Form 990-EZ/990 Schedule A Instructions

- Updated November 20, 2024 - 2.00 PM - Admin, Tax990

Form 990 Schedule A, Public Charity Status and Public Support is a supporting document for certain 990 forms used to provide the IRS with information about public support and the charity status of tax-exempt and nonprofit organizations. This helps determine if the organization qualifies as a public charity and meets tax-exempt requirements.

Table of Contents

Who must File Form 990 Schedule A?

Organizations that file Form 990-EZ or 990 should attach Schedule A if they fall under any of the following categories.

- Public charities described in section 501(c)(3)

- Organizations described in sections 501(e), 501(f), 501(j), 501(k), or 501(n)

- Nonexempt charitable trusts described in section 4947(a)(1) (Except private foundations)

What are the Accounting Methods used for calculating 990 Schedule A?

While filing Form 990 Schedule A, the organizations should use the same accounting method, cash, accrual, or other, as indicated on their 990 form.

- IRS Form 990 - Part XII, line 1

- IRS Form 990-EZ, line G

If your organization’s accounting method has changed from the prior year, you must provide an explanation in

990 Schedule O.

How to Complete Schedule A for Form 990/990-EZ?

Schedule A has 6 parts in total. The requirements for completing some of these parts depend on your organization type.

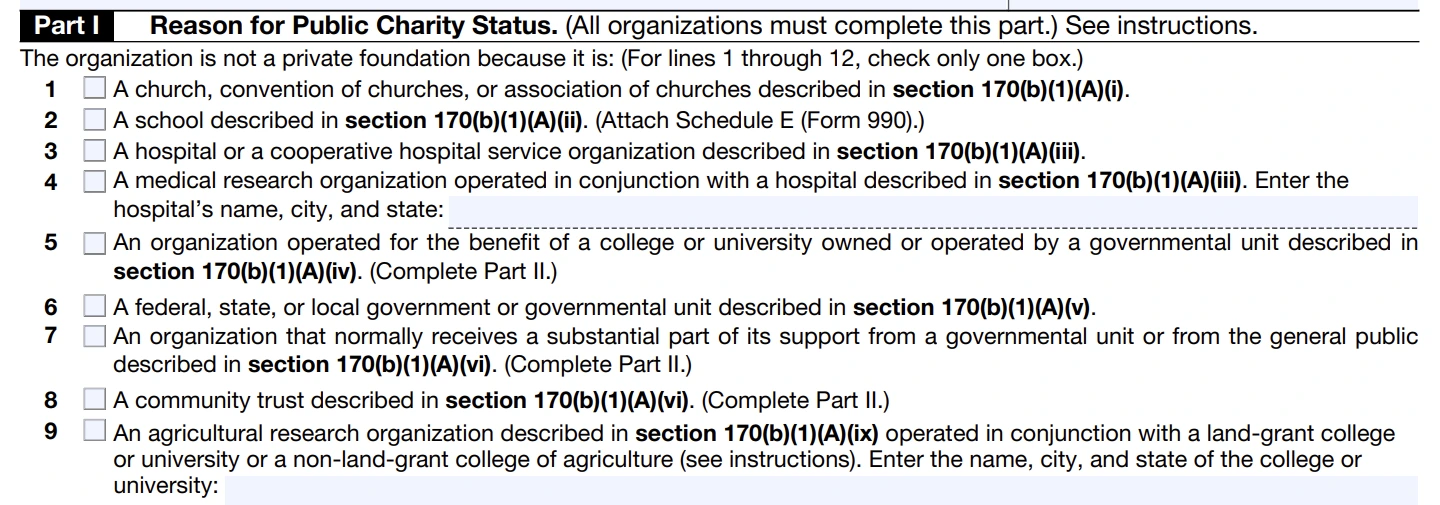

Part I - Reason for Public Charity Status

- This part requires you to provide the reason why your organization is categorized as a public charity. The reason provided can be the same as described in the organization’s tax-exempt determination letter.

-

It contains 12 checkboxes, each of which describes a particular organization type. You check the applicable box to indicate your organization’s public charity status for the corresponding tax year. - For example, if you are filing for a Hospital, you should check the box on line 3.

