The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax

Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? We’ve got your back with a complimentary Form 8868 – simply file it to get extra time.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Faster, Easier 990 E-Filing

Tired of complicated tax filing? Tax990 is here to simplify the process, making filing your 990 easy and stress-free!

Flexible Preparation Options

Fill out your form manually using the form-based method or choose our guided, step-by-step interview-style filing.

Import Last Year's Data

from IRS

Seamlessly transfer your prior year's return data into your current form straight from the IRS registry, no matter where it was filed earlier.

Internal Audit Check

We check your Form 990 against IRS business rules to help catch common issues before you file.

Share 990 for Review

Easily share returns with your board or team for review and approval before submission.

AI-Powered Assistance

Need help? Our smart assistant can answer questions and guide you at any time—day or night.

World-Class Customer Support

Prefer human help? Our expert team is just a chat, email, or phone call away.

Our intuitive features make filing Form 990 easier than ever

Tools Built Exclusively for Tax Professionals

Tax990 provides exclusive features designed to streamline workflows for paid preparers and EROs managing 990 filings for clients.

Efficient Team Collaboration

Collaborate with your team by assigning tasks to prepare and submit 990 filings efficiently.

Centralized Client Management

Easily handle 990 filings for multiple clients, with a secure portal for return reviews.

Seamless E-Signature Options

Tax990 provides quick and efficient e-signing options for Form 8453-TE and Form 8879-TE.

File More, Save More

Save more on filings with our volume-based pricing while keeping your clients tax-compliant.

Want to discover how Tax990 can enhance your tax practice?

What You’ll Need to File Form 990 Online

Here is all the information you’ll need to file 990 online:

- The organization’s basic information

- Financial information such as revenue, expenses, assets,

and liabilities - Program service accomplishments

- Other IRS filings and tax compliance requirements

- Key personnel, governing body, and management details

Need more help completing the form? Check out our Form 990 instructions

How to File Form 990 Electronically with Tax990?

Create your free account and follow these simple steps to e-file your Form 990 effortlessly!

