The Tax990 Commitment

Accepted, Every Time–Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? Pay for your 990 return upfront and file your 8868 at no additional cost. Only need an extension for now? File Form 8868 today, and we’ll credit the fee toward your 990 return when you come back to file.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Easier 8868 E-Filing

Filing Form 8868 is straightforward with our smart tools. We guide you through each section so you can file accurately, with less effort.

Direct Form Entry

Enter information directly into each section of Form 8868 using our intuitive interface, designed for clarity and ease.

Get Instant Extension

With Tax990, you can file your 990 extension in just a few minutes and receive IRS approval instantly.

Internal Audit Check

Your 8868 is validated against the IRS Business Rules to help catch common errors

before submission.

File From Any Device

You can file your 8868 extension with Tax 990 on any device, such as a desktop, mobile, or tablet.

Smart AI Assistance

Our AI chatbot is available 24/7 to guide you through questions or next steps in filling

out your form.

World-Class Customer Support

Need expert help? Connect with our dedicated support team via chat, phone, or email anytime.

Our intuitive features make online filing of Form 8868 easier than ever.

What You’ll Need to File Form 8868 Online

Here is all the information you’ll need to file 8868 Online:

- The organization’s basic Information

- Start and end date of the organization’s accounting period

- Tax dues (if applicable)

- Organization’s books are in the care of details

- Signing authority’s details

How to File Form 8868 Electronically with Tax990?

Create your free account and follow these simple steps to e-file your Form 8868 effortlessly!

