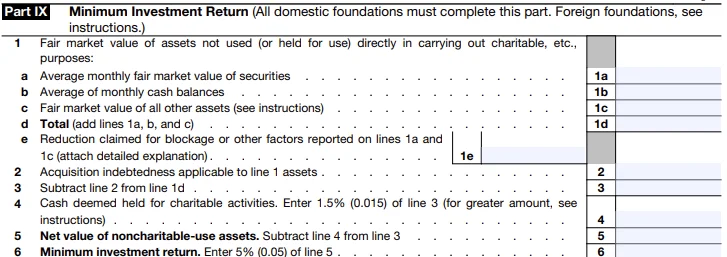

Part IX - Minimum Investment Return:

All the foundations except the foreign foundations described in section 4948(b) that aren't claiming operating foundation status should complete this part.

-

Lines 1a to 1e:

Provide details about the Fair Market Value (FMV) for different assets of your foundation.

-

Lines 2 to 4:

Enter the Acquisition indebtedness applicable to assets not used (or held for use) and the cash deemed held for charitable activities.

-

Lines 5 and 6:

Using this information, derive the Net value of noncharitable-use assets and Minimum investment return.

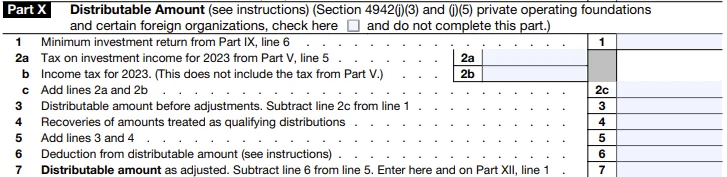

Part X - Distributable Amount

This part must be completed by all foundations except:

- Foreign foundations described in section 4948(b).

- Foundations that claim operating foundation status.

-

Lines 1-7:

Using the minimum investment return, investment income of the tax year, and recoveries, calculate the distributable amount that must be distributed by year-end to avoid the 30% tax on undistributed income.

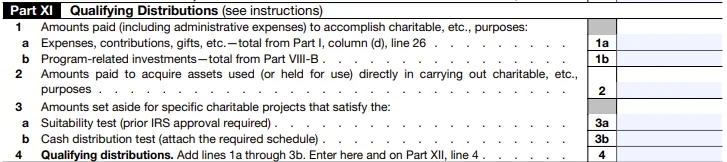

Part XI - Qualifying Distributions:

Qualifying distributions are amounts allocated for religious, educational, or similar charitable purposes.

-

Lines 1a and 1b:

Enter the value for expenses, contributions, gifts, and program-related investments

-

Line 2:

Enter the amounts paid to acquire assets used (or held for use) directly in carrying out charitable activities.

-

Line 3:

Enter the amounts set aside for specific charitable projects that meet the Suitability test and Cash distribution test.

-

Line 4:

Calculate and enter the qualifying distributions based on the information reported above.

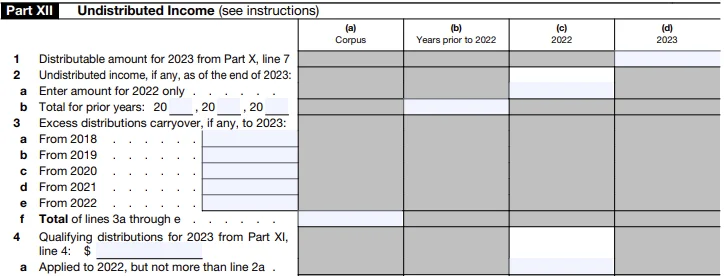

Part XII - Undistributed Income

If you’ve checked item D2 on page 1 or a foundations claiming operating foundation status for any of the years covered do not need to complete Part XII for those years.

In this section, you’re required to provide the following details for each line if applicable,

(a) Corpus

(b) Years Prior to 2022

(c) For 2022

(d) For 2023

-

Lines 1 and 2:

Distributable amount for 2023 and cumulative undistributed income from prior years.

-

Lines 3a to 3f:

Excess distributions carryover to 2023 from 5 prior years, and the total amount of excess distributions carried over.

-

Lines 4 and 4a to 4b:

Enter the qualifying distributions for 2023 from Part X, and the amount spent on each category mentioned. Then, enter the remaining amount distributed apart from the corpus.

