The Tax990 Commitment

Accepted, Every Time–Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Easier Form 1120-POL E-Filing

Filing Form 1120-POL is straightforward with our smart tools. Our system guides you through each section so you can file accurately and easily

Easy Form Preparation

Prepare your Form 1120-POL easily by answering simple questions with our interview-style filing option.

Internal Audit Check

Our built-in audit check reviews your completed form and displays IRS errors before transmission.

Smart AI Assistance & World-Class Support

Have questions? Our AI chatbot is here for instant support. For expert assistance, reach out to our support team via chat, phone, or email.

Our intuitive features make filing Form 1120-POL online easier than ever.

What You’ll Need to File Form 1120-POL Online

Here is all the information you’ll need to file Form 1120-POL Online:

- The organization’s basic Information

- Financial information such as income and deductions

- Program service accomplishments

- Taxable income and tax credits

- Taxes due and any overpayment

- Books are in the care of details

How to File Form 1120-POL Electronically with Tax990

Create your free account and follow these simple steps to e-file your Form 1120-POL effortlessly!

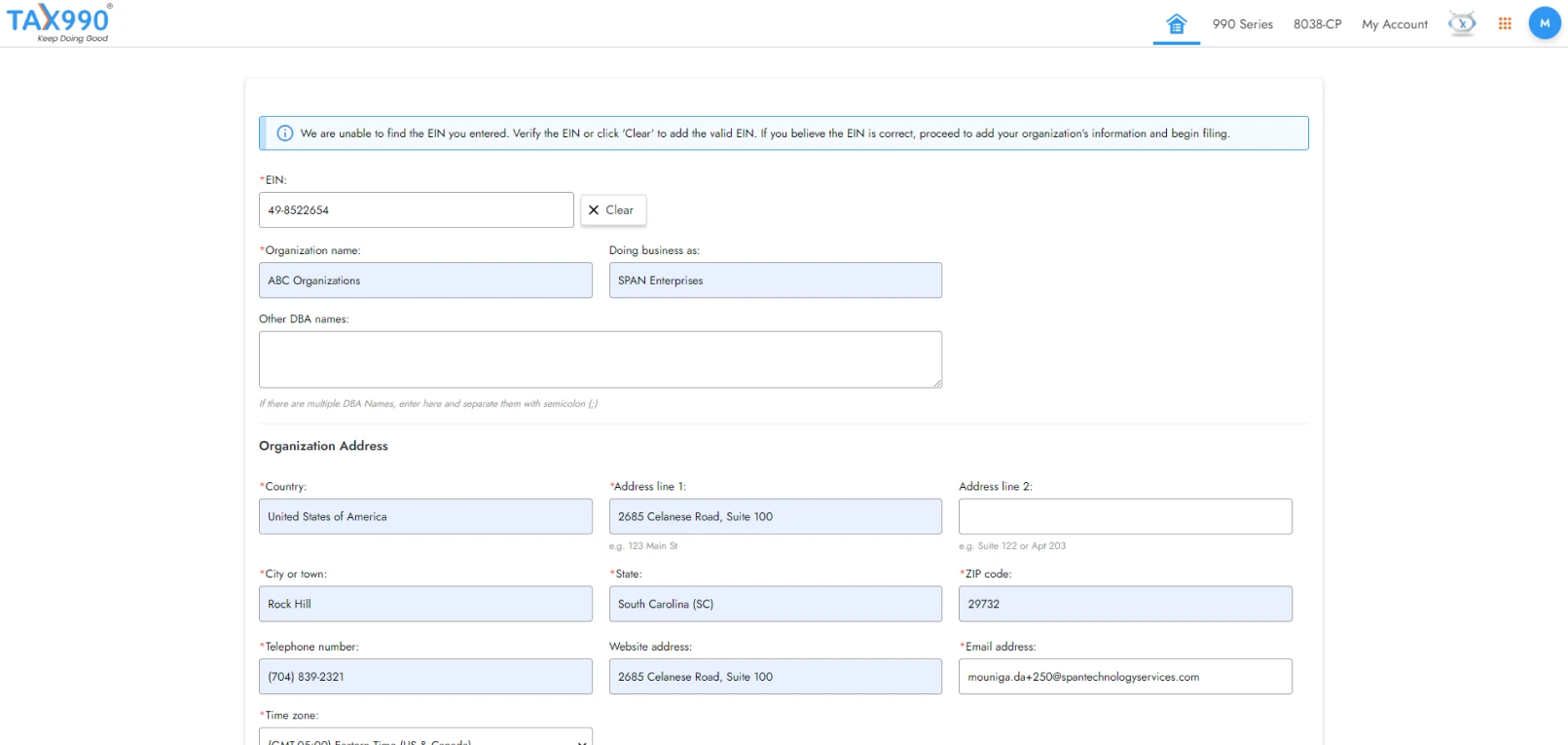

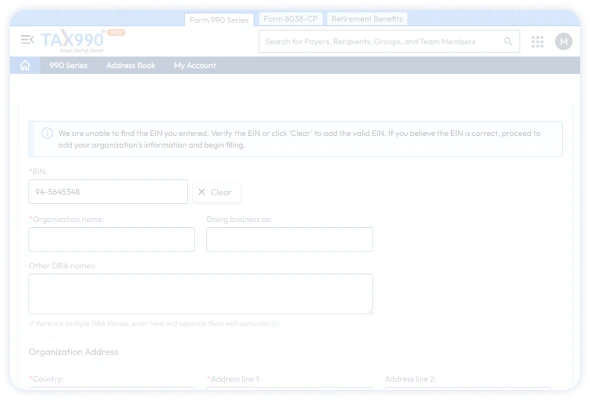

Add Organization Details

Enter your EIN and provide all the basic information about your organization, such as name, address, and principal

officer details.