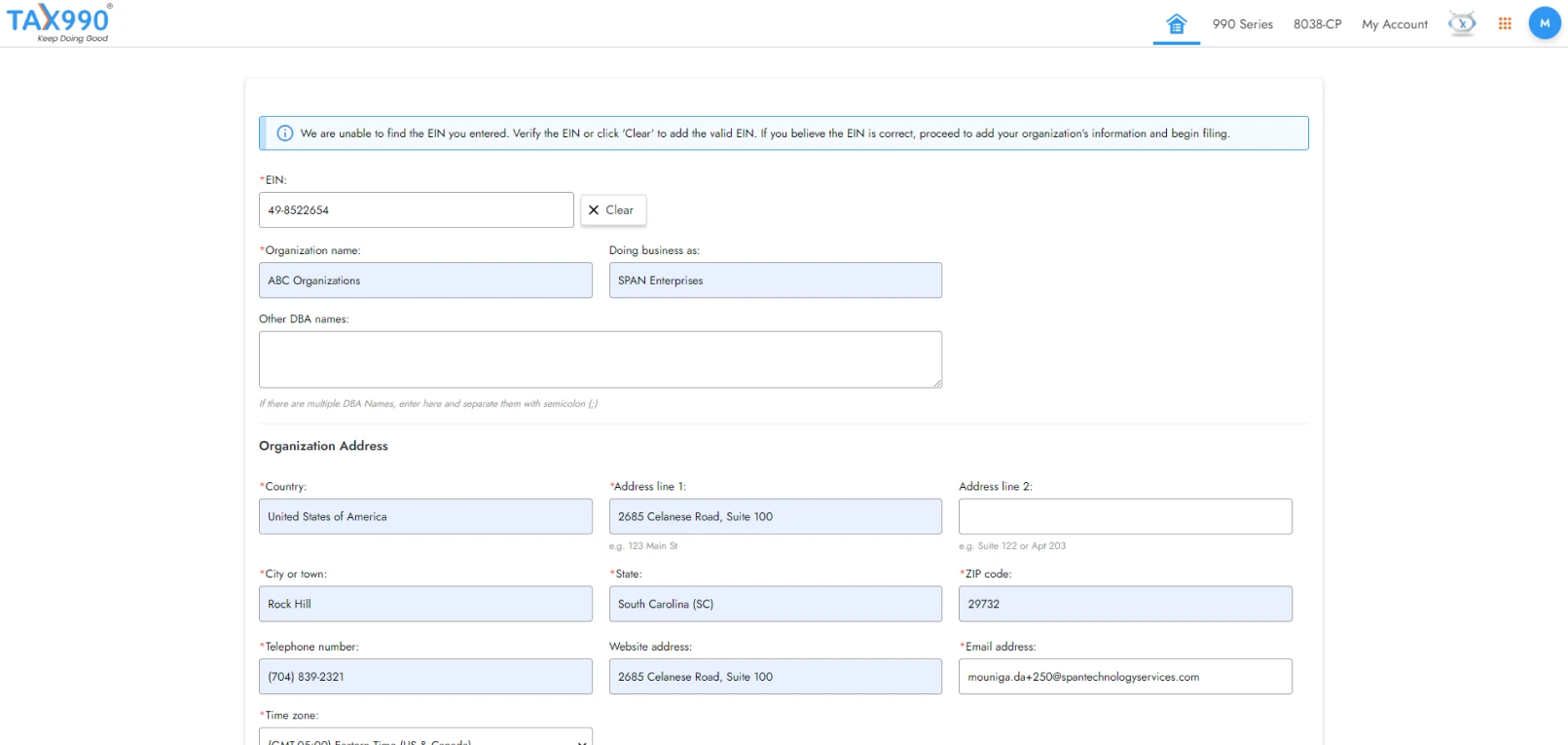

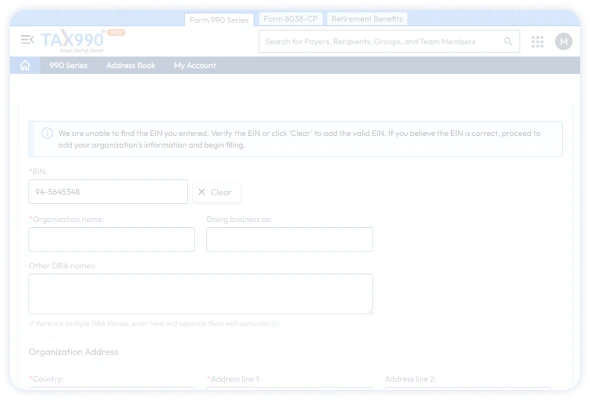

Add Organization Details

Search for your EIN to import your organization’s data from the IRS or enter your organization’s details manually.