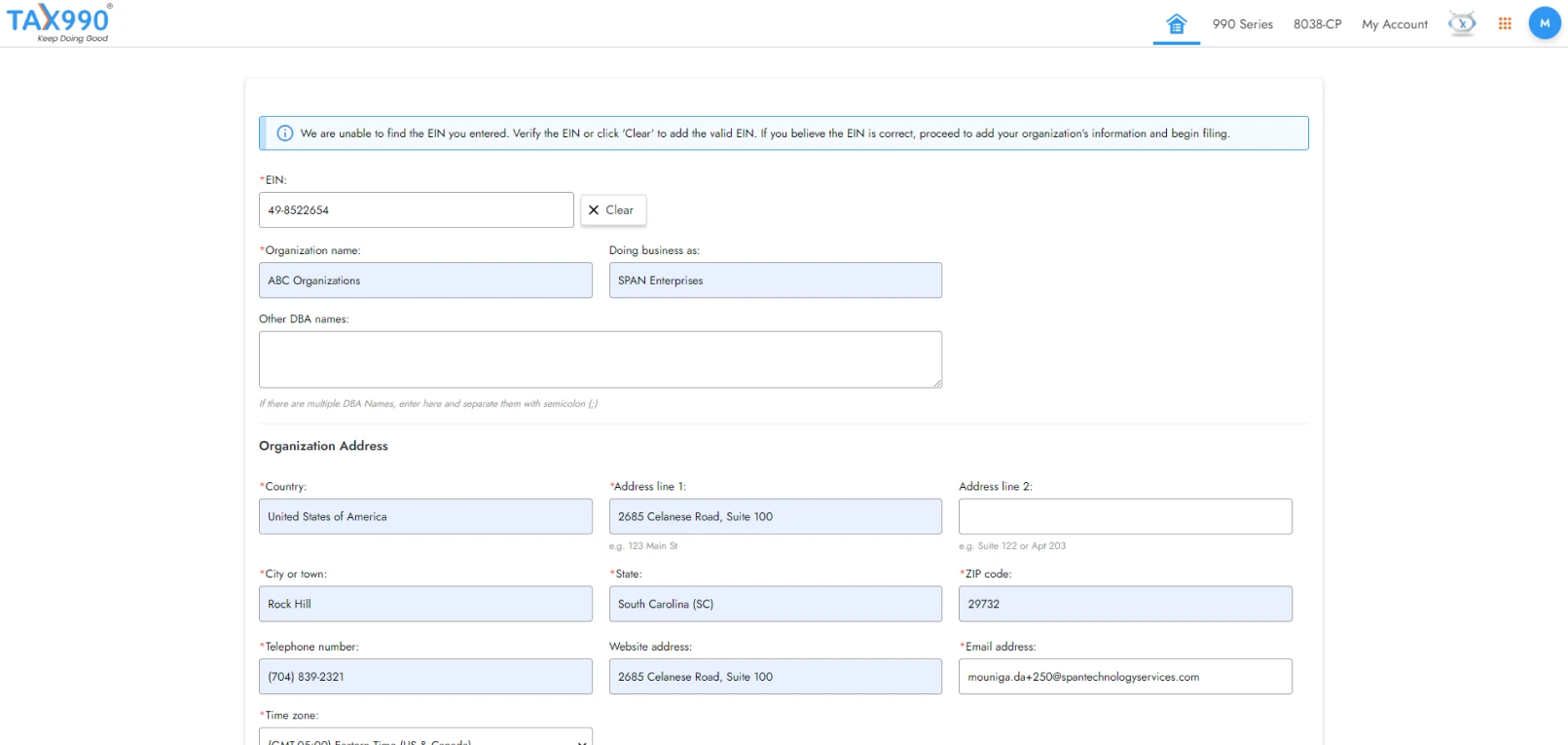

Add Organization Details

Search for your EIN to auto-fill organization details or enter them manually.