-

Line 5:

The amount of excess distributions carryover from prior years that has been applied to the 2023 distributions.

-

Lines 6a to 6f:

Enter the net amount of corpus remaining after adding excess distributions carryover, distributions treated as coming from corpus, and remaining corpus distributions, and subtracting any amounts applied to excess distributions carryover.

-

Lines 7:

Enter the amount treated as distributions out of corpus as per 170(b)(1)(F) or 4942(g)(3).

-

Lines 8 to 10:

Add the details of the excess distributions carried over from 2018.

Calculate the distribution carryover to 2024 and fill out the details to help you analyze the excess from 2019 to 2023 tax years.

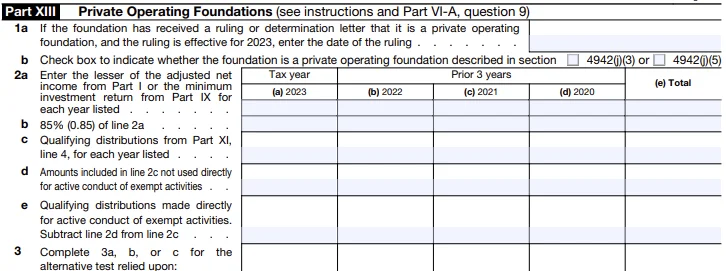

Part XIII - Private Operating Foundations:

If your foundation is claiming operating foundation status, you are required to complete this part.

-

Lines 1a and 1b:

Enter your private foundation’s ruling or determination date and mention the section under which the foundation is described (section 4942(j)(3) or 4942(j)(5)).

-

Lines 2a to 2e:

Provide details about the distribution requirements.

-

Lines 3a to 3c:

Complete the alternative test for private operating foundation status which includes the test for assets, endowment and support. This section can be completed by entering the required information for the current and past three tax years and summing up the entries.

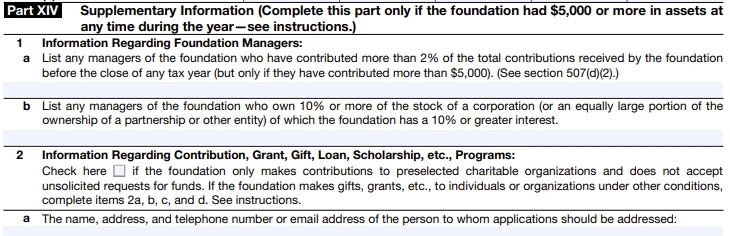

Part XIV - Supplementary Information:

You are required to complete this part only if your foundation has $5,000 or more in assets at any time during the year.

-

Lines 1a to 1b:

Provide information about the foundation, managers, contributions, grants, and similar programs.

-

Lines 2a to 2d:

Enter the information regarding any contributions, grants, gifts, loans, scholarships, and other related programs of the tax year.

-

Lines 3a to 3b:

Here you have to provide details about the grants and contributions paid during the year or approved to be paid and the corresponding total.

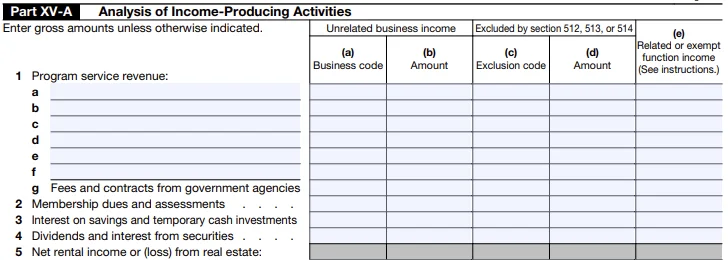

Part XV-A - Analysis of Income-Producing Activities:

This section requires you to provide a summary of income generated from sources and through various activities.

-

Lines 1 to 13:

Provide details about program service revenue, membership dues and assessments, interest on savings and temporary cash investments, dividends, and various other incomes.