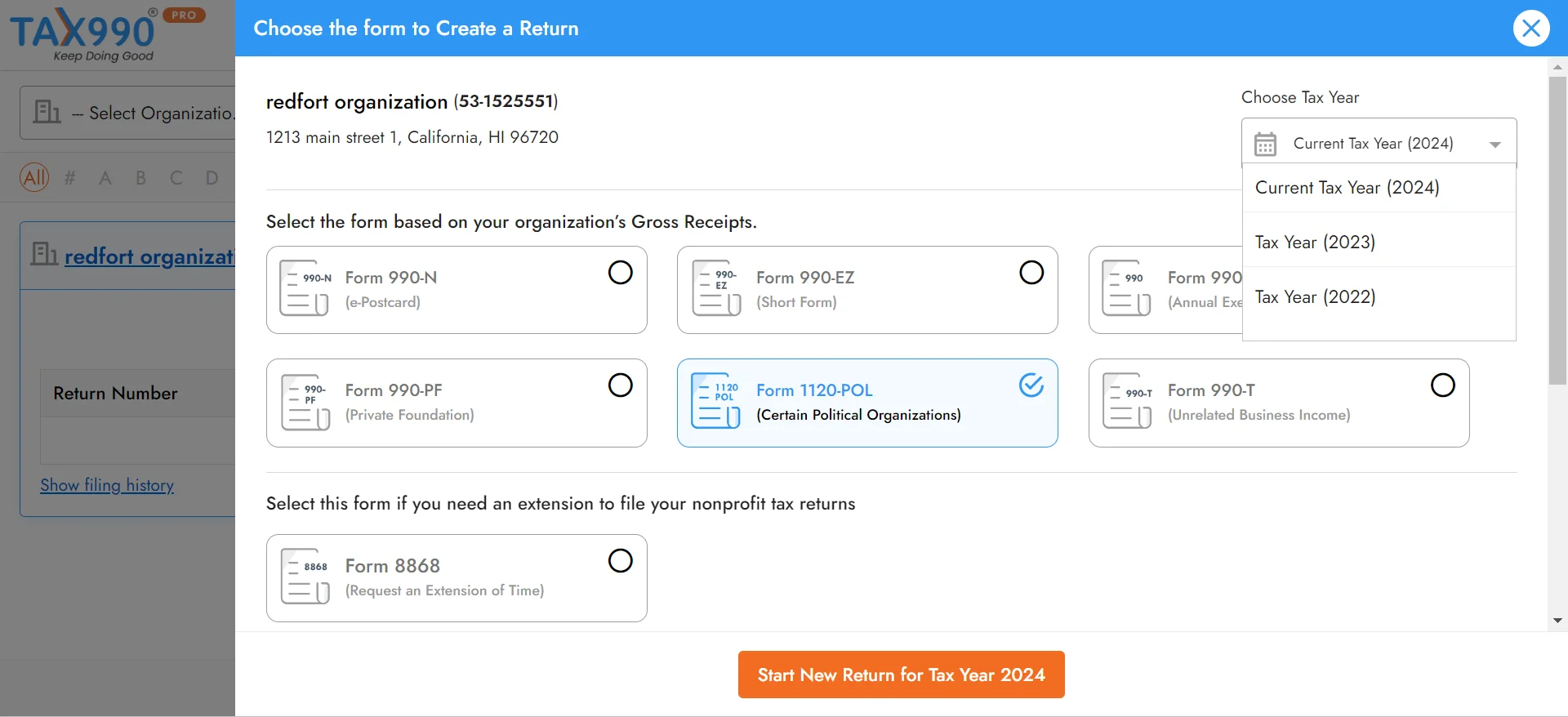

Choose the Tax Year and Form

Tax 990 supports filing for the current and previous tax years. Choose the tax year for which you need to file, select Form 1120-POL, and continue.

