Trusted By Nonprofits

Let Tax990 Revolutionize Tax Form Filing For Your Organization Too

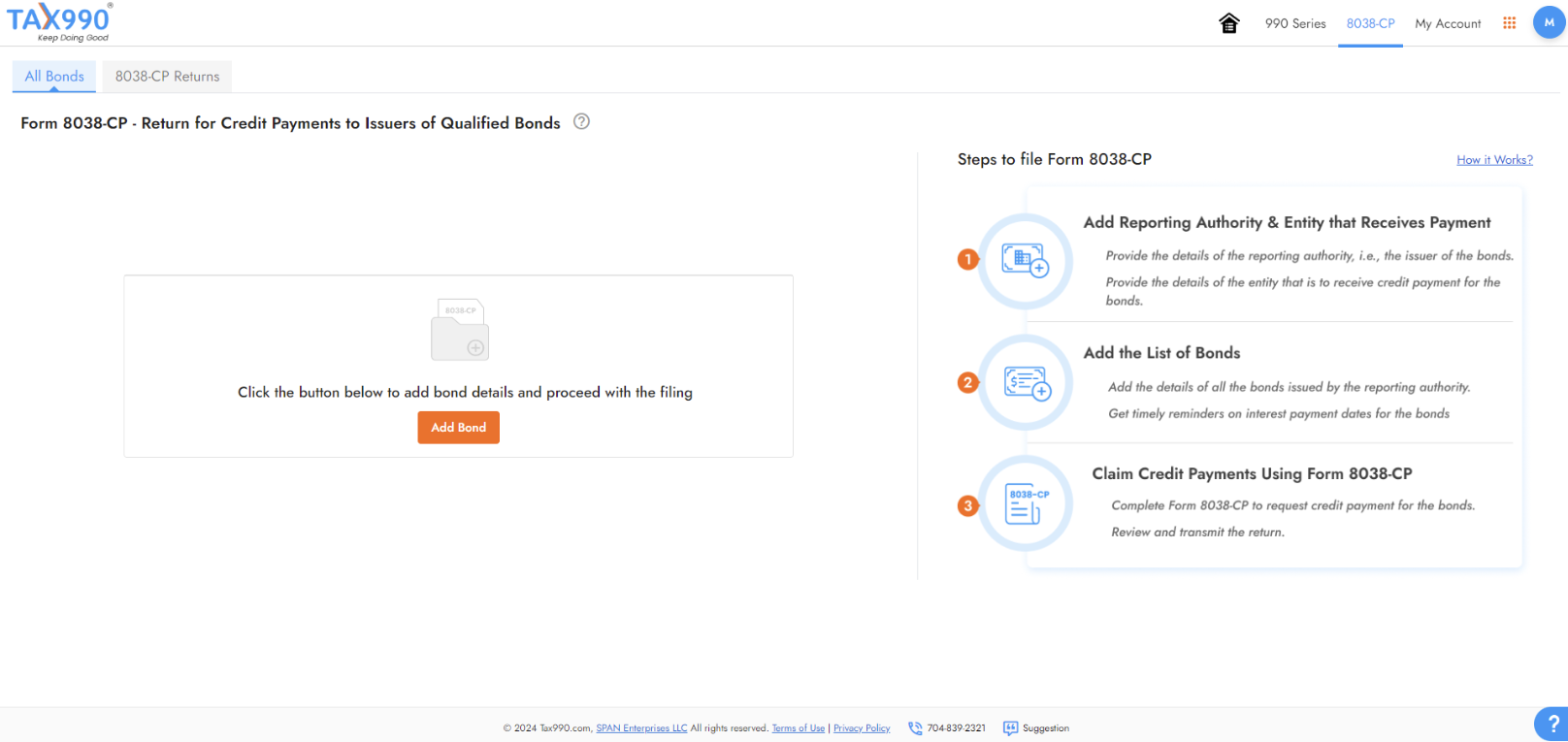

How to file Form 8038-CP Electronically

-

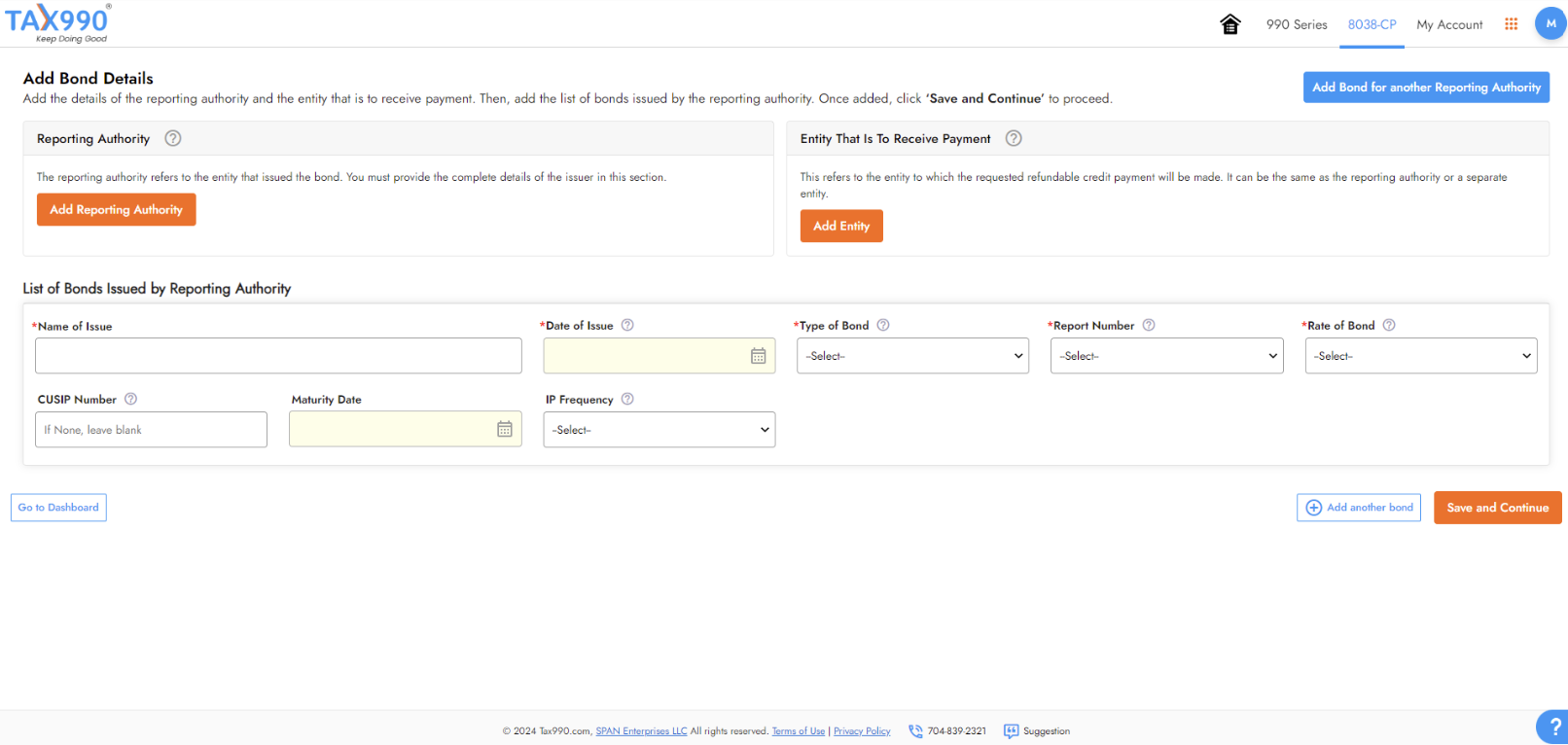

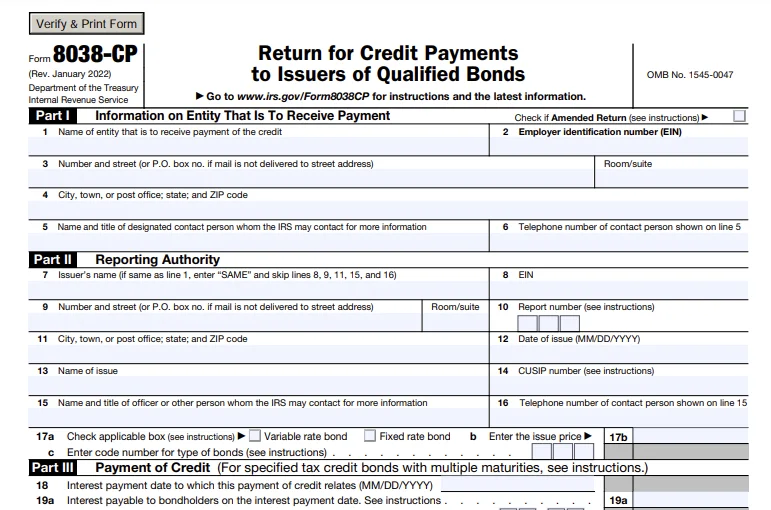

Enter the required details of the reporting authority and the entity that is to receive the claim payment for the bonds.

-

Add the details of all the bonds issued by the reporting authority, such as CUSIP number, interest payment frequency and more.

