Line by Line Instructions to Complete Form 990-EZ

- Updated February 07, 2024 - 2.00 PM - Admin, Tax990

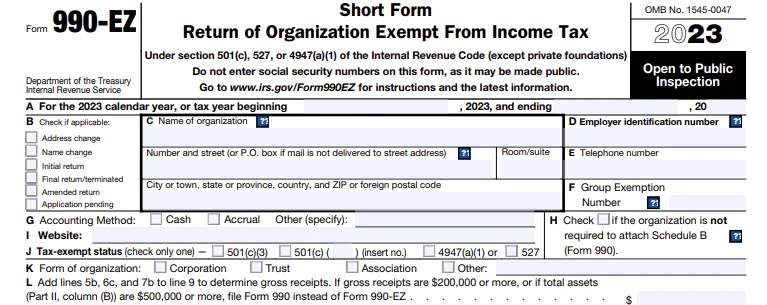

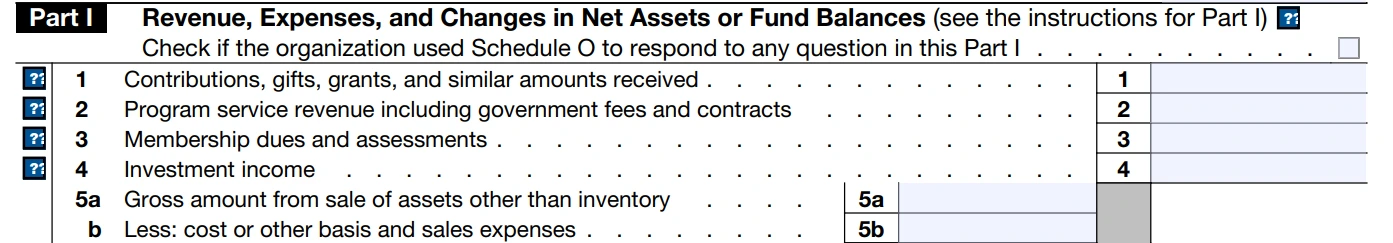

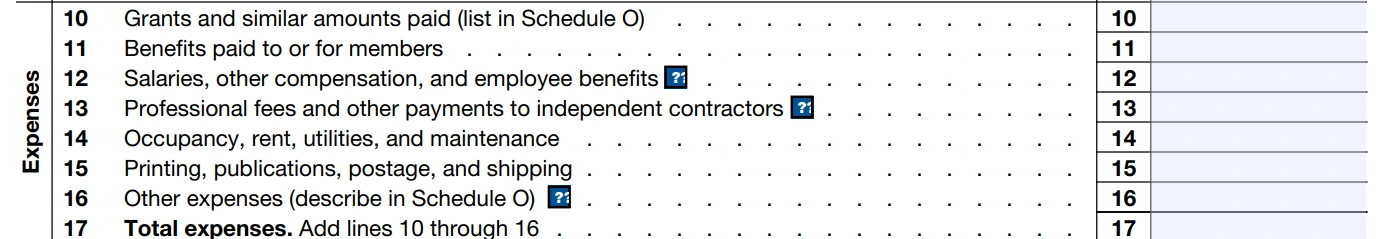

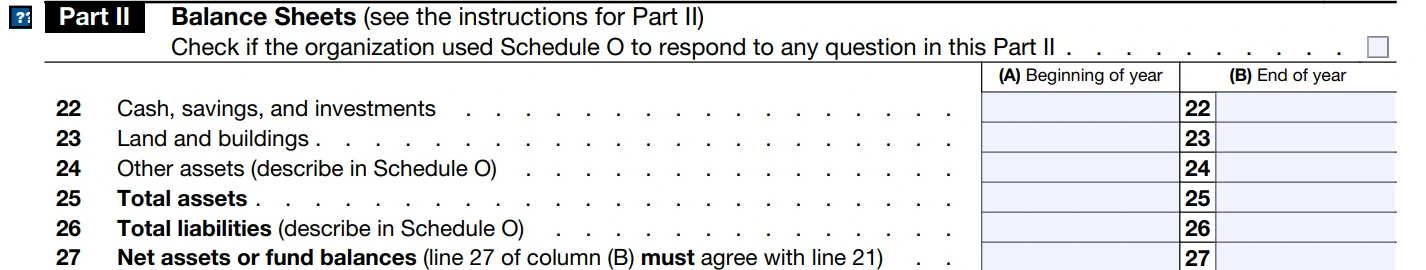

Organizations under section 501(c), 527, or 4947(a)(1) of the (IRC) Internal Revenue Code (except for the private foundations) with gross receipts less than $200,000 and total assets less than $500,000 must file Form 990-EZ (Short Form Return of Organization Exempt From Income Tax).

This article comprises step-by-step instructions on how to fill out your Form 990-EZ.

Additional Filing Requirements for Form 990-EZ:

Organizations that file Form 990-EZ may be required to provide additional information through various Schedules

There are 8 different schedules that may be attached to Form 990-EZ based on your organization type, financial status, and activities.