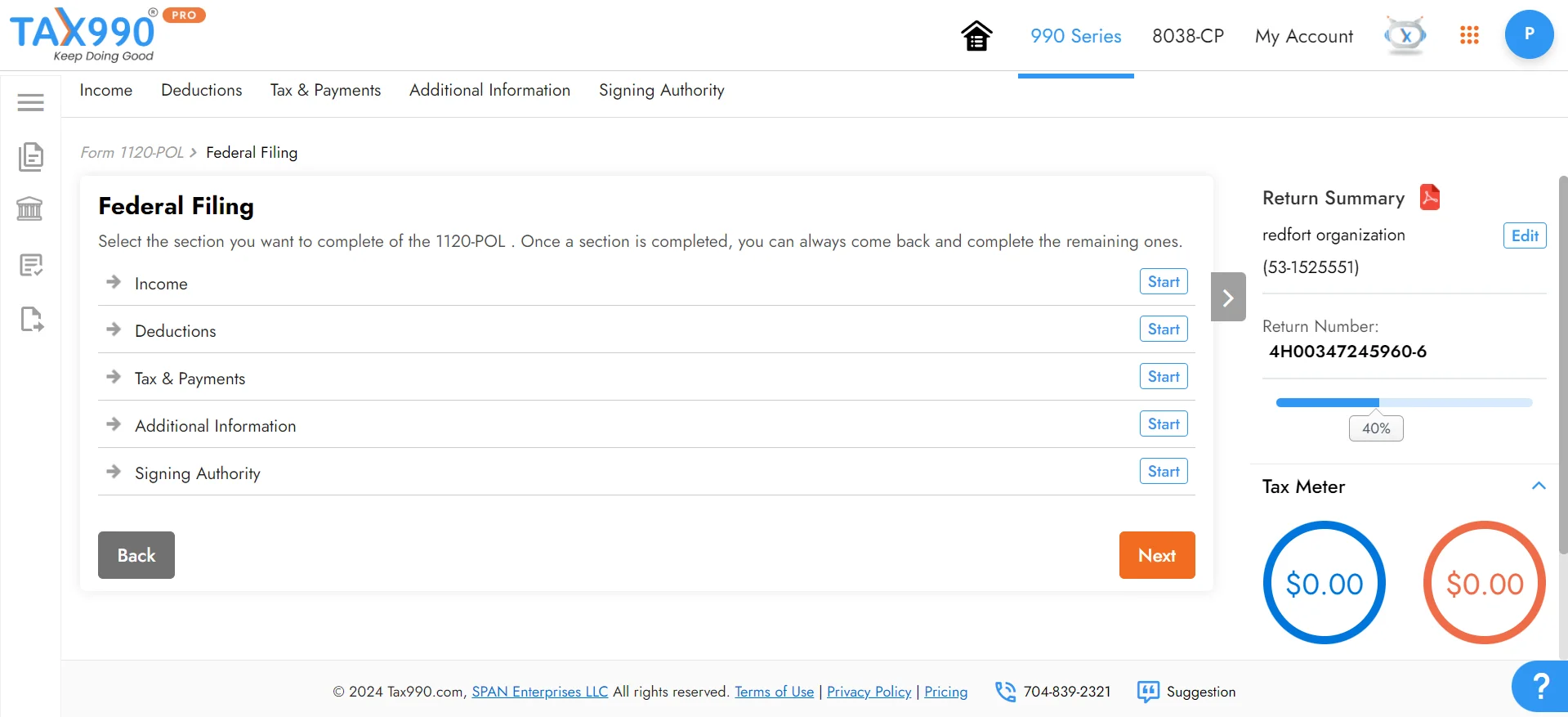

Enter Form 1120-POL Data

Provide all the required information for your Form 1120-POL using our interview-style filing method.