-

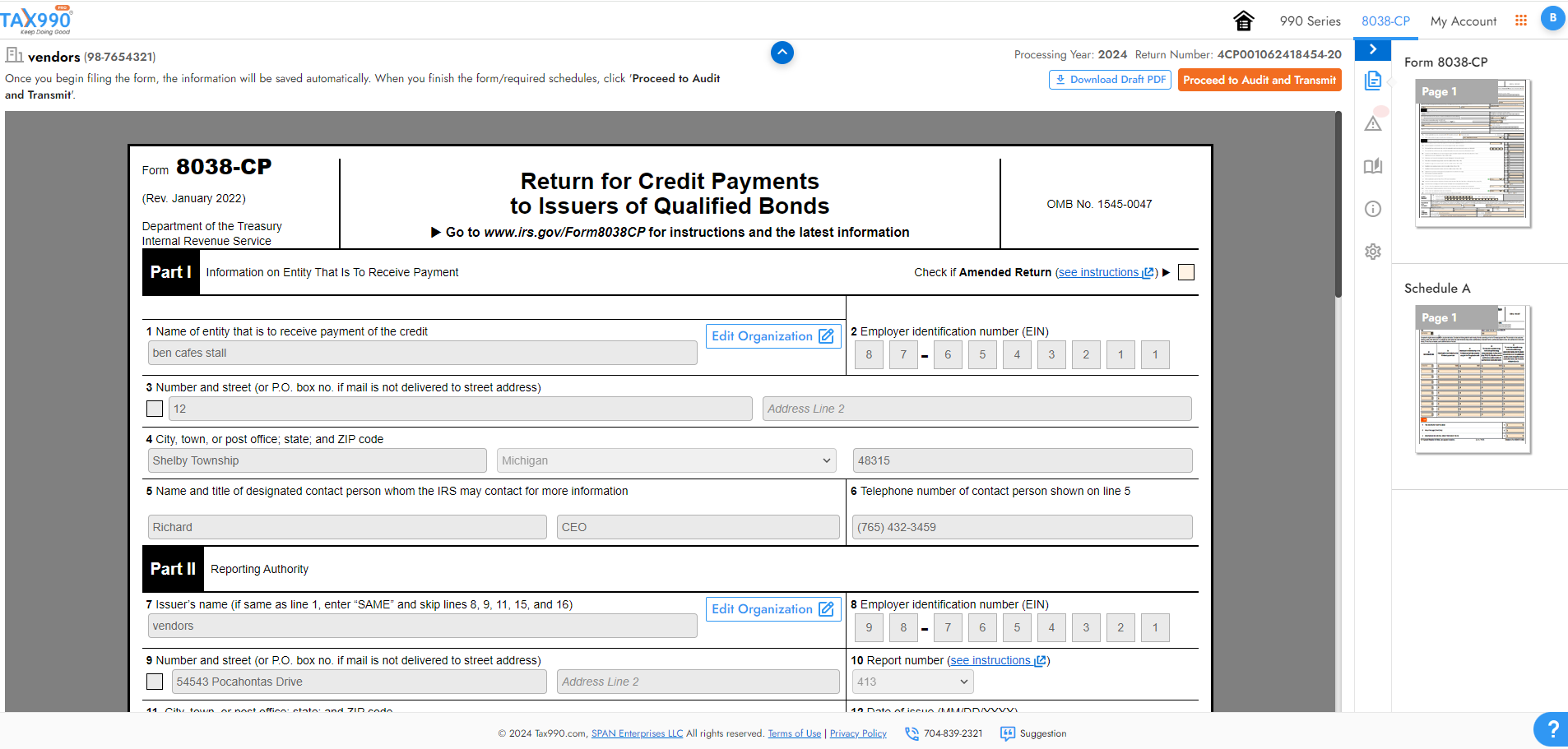

Once the bonds are added, you can start a new 8038-CP return and complete the required information.