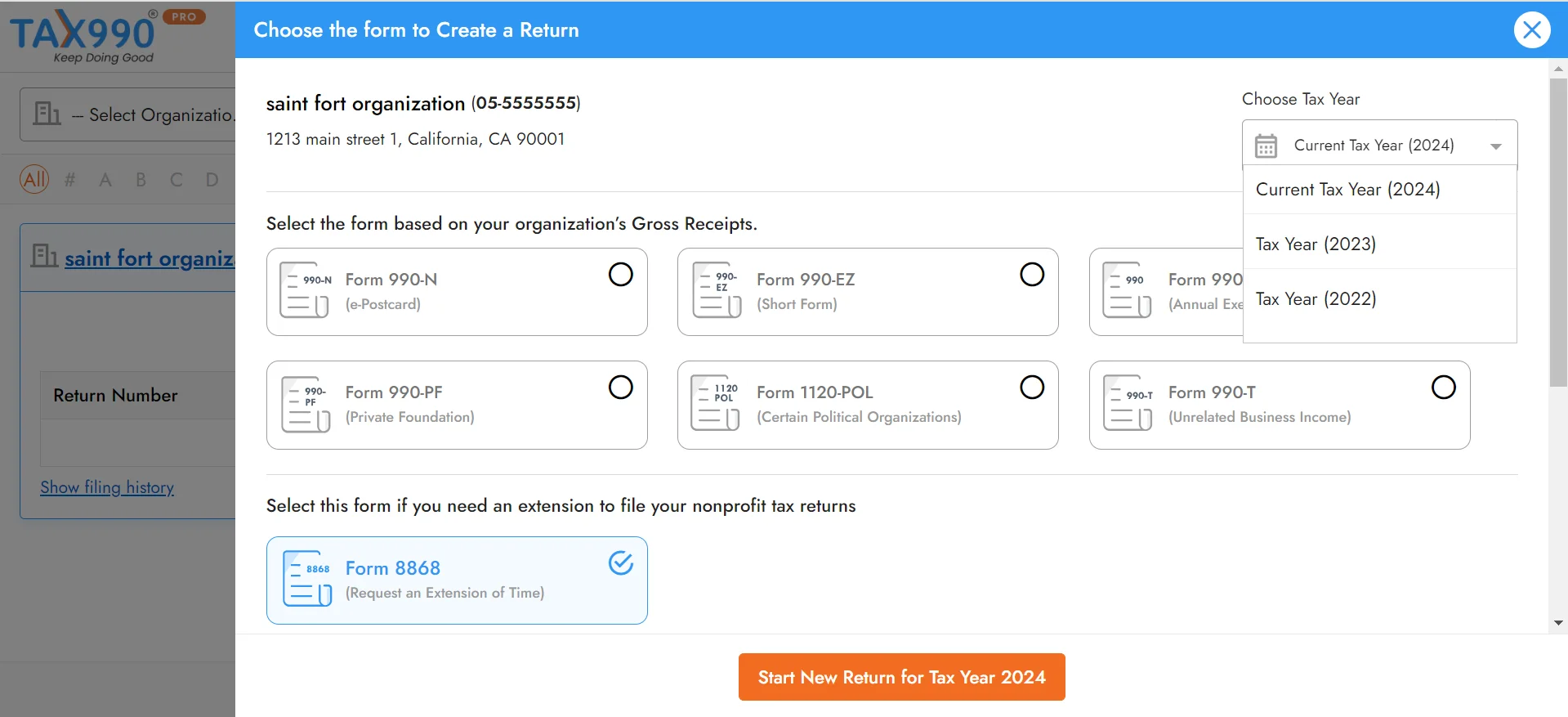

Choose Tax Year and Form

Choose the tax year for which you are required to file, select Form 8868.