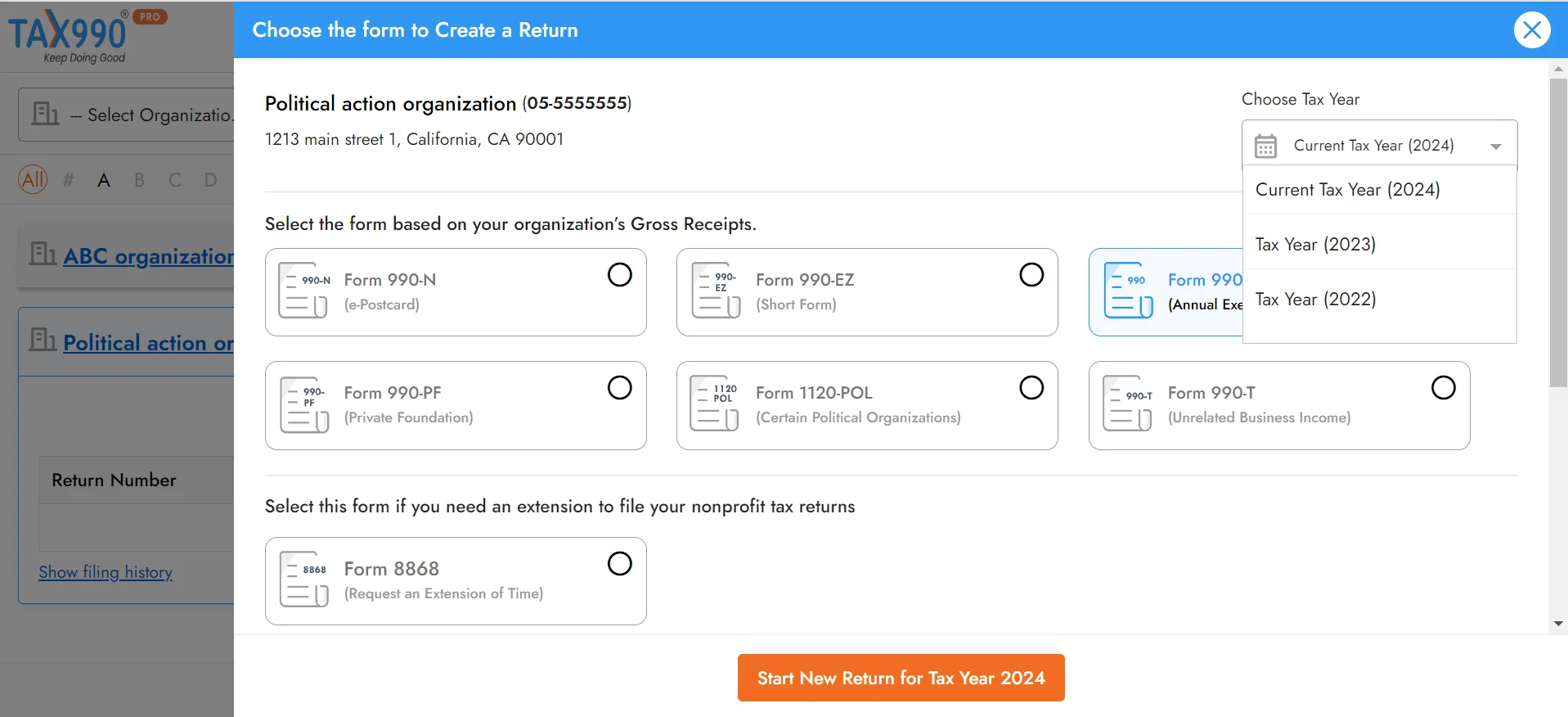

Choose Tax Year and Form

Select Form 990 for the current or prior tax year and proceed.

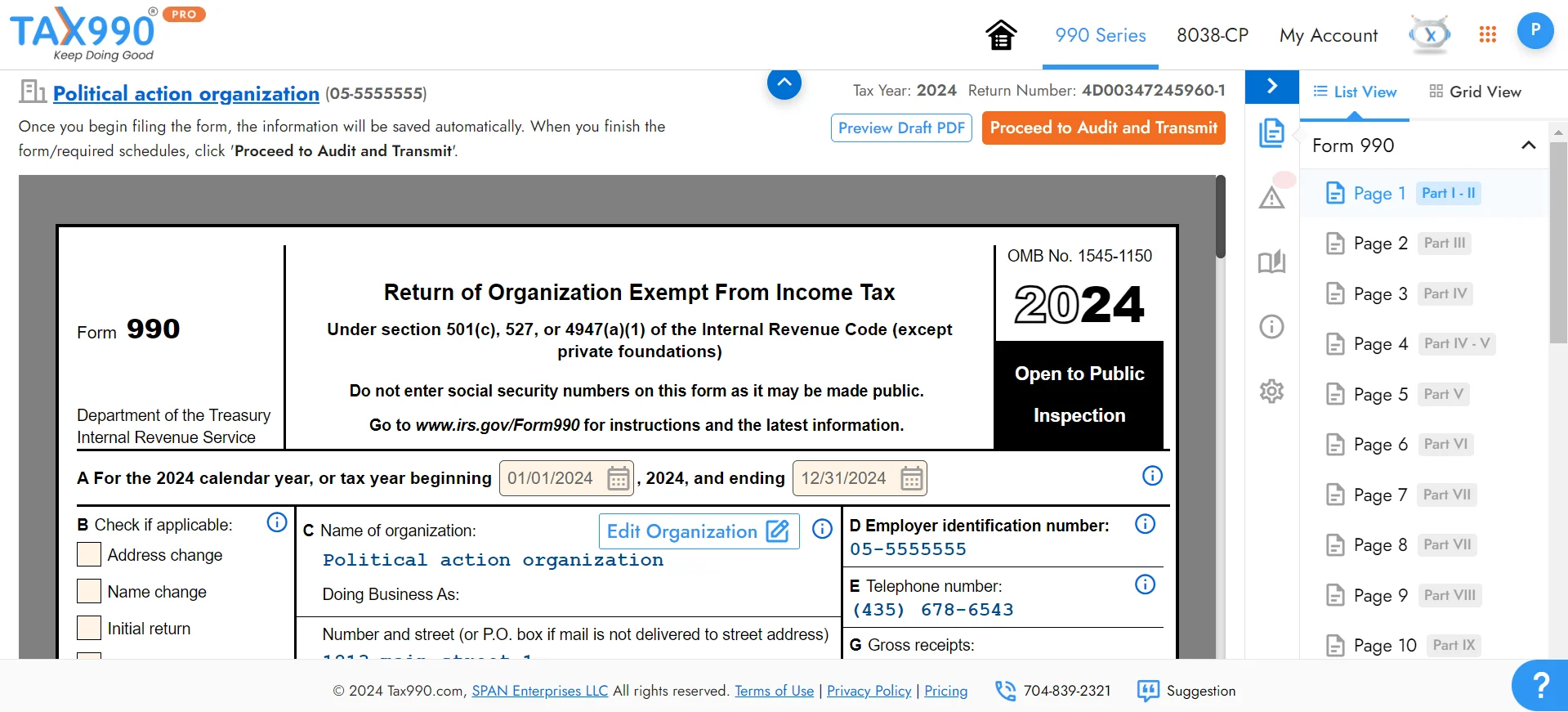

Enter Form 990 Data

Use Form-based or Interview-Style filing to complete your 990.