-

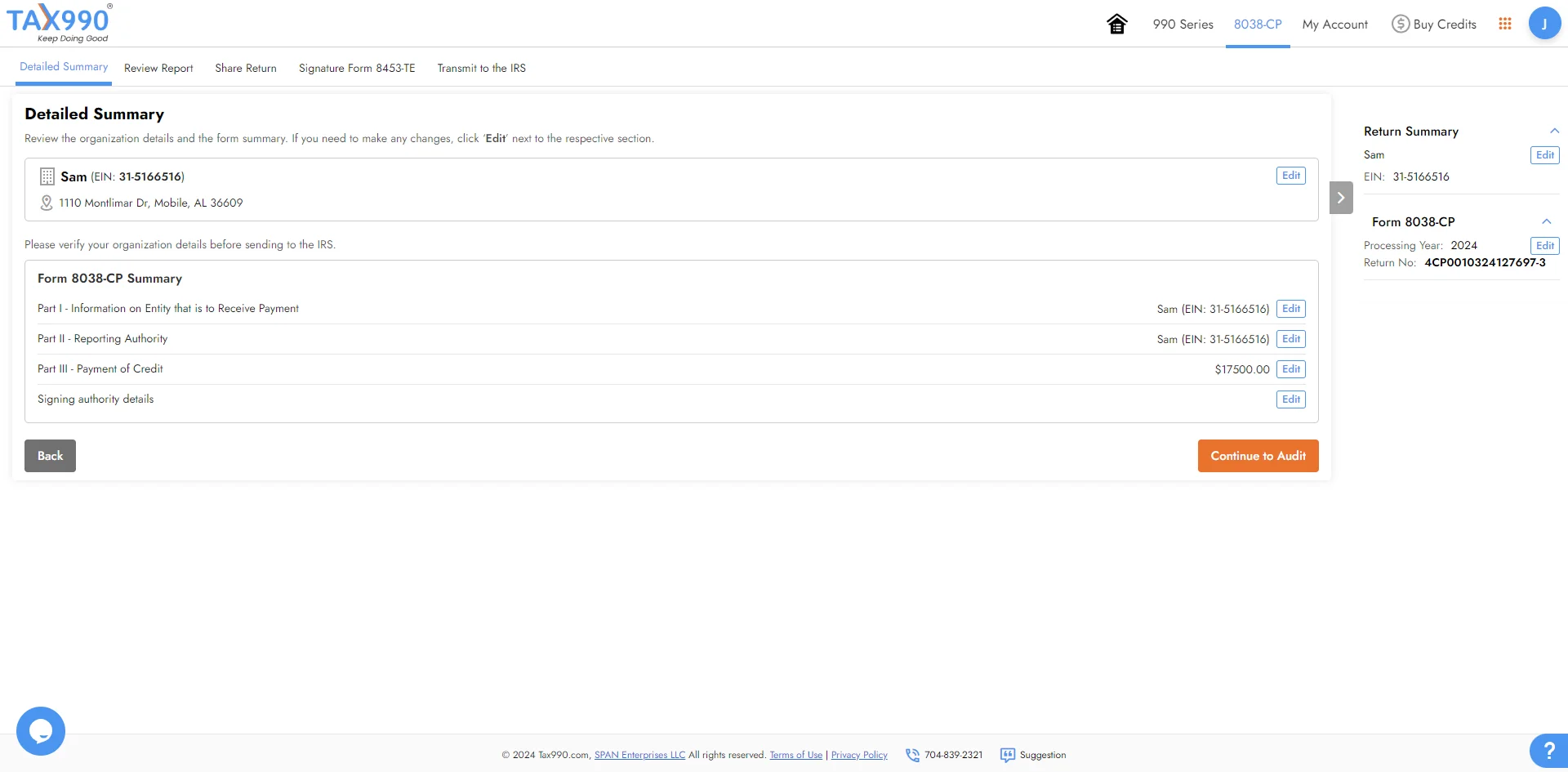

After entering all the required information, you can review the form summary and make changes if necessary.