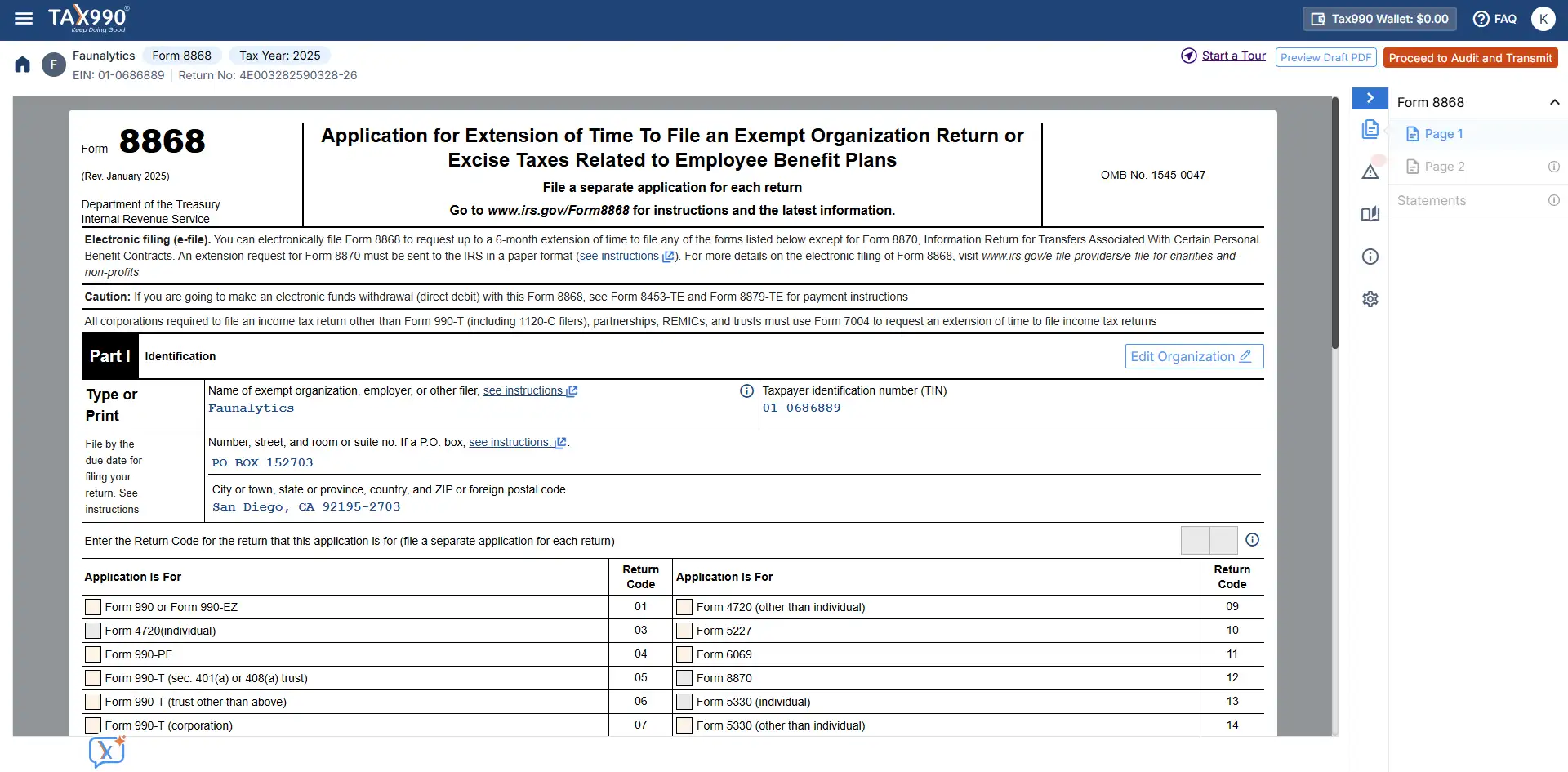

Enter Required Details

Select the return for which you need to file an extension and provide the required information for your Form 8868 extension.