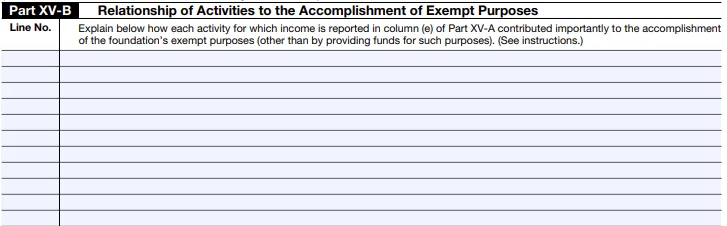

Part XV-B - Relationship of Activities to the Accomplishment of Exempt Purposes:

In this part, you are required to provide an explanation of how each activity reported in column (e) of Part XV-A contributed importantly to the accomplishment of the foundation’s exempt purposes (other than by providing funds for such purposes).

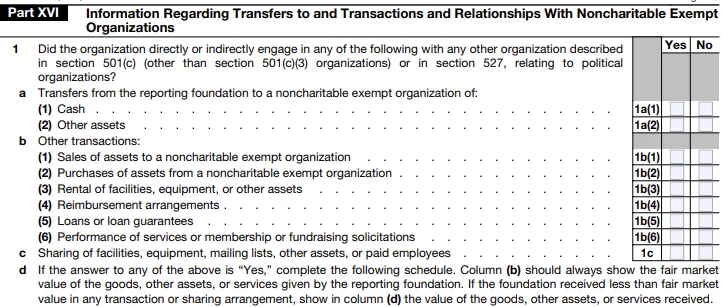

Part XVI - Information Regarding Transfers to and Transactions and Relationships With Noncharitable Exempt Organizations:

This part requires you to report the details regarding the transfers and transactions and other transactions.

It consists of a series of “Yes” or “No” questions.

-

Line 1:

Mention if your foundation (directly or indirectly) is involved in any transfers from the reporting foundation to a noncharitable exempt organization of cash, other assets, other transactions, sharing of facilities, equipment, mailing lists, other assets, or paid employees.

-

Line 2:

Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described in section 501(c) (other than section 501(c)(3)) or in section 52.

If “Yes”, the organization has to fill in the information

-

(a) Name of organization

(b) Type of organization

(c) Description of relationship

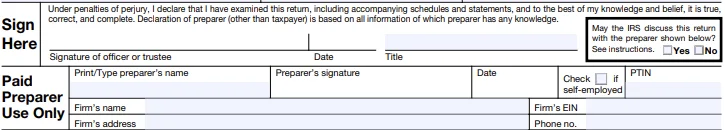

Signature and Paid Preparer:

After filling out the required details, make sure that your return is signed and authorized by one of your organization’s officers such as President, Vice president or other authorized members.

If your Form 990-PF is prepared by a paid preparer, their details can be provided.

Additional Filing Requirements for Form 990-PF

The private foundations that file Form 990-PF may be required to provide additional information regarding the contributions they receive by filing Schedule B.

If your foundation receives $5000 or more contributions from any one contributor during the tax year, you should include Schedule B with your Form 990-PF.

Simplify your 990-PF filing with Tax 990!

Get Started with Tax 990 to prepare and file your Form 990-PF electronically with the IRS.

Tax 990, the IRS-authorized 990 e-filing solution provider, makes your Form 990-PF filing easier than ever with its amazing features.

Choose between form-based and interview-style filing methods at your convenience

When you file Form 990-PF with us, our system will automatically include the applicable 990 Schedules based on the data you enter at no extra cost.

Our Internal Audit Check will ensure the accuracy of your form by reviewing it for any IRS instruction errors before transmission.

We have a live support team ready to assist you via live chat, phone, or email regarding any issues you may have while filing. Our team is available Monday through Friday from 8:30 AM - 5:30 PM EST.

Steps to File Form 990-PF:

Follow these simple steps to file your Form 990-PF electronically with Tax990:

Step 1

Add Organization Details

Enter your foundation details manually or provide your EIN and our system will import the required information from the IRS database.

Step 2

Choose Tax Year and Form

Tax 990 supports filing for the current and previous years. Choose the tax year for which you are filing and select Form 990-PF.

Step 3

Enter Form Data

Enter the required information and complete your Form 990-PF.

Step 4

Review your Form Information

After providing all the required information, review your form and proceed.

Step 5

Transmit directly to the IRS

Once you have reviewed your form and verified your information, you can transmit your Form 990-PF

to the IRS.