-

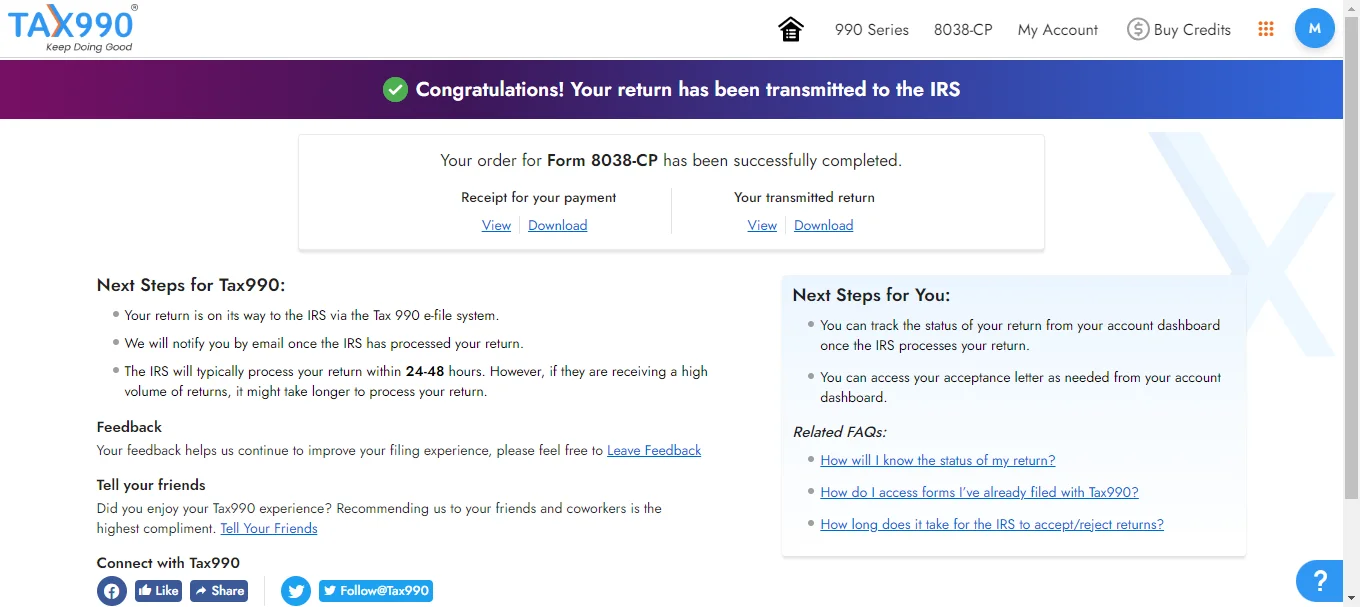

After reviewing your form, transmit it to the IRS. Our system will keep you posted on the IRS status of your form via email or text.

Ready to E-file Form 8038-CP?

Information Required to E-file Form 8038-CP Online

Here is the list of major information that you’ll need to file Form 8038-CP online,

- Details of the reporting entity (issuer)

- Details of the entity that is to receive the payment

- Information regarding the bond issue

- Interest payment date

- Amount of credit payment requested

Exclusive Features for Seamless Form 8038-CP E-Filing

Free 8038-CP Schedule A

Tax 990 supports Form 8038-CP Schedule A and includes it with your form automatically for Free based on the data you enter.

Multi-User Access

You can invite team members from your organization to assist with form preparation or help manage the filing process.

Internal Audit Check

You’ll be alerted of IRS instruction errors in your form before transmitting through our internal audit check.

Reviewers and Approvers

You have the option to share the completed form with your organization’s board members and have them review and approve it.

Re-Transmit Rejected Return

If the IRS rejects a form you filed with us, you can fix any errors and re-transmit for free.

Seamless Customer Support

Our support team is available via live chat, phone, and email to assist you with the questions you may have during and after the filing.

Ready to start your 8038-CP E-filing?

E-filing fees for Form 8038-CP

- Includes Schedule A

- Add users to assist in the filing process

- Built-in error check system

- Invite users to review and approve

Ready to e-file Form 8038-CP?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions about Tax Form 8038-CP

What is IRS Form 8038-CP?