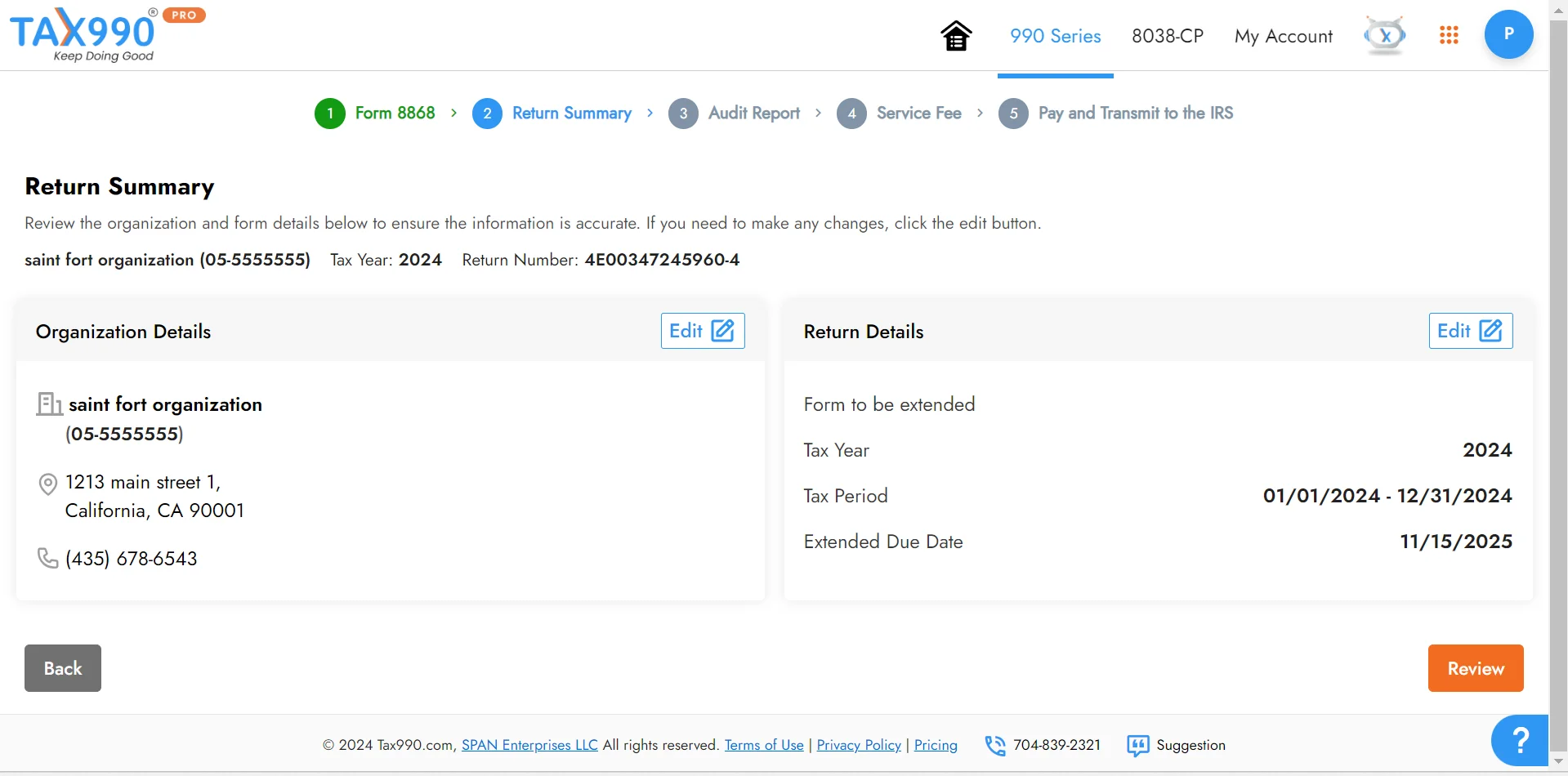

Review your Form

Review your form summary. You also have the option to share your form with foundation members for review and approval.