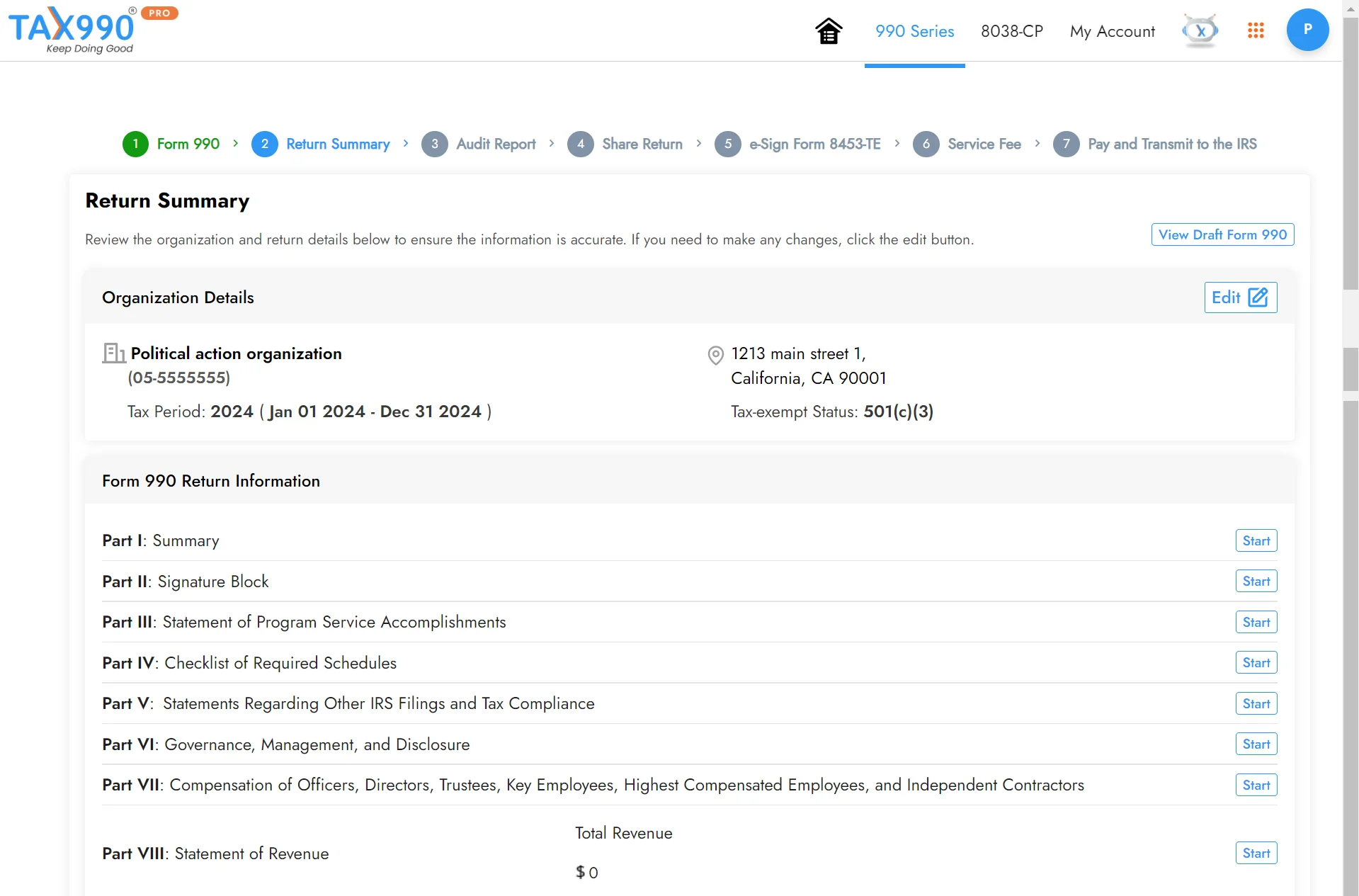

Review your Form Summary

Check your form summary, edit if needed, and share for review/approval.