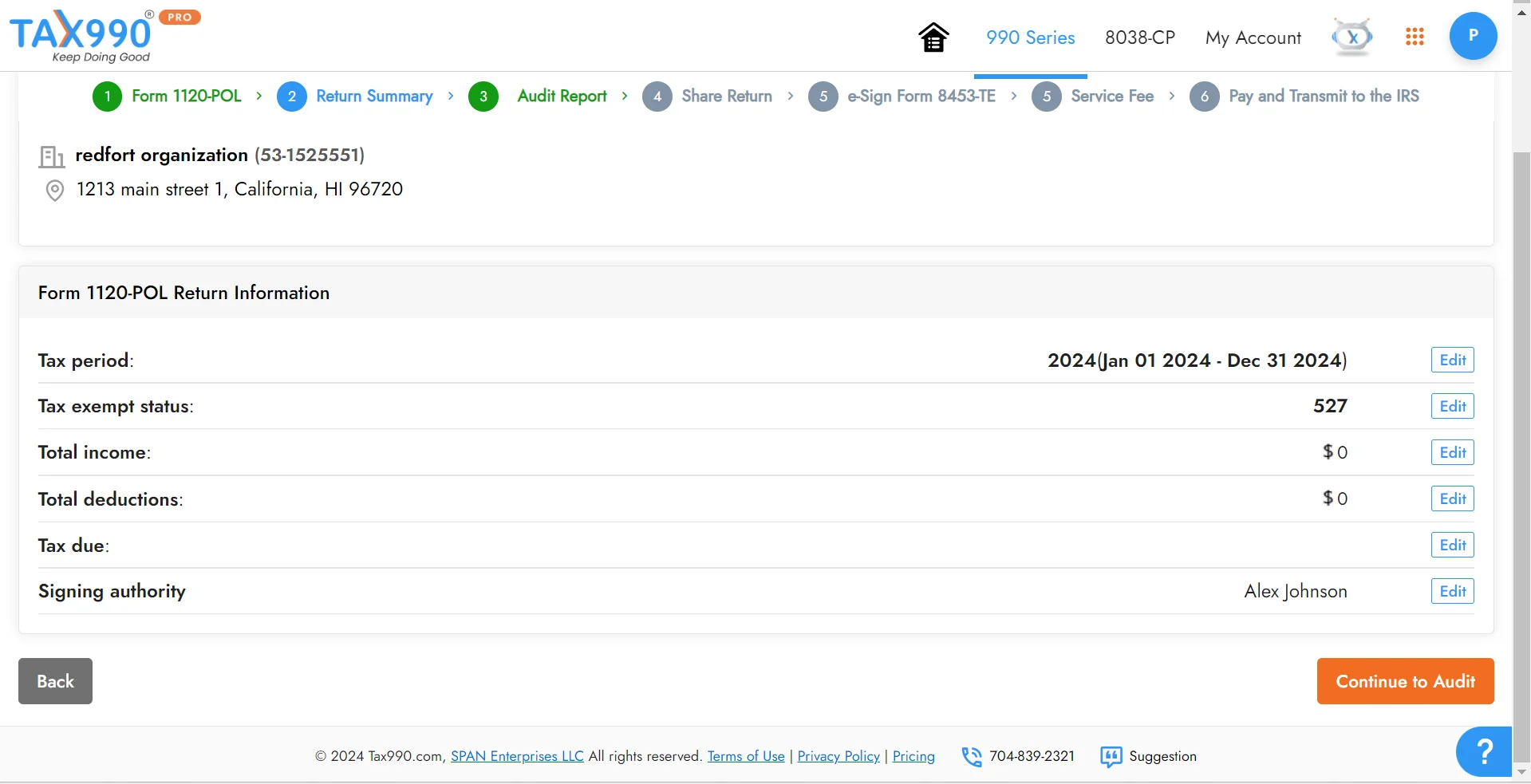

Review your Form Summary

Review your form summary for any errors and share your form with your board for review and approval.

