Tax990’s Internal Audit System An Overview

- Reporting accurate data in your nonprofit tax returns is extremely crucial. Also if you file a 990 with incomplete information, it can lead to

needless penalties. - Tax990 incorporates an error check system that audits your completed forms based on the IRS Business Rules before transmission.

- With this feature, you can identify and fix any IRS instruction errors on your form, ensuring

error-free returns.

How Internal Audit Check Works?

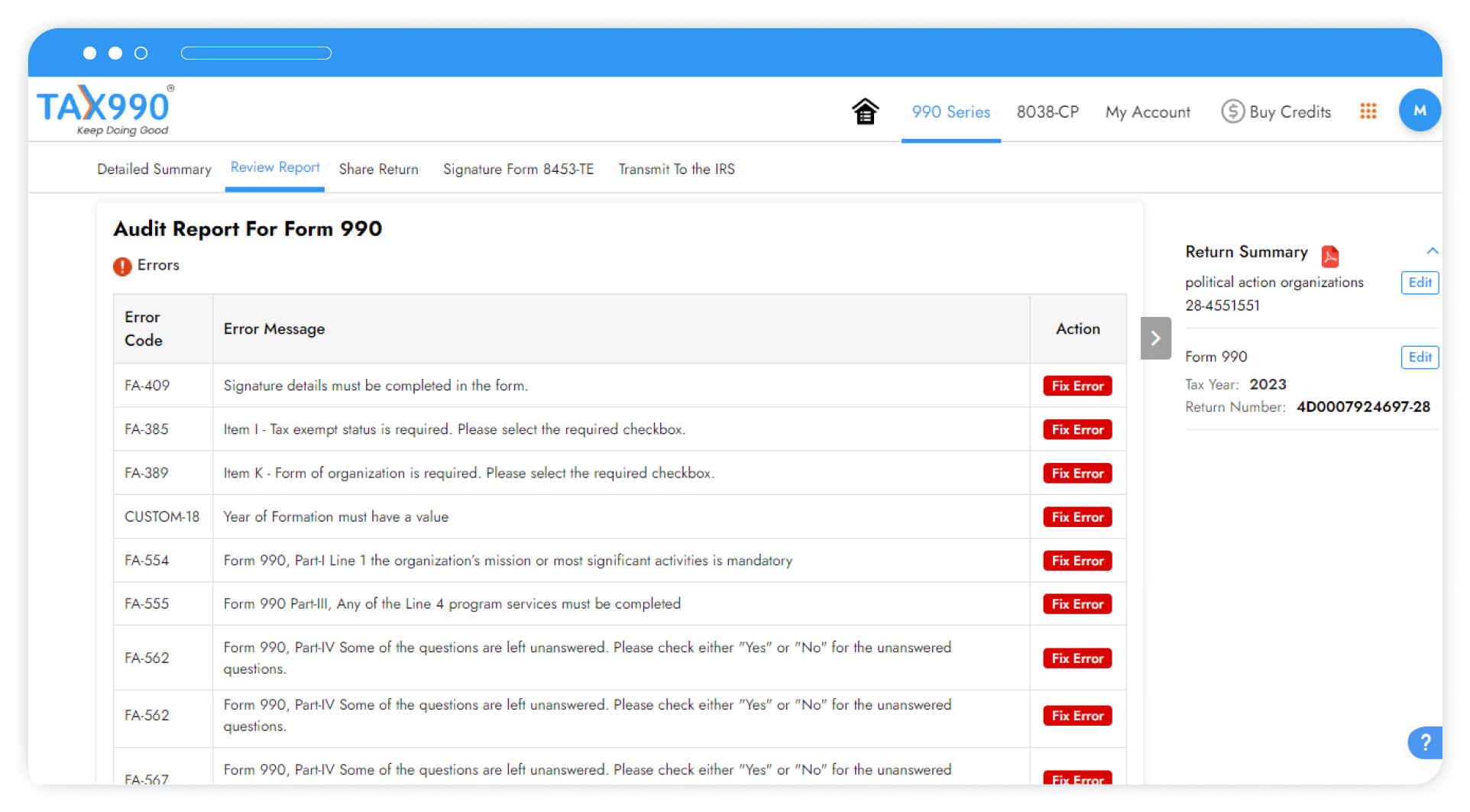

Auditing the Return

Once you complete filling out your form, Tax990 will audit the return and indicate if there are any errors identified on

your form.