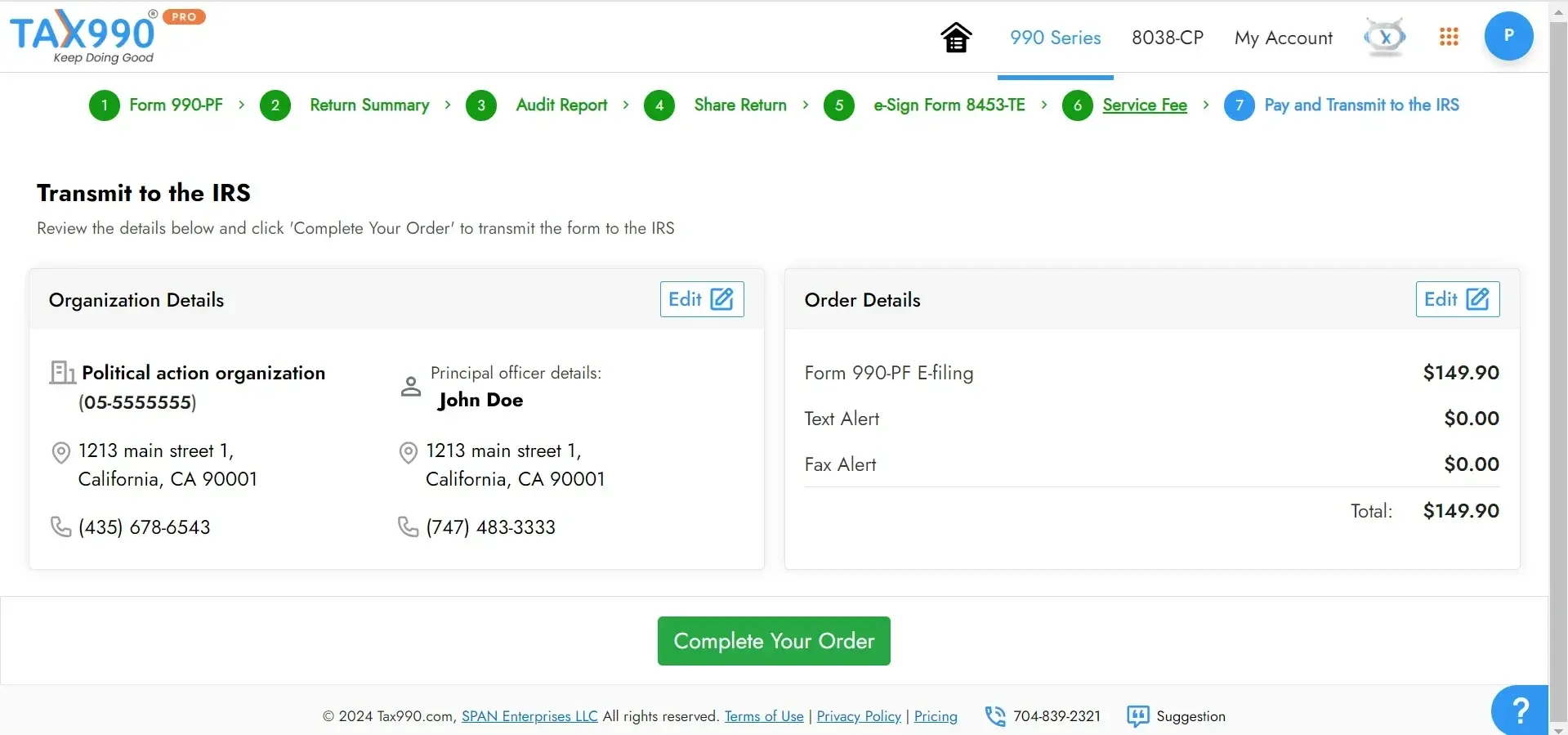

Transmit your Return to the IRS

Transmit your return and get real-time IRS status updates.

Are you ready to file 990 online?

What We Charge to File Form 990 Online with Tax990

$199.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back

File easily and get back to what matters most!

Frequently Asked Questions

What is IRS Form 990?