You’re required to complete Part II and Part III only if applicable to your organization.

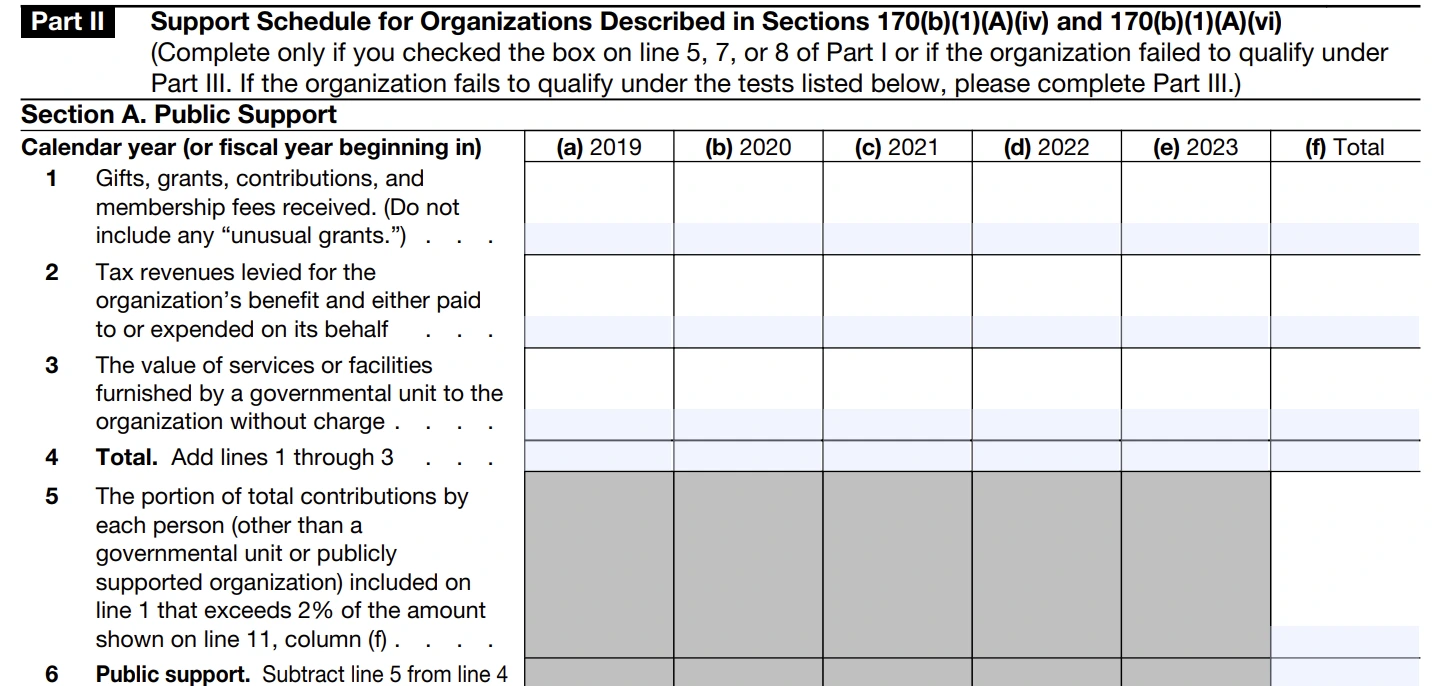

Part II - Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)

This part is only required for the organizations described under sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi) (or) organizations that failed to qualify under Part III.

Part II divided into 3 sections including:

A. Public Support:

Report the amount of support received from the public in the form of gifts, grants, contributions, and more during the tax years beginning within the 5-year period (2020 - 2025).

B. Total Support:

Report the total amount of support received by your organization (including public support) in the form of gross income from payments received on securities loans, rents, unrelated business activities, and other sources during the same period.

Note:

The organizations that are filing Form 990 for the first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization should not complete the remaining section of Part II.

C. Computation of Public Support Percentage:

Derive and report the percentage of your organization’s public support for 2024 based on the information you reported in two previous sections.

