Schedule D for Form 990 - Supplemental Financial Statements

- Updated August 14, 2023 - 2.00 PM - Admin, Tax990

According to IRS filing requirements, nonprofit organizations that file Form 990 may be required to attach Schedule D for reporting additional information regarding their financial status.

This article discusses the purpose of, filing requirements for, and instructions to complete Schedule D.

Table of Contents

What is the Purpose of Form 990 Schedule D?

Schedule D is used to report required details regarding donor-advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

Who Must File Form 990 Schedule D?

Schedule D must be included with Form 990 under the following conditions

If the organization answers “Yes” to any of the questions between lines 6 and 12a on Part IV (Checklist of Required Schedules) of Form 990.

Note:

If the organization answers “Yes” to line 12b on Part IV (Checklist of Required Schedules) of Form 990, they can complete Parts XI and XII of Schedule D voluntarily.

How to Complete Schedule D for Form 990?

Schedule D consists of 13 parts. Based on the information you reported on your Form 990, you organization is required to complete the applicable parts.

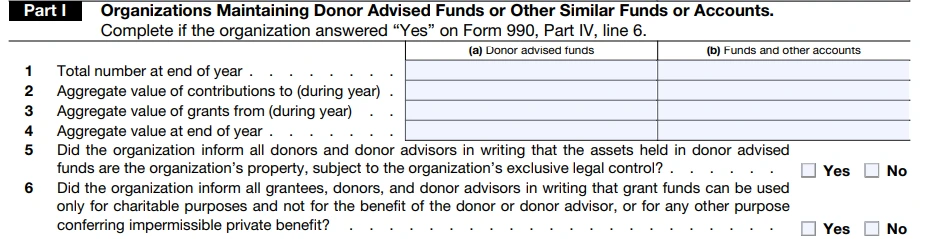

Part I - Organizations Maintaining Donor-Advised Funds or Other Similar Funds or Accounts

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 6.

Donor-advised fund is a fund or account maintained and controlled by sponsoring organizations (generally section 501(c)(3) organizations) that comprises of contributions made by donors.

If you are a sponsoring organization, report details regarding all the donor-advised funds maintained by your organization during the corresponding tax year. Also, provide any other similar funds maintained by your organization.

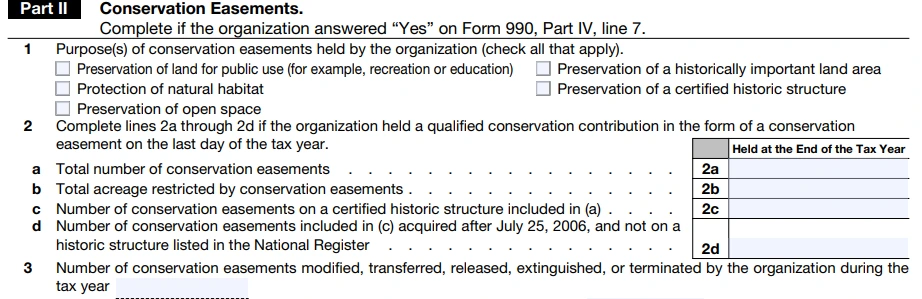

Part II - Conservation Easements

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 7.

Provide details regarding the conservation easements held by your organization (if any) for any of the following purposes:

- Preservation of land for public use (for example, recreation or education)

- Preservation of a historically important land area

- Protection of natural habitat

- Preservation of a certified historic structure

- Preservation of open space

Also, report how the monitoring, inspection, handling of violations, and enforcement are managed by your organization.

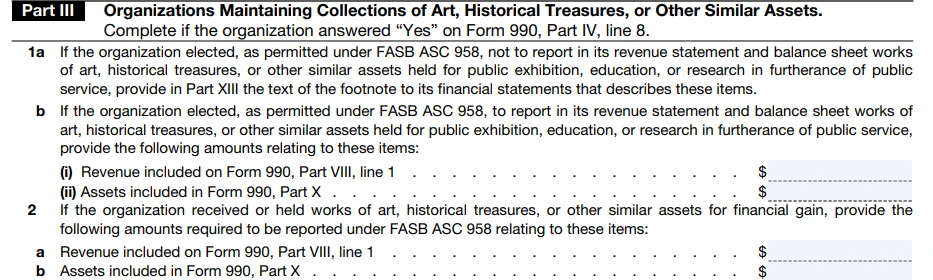

Part III - Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 8.

Note:

Organizations that don't maintain collections as described in FASB ASC 958 aren't required to complete Part III.

Provide details regarding the items held by your organization for public exhibition, education, or research in furtherance of public service and explain how they further your organization’s exempt purposes.

Also mention the revenue and asset values that need to be reported under FASB ASC 958 relating to these items.