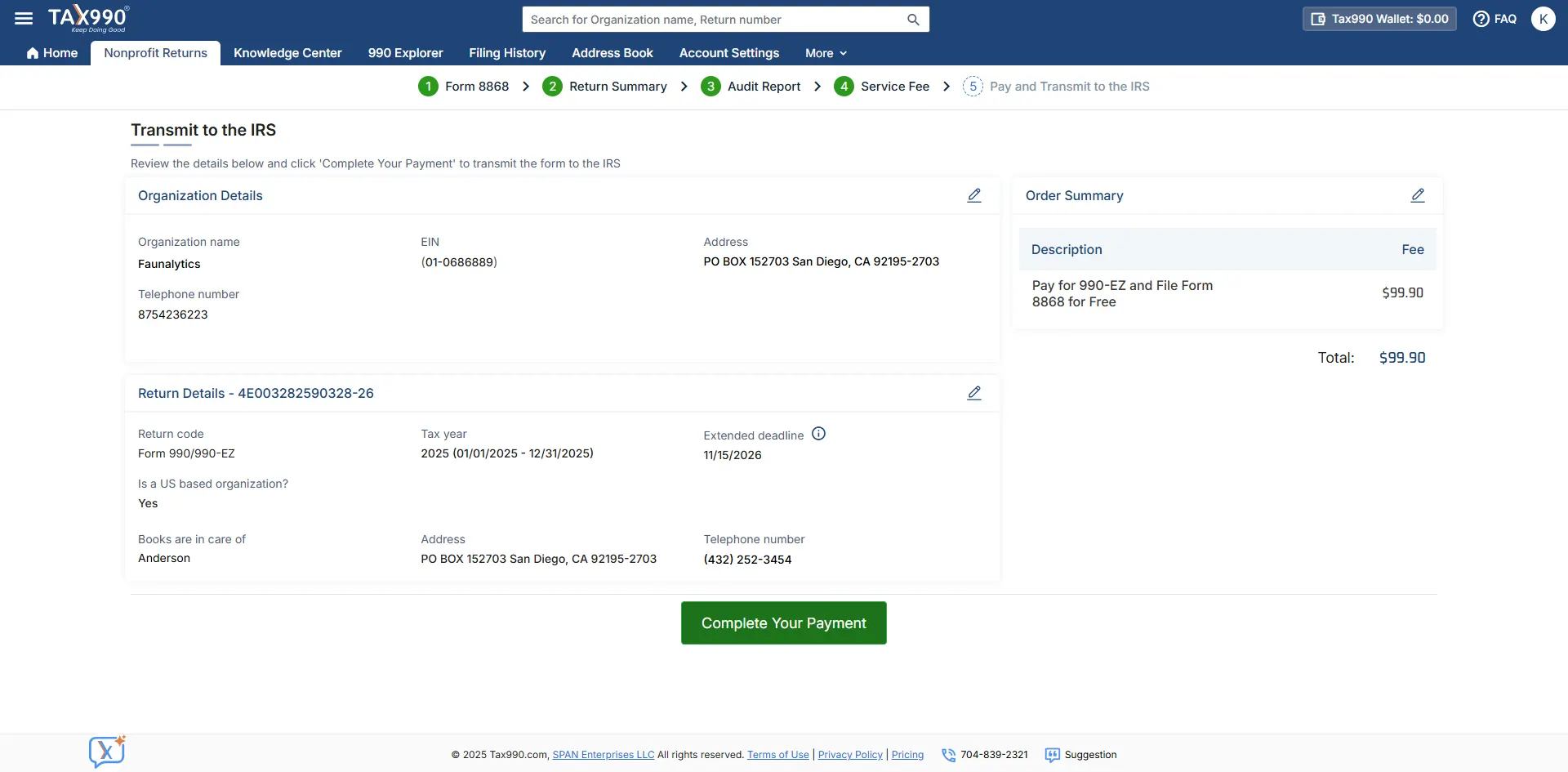

Transmit your Return to the IRS

Once you have reviewed your form, transmit it to the IRS. We will keep you updated on the IRS status of your form via email or text.

Ready to file Form 1120-POL online?

Fees to File Form 1120-POL Online with Tax990

$49.90/ Form

- Retransmit Rejected Returns

- No Cost Corrections

- Money-Back Guarantee

File easily and get back to what matters most!

Frequently Asked Questions

What is IRS Form 1120-POL?

Form 1120-POL is an annual return filed by political organizations to report their political organization's taxable income such as income, deductions, taxes due, or overpayment.

Who must file Form 1120-POL?

- Political organizations that have any taxable income (whether or not it is tax-exempt)

- Tax-exempt organizations that are treated as having political organization taxable income under section 527(f)(1)

When is the due date to file Form 1120-POL?

- Form 1120-POL must be filed on or before the 15th day of the 4th month after the organization’s accounting period ends.

- For the organizations operating under the calendar year, the deadline will be April 15th (unless it falls on a Saturday, Sunday, or federal holiday).

What are the 990 filing requirements for Political organizations that file Form 1120-POL?

An organization that files Form 1120-POL may also be required to file the following tax returns based on its type and requirements.

An exempt political organization must also file one of these forms if its annual gross receipts are $25,000 or more:

- Form 990 - Return of Organization Exempt From Income Tax

- Form 990-EZ - Short Form Return of Organization Exempt From Income Tax