Public Support Percentage

=

Public support

Total Support

Also, mention the public support percentage for 2024 as reported on the previous year’s Schedule A. Then, report your organization’s qualification as a publicly supported organization in one of the following tests:

33 ⅓ % support test:

Your organization will be qualified as a publicly supported organization if the public support percentage for 2024 or 2023 is more than or equal to 33 ⅓.

10% - facts-and-circumstances test:

Your organization will be qualified as a publicly supported organization if the public support percentage for 2024 or 2023 is at least 10% under the facts and circumstances (Should provide an explanation in Part VI).

Note:

If your organization is described in Section 170(b)(1)(A)(iv) or 170(b)(1)(A)(vi) and is not qualified in any of these tests, it will be treated as a private foundation, and you should file Form 990-PF instead of Form 990 or 990-EZ.

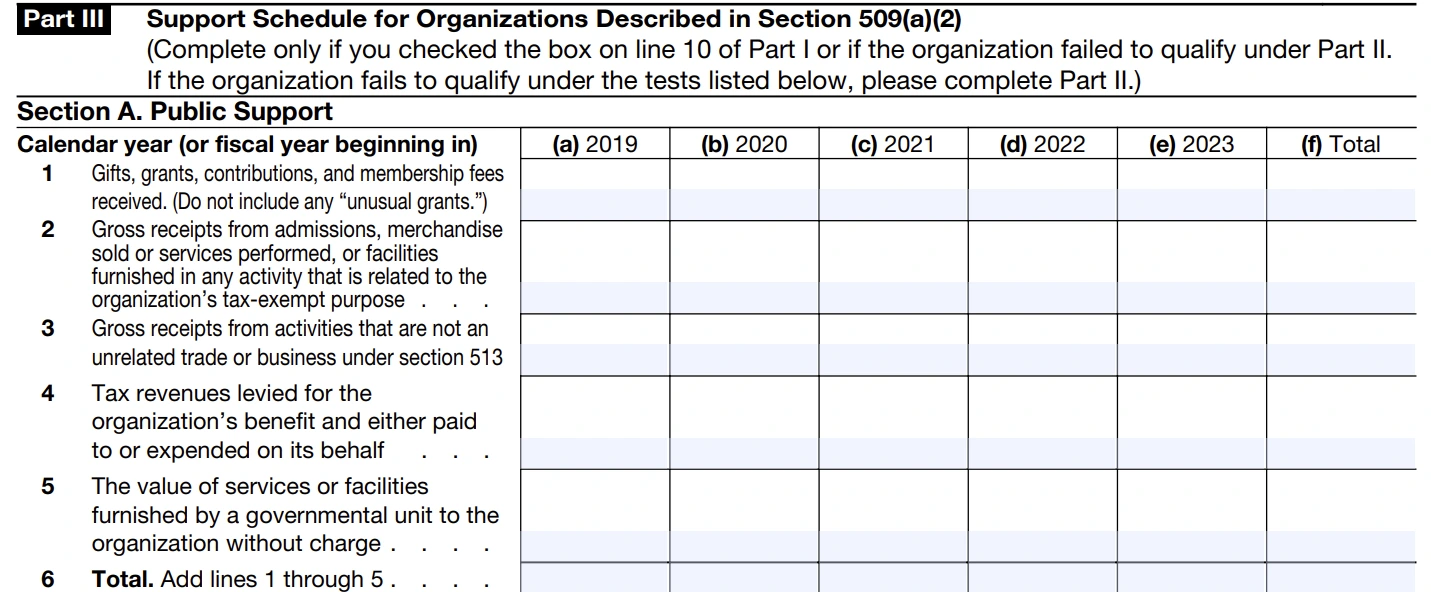

Part III - Support Schedule for Organizations Described in Section 509(a)(2)

This part needs to be completed only by the organizations described in Section 509(a)(2) (or) the organizations that failed to qualify under Part II.

A. Public Support:

Report the amount of public support received by your organization as grants, contributions, gross receipts from admissions, and activities that are not an unrelated trade or business under section 513 and more over the 5-year period (2020 - 2025).