Fixing the Errors

Upon clicking the errors, you’ll be redirected to the respective page/section on the form. You can then follow the instructions provided to fix them and make sure your return is accurate.

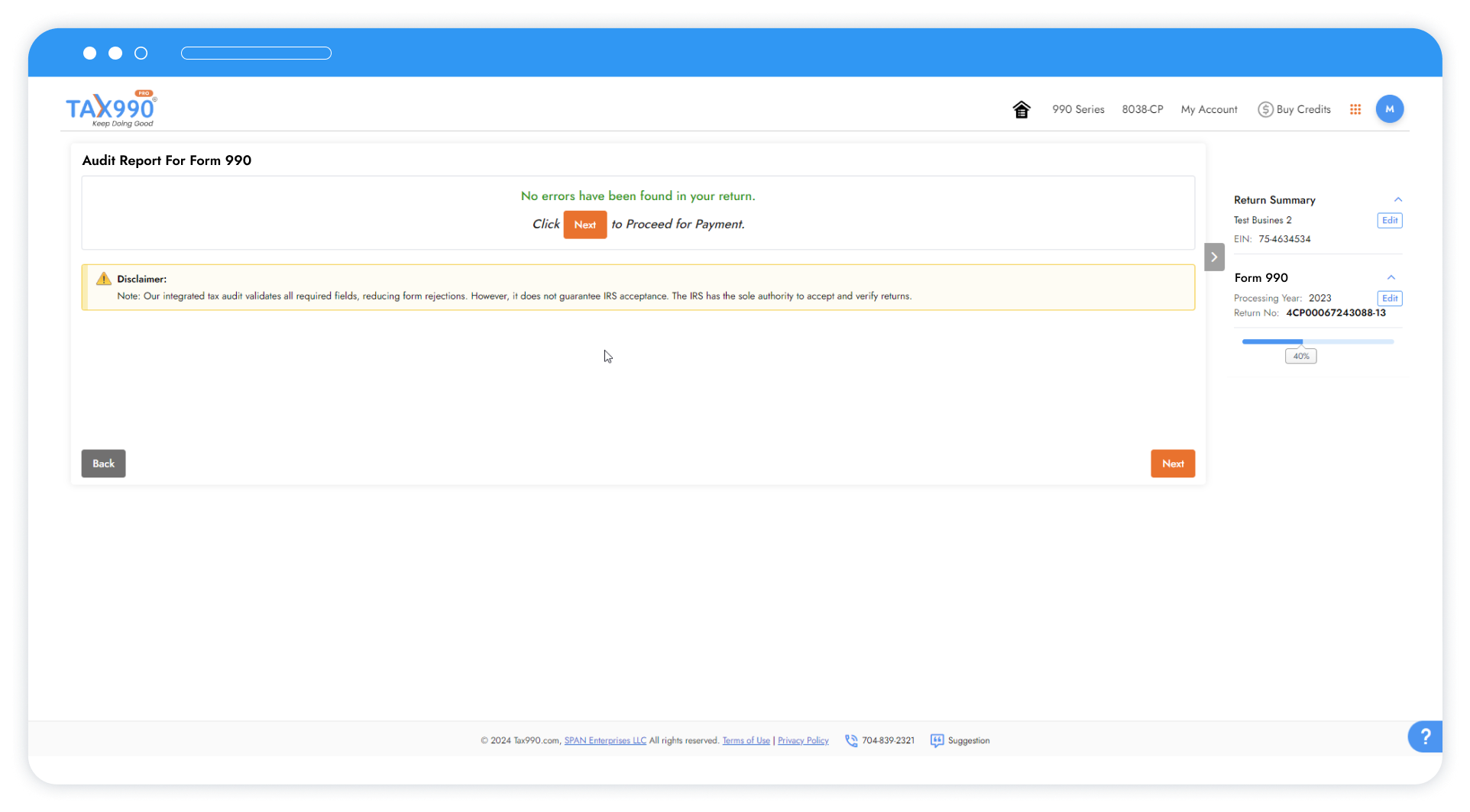