What returns may be required along with my Form 1120-POL?

- Form 8871 - Political Organization Notice of Section 527 Status In general, being tax-exempt political organizations should file Form 8871 within 24 hours of the established date and any kind of material change in the organization should also be reported Within 30 days.

- Form 8872 - Political Organization Report of Contributions and Expenditures Political organizations should report the contributions and expenditures that occurred during the calendar tax year.

- Form 8997 - Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments During the respective year, organizations should identify qualified investments in the qualified opportunity fund and should file Form 8897 along with Form 1120-POL.

- Form 8992 - U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI). It used to figure out about their domestic corporation’s GILTI, along with 1120-POL

Can I paper-file Form 1120-POL?

Yes, you can complete and mail your 1120-POL return to the following address:

Internal Revenue Service Center,

Ogden, UT 84201.

If your organization’s office is located in a foreign country or a U.S. possession, mail your 1120-POL return to

P.O. Box 409101,

Ogden, UT 84409.

Can I get an extension to file Form 1120-POL?

Yes! You can get an automatic 6-month extension by filing Form 7004 before the original Form 1120-POL filing due date.

What are the penalties for filing Form 1120-POL late?

If you fail to file Form 1120-POL within the deadline, you will be required to pay a penalty equal to 5% of the tax due for every delayed month, with a maximum of 25% of the tax due.

The minimum penalty for a return more than 60 days late is the tax-due amount of $450 (whichever is smaller).