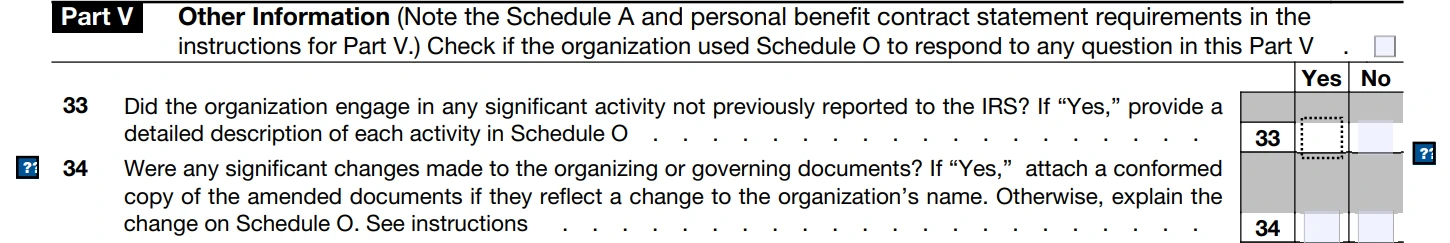

Schedule A - Public Charity Status & Public Support

Schedule B - Schedule of Contributors

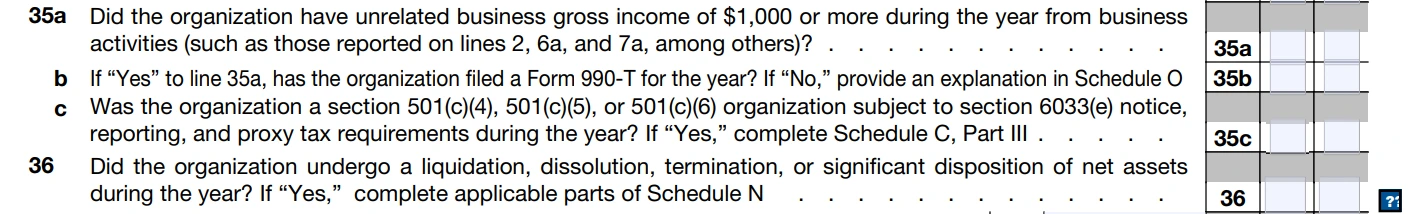

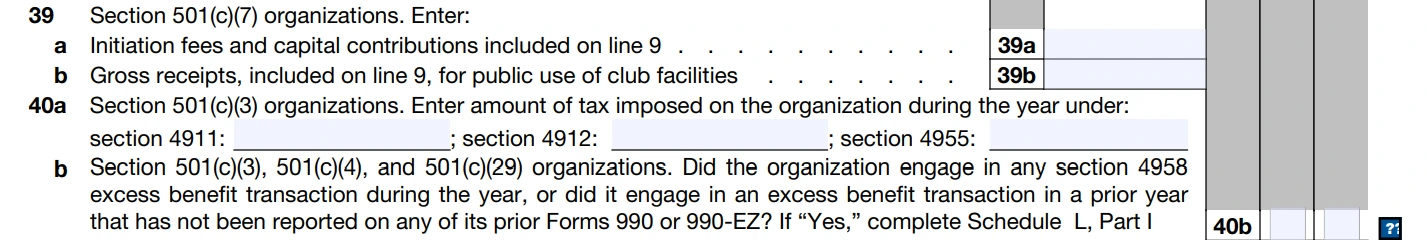

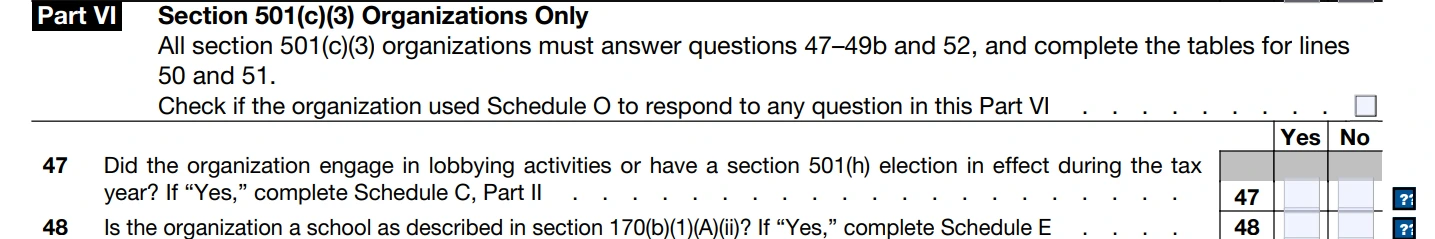

Schedule C - Political Campaign and Lobbying Activities

Schedule E - Schools

Schedule G - Supplemental Information

Schedule L - Transactions with Interested Persons

Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

Schedule O - Supplemental Information to Form 990

Tax 990 is here to make your 990-EZ filing Easier!

Tax 990, the IRS-authorized 990 e-filing solution provider, makes your Form 990-EZ filing hassle-free with its exclusive features.

Our software provides you with 2 different filing methods - Form-based and Interview-Style. Choose one at your convenience.

When you file Form 990-EZ with us, our system will automatically generate the applicable Form 990 Schedule based on the data you enter at no extra cost.

Our built-in Internal Audit Check will review your form for any IRS instruction errors and allow you to fix them before transmission.

We have a live support team of experts ready to assist you with any issues you may have while filing. Our team is available via live chat, phone, or email.

How to file your Form 990-EZ electronically?

Get Started with Tax 990 to prepare and e-file your Form 990-EZ with the IRS.

Follow these simple steps to e-file your form 990-EZ with Tax 990:

Step 1: Add Organization Details

Enter your organization details manually or let our system import the required details from the IRS using your EIN.

Step 2: Choose Tax Year

Tax 990 supports filing for the current and previous years. Choose the tax year for which you are filing and then select Form 990-EZ

Step 3: Complete Form 990-EZ Details

Provide all the required information to complete your Form 990-EZ.

Step 4: Review your Form Information

After providing all the required information, review your form and proceed.

Step 5: Transmit directly to the IRS

Once you have reviewed your form and verified your information, you can transmit Form 990-EZ

to the IRS.

Step 1

Add Organization Details

Enter your organization details manually or let our system import the required details from the IRS using your EIN.

Step 2

Choose Tax Year

Tax 990 supports filing for the current and previous years. Choose the tax year for which you are filing and then select Form 990-EZ

Step 3

Complete Form 990-EZ Details

Provide all the required information to complete your Form 990-EZ.

Step 4

Review your Form Information

After providing all the required information, review your form and proceed.

Step 5

Transmit directly to the IRS

Once you have reviewed your form and verified your information, you can transmit Form 990-EZ

to the IRS.