B. Total Support:

Report the total amount of financial support (including public support) received from various sources of income during the same period.

Note:

If you're filing Form 990 for your first to fifth tax year as a section 501(c)(3) organization, you’re not required to complete the remaining sections of Part III.

C. Computation of Public Support Percentage:

Report the percentage of your organization’s public support for 2024 and mention the public support percentage reported on 2024 Schedule A.

D. Computation of Investment Income Percentage:

Calculate and report the percentage of investment income for 2024 and 2023. Following that, report your organization’s qualification as a publicly supported organization in the following test:

33 ⅓ % support test:

Your organization will be qualified if:

The public support percentage for 2024 or 2023 is more than 33 ⅓, and the investment income percentage for 2024 or 2023 is less than 33 ⅓.

Note:

If your organization is described in Section 509(a)(2) and is not qualified for this test, it will be treated as a private foundation, and you should e-file Form 990-PF instead of Form 990-EZ

or 990.

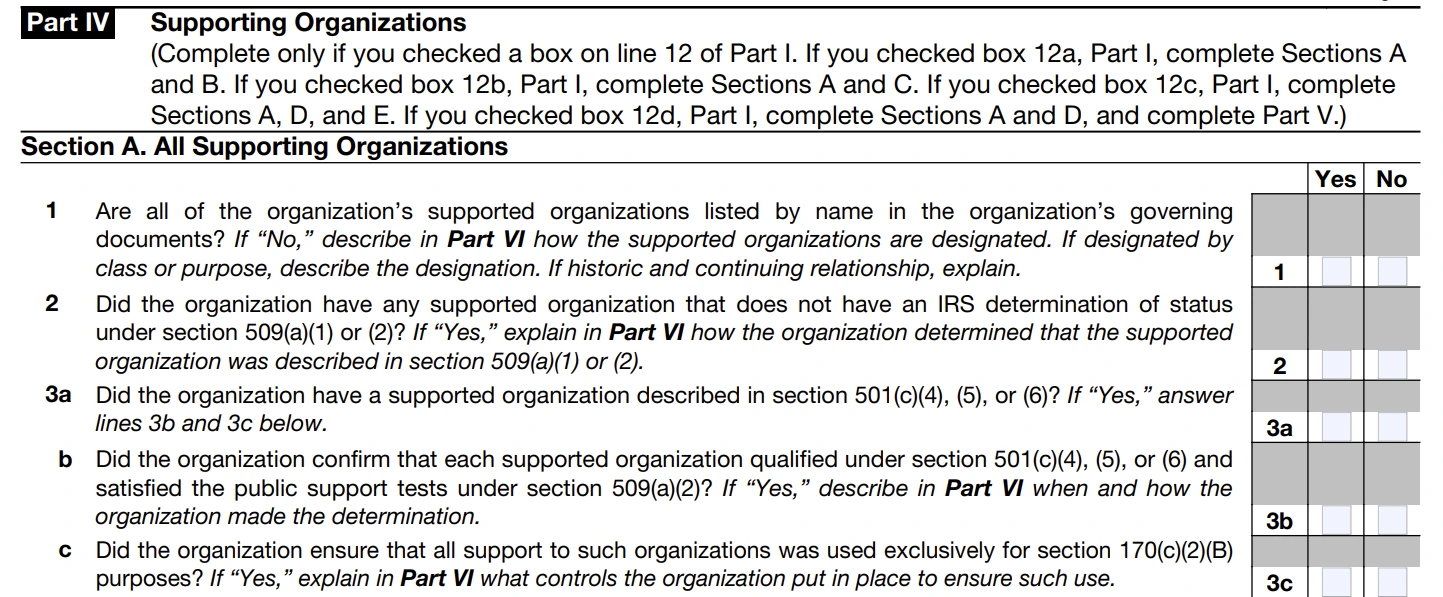

Part IV - Supporting Organizations

This part needs to be completed only by the supporting organizations, as reported in part I.

Part IV consists of 5 sections. Section A is the only section that all supporting organizations must complete. You may be required to complete other sections depending on the type of organization.