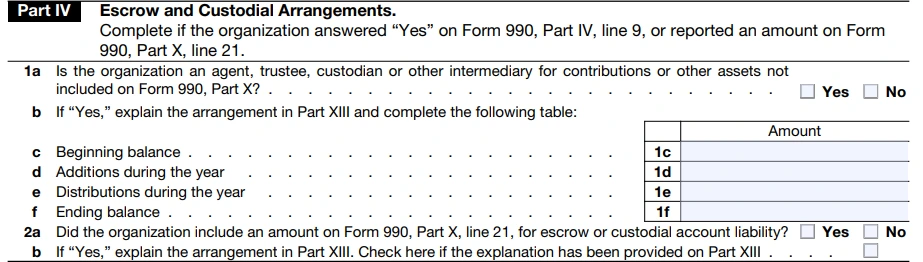

Part IV - Escrow and Custodial Arrangements

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 9.

If your organization acts as an agent, trustee, custodian, or other intermediary for any contributions or assets, report the required details in the table provided and provide an explanation in Part XIII.

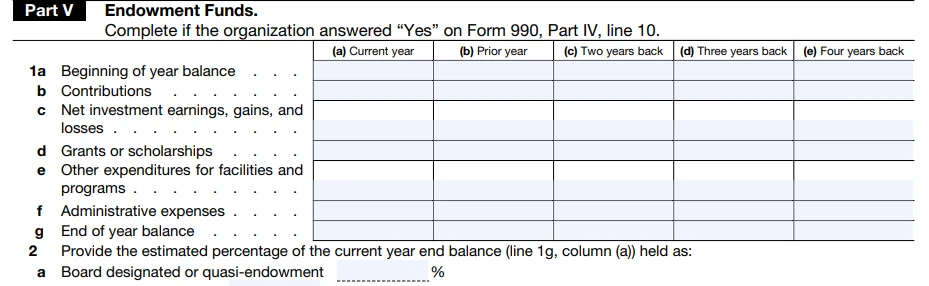

Part V - Endowment Funds

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 10.

Report the details regarding the Contributions, Net investment earnings, gains, losses, and other amounts held as endowment funds by your organization during the current year and four prior years.

Also, report the endowment funds held by other related and unrelated organizations, if any.

The endowment fund reported should be in relation to

- Your organization’s aggregate of the donor-restricted assets

- Organizations operated exclusively to promote one or more exempt purposes of your organization

- Organizations that hold endowment funds for your organization’s benefit.

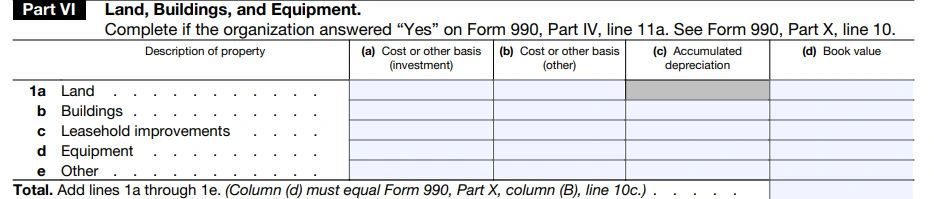

Part VI - Land, Buildings, and Equipment

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 11a, and reported an amount other than zero on part X line 10a.

Report the cost or other basis, accumulated depreciation, and book values of land, buildings, leasehold improvements, equipment, and other assets held for investment or other purposes.

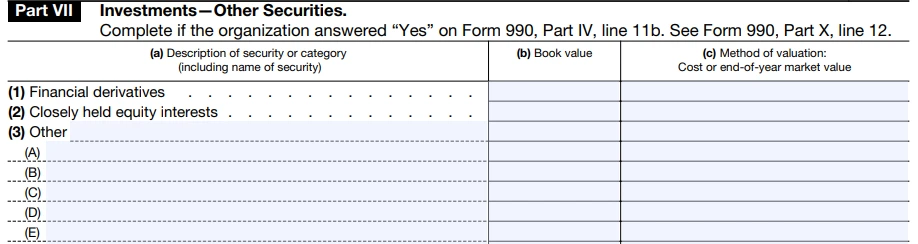

Part VII - Investment - Other Securities

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 11b (or) reported an amount on Part X, line 12 (column B), that is, 5% or more of the total assets reported on Part X, line 16 (column B).

Describe the investments made by your organization towards various securities and report the book value and the end-of-the-year market value of each of them.

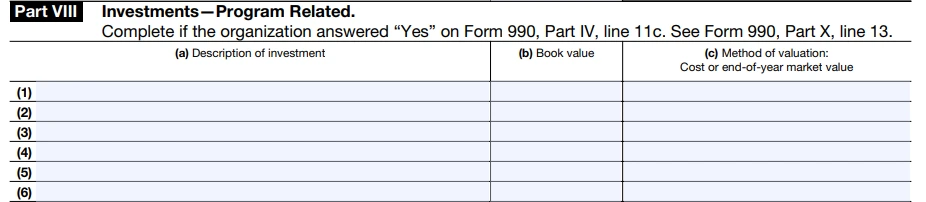

Part VIII - Investment - Program Related

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 11c (or) reported an amount on Part X, line 13 (column B), that is 5% or more of the total assets reported on Part X, line 16 (column B).