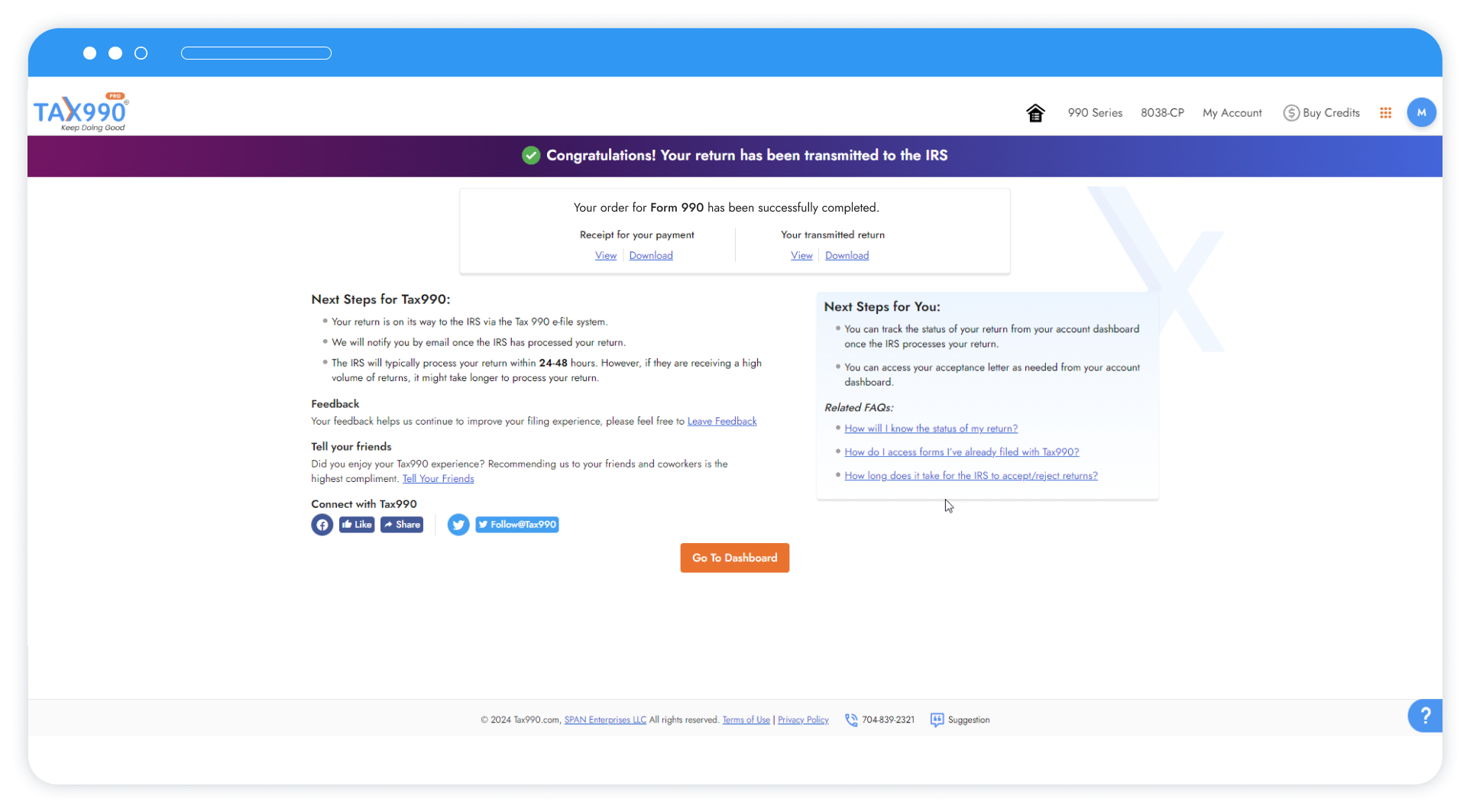

Transmitting to the IRS

Once you have fixed all the errors, you can review the summary once and proceed with the transmission of

your return.

Frequently Asked Questions