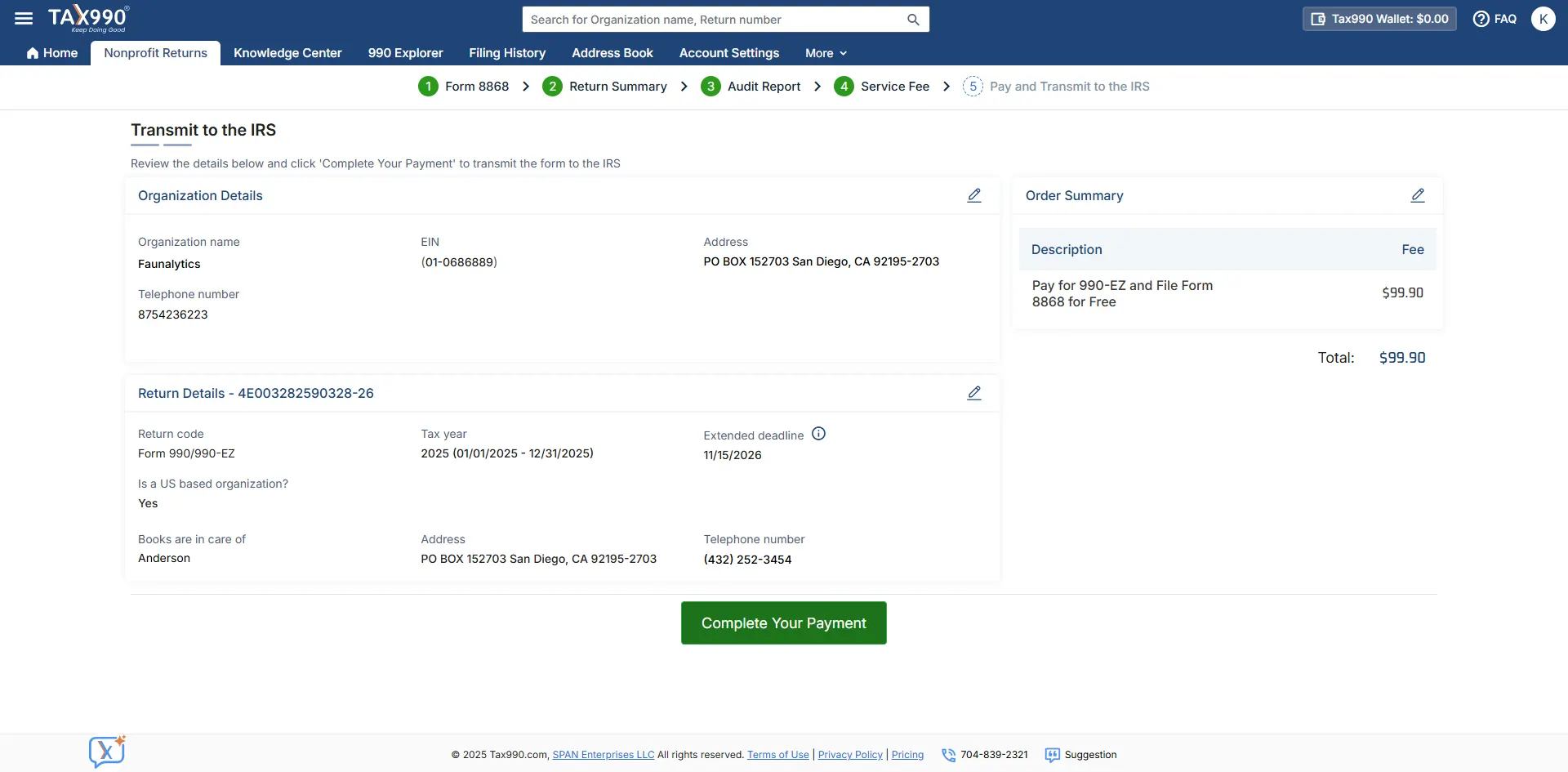

Transmit your Return to the IRS

Once you have reviewed the form, you can transmit it to the IRS. The IRS will provide you with a 6-month automatic extension.

Ready to file 8868 online?

Fees to File Form 8868 Online with Tax990

$14.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- Guaranteed approval or money-back

File easily and get back to what matters most!

Frequently Asked Questions

What is Form 8868?

Form 8868 is a tax extension form filed by exempt organizations to get an automatic 6-month extension to file their annual tax returns.

For what returns is the extension Form 8868 applicable?

Form 8868 can be used to extend the deadline for Form 990, 990-EZ, 990-PF, 990-T, 4720, 1041-A, 5227, 5330, 6069, and 8870.

Do I need to provide any explanation for requesting an extension?

No! This extension is automatic, which means you aren’t required to provide the IRS with a reason for requesting more time to

File your nonprofit tax returns.

When is the due date to file Form 990 extension?

The due date to file 990 extension (Form 8868) is actually the same as the due date of the original nonprofit tax forms for which the extension

is being requested.

For example, If you need to get an extension for Form 990, then the deadline is 15th day of the 5th month after the organization’s accounting period ends.

So, for calendar filers, the deadline to file Form 8868 is May 15.

Can I paper file Form 8868?

Yes! Form 8868 can be filed either electronically or on paper. However, if you are requesting an extension for Form 8870, you must paper file Form 8868.

Where to Mail Form 8868?

You can complete and mail your 8868 return to the following address.

Internal Revenue Service Center,

Ogden, UT 84201-0045.

How to pay tax dues when filing Form 8868 electronically?

You can choose one of the following options to pay your tax dues when filing Form 8868 electronically.

- EFTPS - Electronic Federal Tax Payment System

- EFW - Electronic Funds Withdrawal