Describe the investments made by your organization to accomplish the exempt purposes and report the book value and the end-of-the-year market value of each of them.

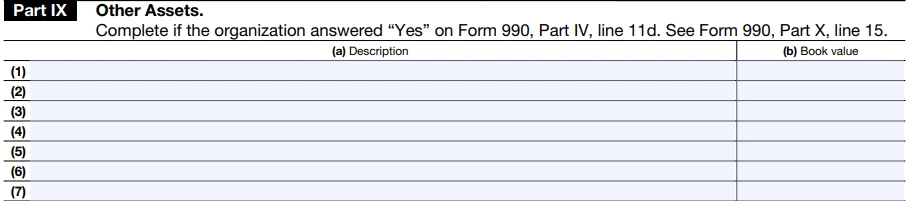

Part IX - Other Assets

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 11d (or) reported an amount on Part X, line 15 (column B), that is 5% or more of the total assets reported on Part X, line 16 (column B).

Provide a description of assets held by your organization and report the book value of each of them. You can classify the assets on any reasonable basis.

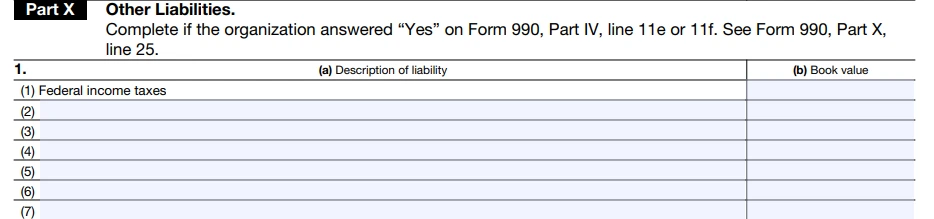

Part X - Other Liabilities

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 11e or 11f (or) reported an amount on Part X, line 25 (or) had financial statements for the tax year with a footnote about the organization's liability for uncertain tax positions.

Provide a description of liabilities that your organization has (including Federal income taxes) and the other amounts owed by your organization.

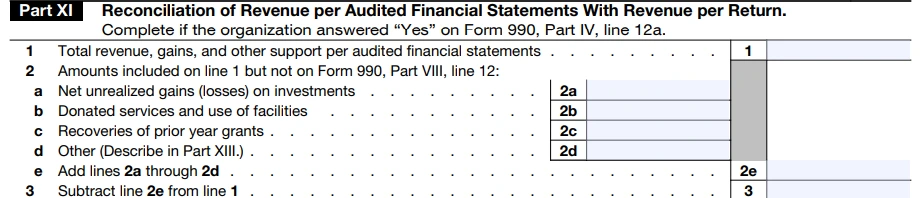

Part XI - Reconciliation of Revenue per Audited Financial Statements With Revenue per Return

This part should be completed by organizations that answered “Yes” on 990 form, Part IV, line 12a.

Note:

If your organization didn’t receive audited financial statements, you are not required to complete this part.

Enter the revenue, gains, and other support reported on your organization’s audited financial statements and reconcile that data with the revenue reported on your organization's Form 990.

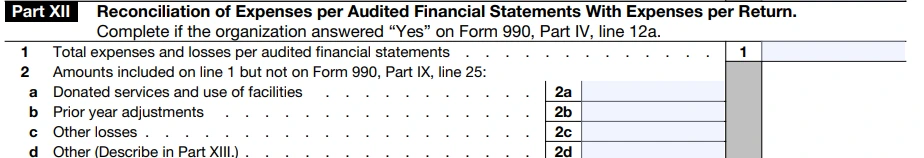

Part XII - Reconciliation of Expenses per Audited Financial Statements With Expenses per Return

This part should be completed by organizations that answered “Yes” on Form 990, Part IV, line 12a.

Note:

If your organization didn’t receive audited financial statements, you are not required to complete this part.

Similar to the previous part, enter the expenses of your organization as reported on audited financial statements and reconcile that data with the expenses reported on your Form 990.

Part XIII - Supplementary Information

In this part, you are required to provide additional information regarding the answers you provided for some of the lines in previous parts.

This space can also be used to provide any other explanation for other lines on Schedule D.

Tax 990 Automatically Includes Schedules D with your 990 Form for Free!

Our system will automatically include all your required Schedules based on the information you provide at no extra cost.

Your 990 filings will be made easier than ever with the exclusive features of Tax 990.

Prepare your forms with complete ease using Form-Based or Interview-Style filing options.

Invite users to assist you with form preparation and manage the filing.

Make use of our built-in error check system to ensure the accuracy of your returns.

Get your questions resolved instantly by our US-based support team via live chat, phone, and email.