- All Supporting Organizations

- Type I Supporting Organizations

- Type II Supporting Organizations

- Type I Supporting Organizations

- Type I Supporting Organizations

Each section consists of a series of “Yes” or “No”questions regarding the organizations’ activities, business holdings, and other financial information.

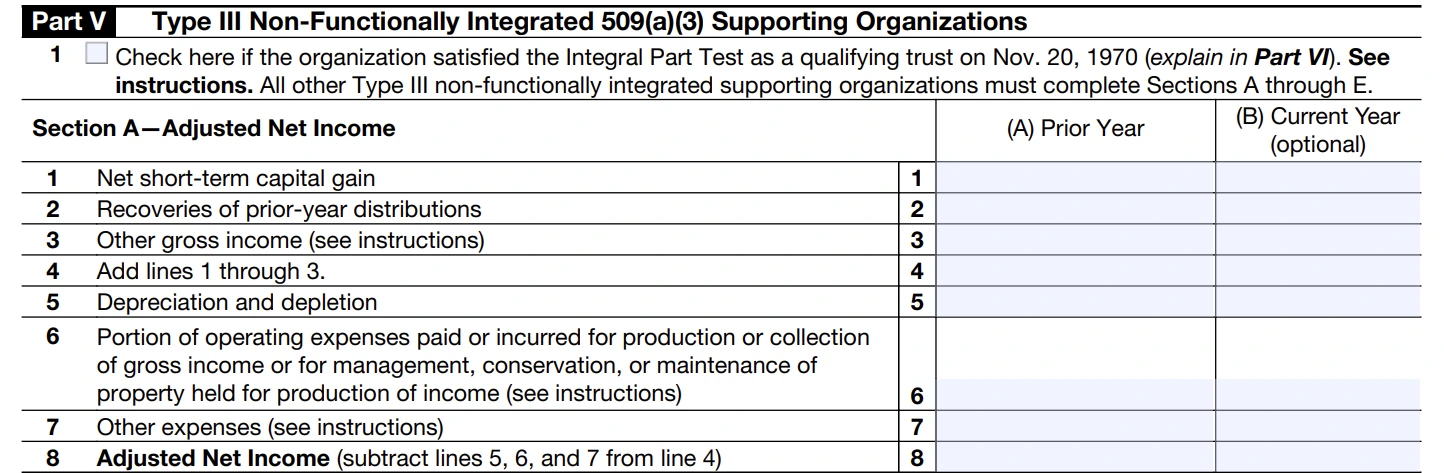

Part V - Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations

If your organization is a Type III support organization that is not functionally integrated, you should complete this part.

Part V allows organizations to report the ways in which they comply with the distribution requirements as a sponsoring organization. Organizations are required to make a minimum distribution to or for use by one or more sponsoring organizations.

It consists of 5 sections:

- Adjusted Net Income - Report your organization’s adjusted net income for the current and prior years.

- Minimum Asset Amount - Based on your organization’s average market value and fair market value of assets, derive and report the minimum asset amount for the current and prior years. prior years.

- Distributable Amount - Enter the distributable amount, which should be either 85% of the adjusted net income or the minimum asset amount for the prior tax year.

- Distributions - Report the total amount of distributions made for exempt purposes.

- Distribution Allocations - Report the distributable amount for 2024, including the excess distributions from the past 5 years, and determine the excess distribution carryover to 2024.

Part VI - Supplemental Information

In this part, you can provide additional information regarding the questions you answered in the previous parts. This part can be duplicated if you require more space.

Tax990 Automatically Includes Schedule A with your 990 Form!

When you file your Form 990 or 990-EZ with Tax 990, the IRS-authorized 990 e-filing solution, our system automatically includes Schedule A and all other required Schedules at no extra cost.

Additionally, Tax990 offers multiple features designed to ease your filing experience, including:

- Form-Based and Interview-Style filing options to prepare forms.

- Internal audit check to ensure the accuracy of returns before transmission.

- Multi-user access to invite team members for preparation, review, and approval.

- US-based support team to assist with your questions via live chat, phone, and email.