Form 990 is an annual information return that must be filed by nonprofit organizations, tax-exempt entities, charitable trusts, and section 527 political organizations. It is used to report essential financial data, operational activities, and other information mandated by section 6033 to the IRS.

This form plays a vital role in ensuring organizations remain compliant with IRS regulations and provides transparency to potential donors, offering them insight into the organization's financial health and activities.

Who must file Form 990?

Organizations with gross receipts of $200,000 or more (or) assets of $500,000 or more are required to file Form 990.

When is the deadline to file Form 990?

Form 990 is due by the 15th day of the 5th month after the end of the accounting period. For organizations following the calendar tax year, the

deadline to file Form 990 is May 15th.

Operating on a Fiscal Tax Year? Find your 990 deadline using our due date calculator.

How many parts are there in Form 990?

Here’s the breakdown of Form 990:

- Part I - Summary

- Part II - Signature Block

- Part III - Statement of Program Service Accomplishments

- Part IV - Checklist of Required Schedules

- Part V - Statements Regarding Other IRS Filings and Tax Compliance

- Part VI - Governance, Management, and Disclosure

- Part VII - Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

- Part VIII - Statement of RevenueStatement of Revenue

- Part IX - Statement of Functional Expenses

- Part X - Balance Sheet

- Part XI - Reconciliation of Net Assets

- Part XII - Financial Statements and Reporting

Check out our step-by-step instructions on how to complete Form 990.

What are the additional filing requirements for Form 990?

Organizations filing Form 990 may be required to attach certain schedules for reporting additional information, depending on the details they report. From the 16 Schedules available for Form 990, organizations should attach any and all applicable schedules based on their requirements.

Should Form 990 be filed electronically?

Yes! According to the Taxpayer Act of 2019, the IRS requires organizations to file Form 990 electronically for a tax year ending on or after July 31, 2020.

Get Started with Tax990 and file your Form 990 electronically with the IRS. Supports current (2024) and prior year filings (2022 & 2023).

Can I get an extension to file Form 990?

Yes! If your organization requires additional time to file Form 990, you can submit Form 8868 to request an extension. The IRS grants an automatic 6-month extension if Form 8868 is filed on or before the original due date.

For organizations following a calendar tax year, filing for an extension moves the 990 deadline to November 15.

What are the penalties for filing Form 990 late?

If you do not file Form 990 by the deadline, your organization will incur late filing penalties imposed by the IRS. These penalties range from $25 to $125 per day, depending on your organization’s gross receipts, and they accrue for each day the form is late.

For more information about 990 penalties, click here to learn more.

How do I amend a previously filed 990 return, and what information can I amend?

If your original Form 990 was submitted through Tax 990, all field values from that form will automatically populate the amended form when you select the "Amend this Return" option. To make changes, simply access the relevant section, click ‘edit’, revise the necessary information, and submit the updated form to the IRS.

If you originally filed your Form 990 with a different provider, you can still use Tax990 to file amendments. You will need to enter all required information into the fields manually.

Do I need to file Form 990 if my tax-exempt status was revoked?

Organizations that have not submitted the required Form 990 series returns for three consecutive years and have consequently lost their tax-exempt status must apply for reinstatement.

Once your reinstatement application has been processed, you can submit your Form 990 to the IRS, indicating that your reinstatement application is currently pending.

What is the difference between Form 990 and Form 990-PF?

Form 990 must be filed by tax-exempt organizations with gross receipts of $200,000 or more or total assets of $500,000 or more. On the other hand, Form 990-PF is specifically designated for private foundations.

What is a no-cost amendment?

At Tax990, we know that mistakes can occasionally happen when filing your 990. That’s why, as part of the Tax990 Commitment to accuracy, transparency, and peace of mind, we offer No-Cost Amendments.

If you filed your original Form 990 with us and later discover an error after the IRS has accepted it, you can file a corrected return without paying any additional fees—up to 3 times.

Helpful Resources

Form 990 Instructions

Get step-by-step instructions to complete your form.

Form 990 Schedules

Find out more about Form 990 Schedules

Form 990 Due Date

Learn more about the 990 deadlines and how to avoid penalties.

Form 990 Due Date Calculator

Find out when 990 is due for your organization

Form 990 Finder

Find out the right 990 Form for your organization

Form 990 Penalties

Check out the penalty rates for late filing of the 990

Helpful Videos