Form 990/990-EZ Schedule I Instructions

- Updated August 21, 2024 - 2.00 PM - Admin, Tax990

Nonprofit organizations that file Form 990 may be required to include Schedule I for reporting additional information regarding grants and other assistance made.

In this article, you can find more details about Schedule I, its filing requirements, and more.

Table of Contents

What is the Purpose of Form 990 Schedule I?

Schedule I is used to provide the IRS with detailed information on grants and other assistance made directly by the filing organization to domestic organizations, domestic governments, and domestic individuals during the corresponding

tax year.

The activities that are conducted indirectly by the organization through a disregarded entity or a joint venture treated as a partnership can also be reported.

Grants and other assistance also includes

- Awards

- Prizes

- Contributions

- Non-cash assistance

- Cash allocation

- Stipends

- Scholarship

- Fellowship

- Research grants

- Other similar payments and distributions

Who Must File Form 990 Schedule I?

Nonprofits and tax-exempt organizations that have answered "Yes" on Form 990, Part IV (Checklist of Required Schedules), line 21 or line 22 must file Schedule I and attach it with Form 990.

This includes

- Organizations that report grants or other assistance of more than $5,000 to any domestic organization or government on Part IX, column (A), line 1

- Organizations that report grants or other assistance of more than $5,000 to any domestic individual on Part IX, column (A), line 2

How to Complete Form 990 Schedule I?

Schedule I has 4 parts in total. The requirements for completing some of these parts depend on the answers you provided on your Form 990.

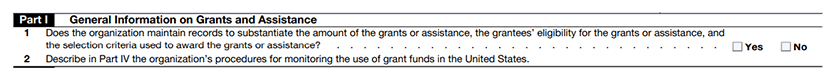

Part I - General Information on Grants and Assistance

This part must be completed if you have answered “Yes” on Form 990, Part IV line 21, or line 22.

Indicate if your organization maintains records to substantiate the amount of the grants or assistance, the grantees' eligibility for the grants or assistance, and the selection criteria used to award the grants or assistance.

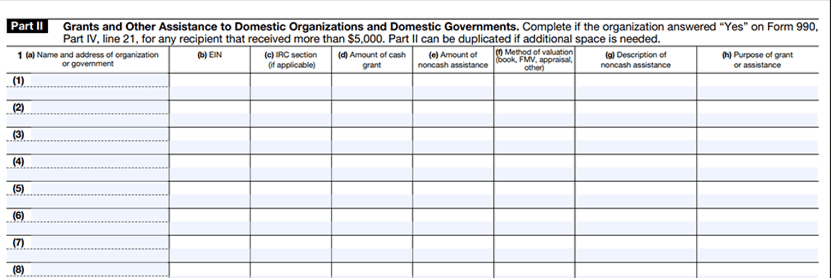

Part II - Grants and Other Assistance to Domestic Organizations and Domestic Governments

This part should be complete if you have answered "Yes" on Form 990, Part IV, line 21.

In this part, you are required to report details regarding the grants and other assistance offered to domestic organizations and governments.

The details include

(a)

Name and address - Enter the full legal name and mailing address of the recipient organization or government entity.

(b)

EIN - Enter the employer identification number of the grant recipient.

(c)

IRC section - Enter the section of the lRC under which the recipient organization receiving the assistance is tax-exempt.

(d)

Amount of cash grant - Enter the total amount of cash grants that the organization received in the tax year

(e)

Amount of noncash assistance - Enter the Fair Market Value (FMV) of the non-cash assistance

(f)

Method of valuation - Enter the method of valuation for non-cash assistance (book, FMV, appraisal, other)

(g)

Description of noncash assistance - Describe the property or noncash assistance.

(h)

Purpose of grant or assistance - Mention the purpose or ultimate use of the grant funds or other assistance.

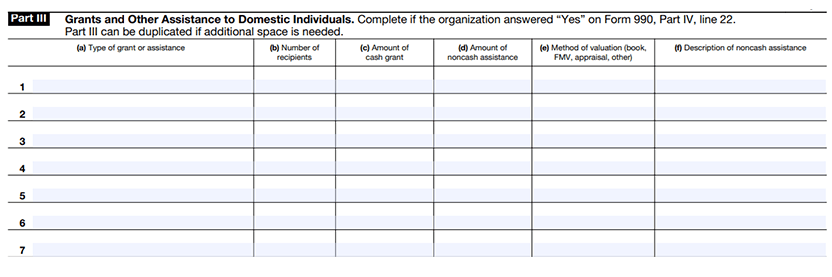

Part III - Grants and Other Assistance to Domestic Individuals

This part should be completed if you have answered "Yes on 990 Form, Part IV, line 22.

Similar to the previous part, this part requires you to report details regarding grants and other assistance offered to domestic individuals.

The required details include

(a)

Type of grant or assistance - Enter the type of grants and assistance and describe its purpose.

(b)

Number of recipients - Enter the number of recipients for each type of assistance.

(c)

Amount of cash grant - Enter the total amount of cash grants made to each individual.

(d)

Amount of noncash assistance - Enter the FMV of noncash property offered.

(e)

Method of valuation - indicate the method used to calculate the noncash assistance

(f)

Description of noncash assistance - Provide a description of the property or noncash assistance.

Part IV - Supplemental Information:

In this part, the IRS requires an explanation for a few of the answers you have provided in the previous parts.

This part can also be used to provide the IRS with additional information regarding any other questions from the previous part if you need.

Choose Tax990 to File your Form 990 with Schedule I!

Tax 990, an IRS-authorized e-filing solution, generates Schedule I and all other required Schedules at no extra cost based on the data you enter on your Form 990.

We offer multiple other features that simplify your 990 filings. Here are some of them

Provides flexible options to prepare forms - Form-Based and Interview-Style filing

Copy data option to import certain data from prior returns you filed with Tax 990 to the current return

Internal audit check to make sure that your 990 returns are error-free

US-based support team to assist with your questions via live chat, phone,

and email.