Form 8038-CP is used by the issuers of certain bonds to claim a refundable credit payment from the Federal Government equal to a specified percentage of the interest payments on those bonds

Who can file Form 8038-CP?

The issuers of any of the following bonds can file Form 8038-CP to claim credit payments for the interest payments made:

- Build America Bonds (BAB)

- New Clean Renewable Energy Bonds (NCREB)

- Qualified Energy Conservation Bonds (QECB)

- Qualified Zone Academy Bonds (QZAB)

- Qualified School Construction Bonds (QSCB)

- Recovery Zone Economic Development Bonds (RZEDB)

What and When should I include Form 8038-CP Schedule A?

Form 8038-CP Schedule A is used to claim the credit payments under section 6431(f) that should be included for the following bonds.

- New Clean Renewable Energy Bonds (NCREB)

- Qualified Energy Conservation Bonds (QECB)

- Qualified Zone Academy Bonds (QZAB)

- Qualified School Construction Bonds (QSCB)

When is the deadline to file Form 8038-CP?

For Fixed rate bonds:

Form 8038-CP should be filed between 45 days and 90 days before the date when the relevant interest was paid.

For Variable rate bonds:

- When the issuer knows the interest payment amount 45 days prior to the interest payment date, Form 8038-CP can be filed within the same timelines as fixed rate bonds. (A separate Form 8038-CP needed to be filed).

- When the issuer doesn’t know the interest payment amount 45 days prior to the interest payment date, the issuer must collate all credit payments on a quarterly basis and file Form 8038-CP for reimbursement in arrears. It shouldn't exceed 45 days from the last interest payment date within the quarterly period.

Not sure when to file Form 8038-CP? Use our Due Date Finder

How many parts are there in Form 8038-CP?

Here’s the breakdown of Form 8038-CP:

- Part I - Information on Entity That Is To Receive Payment

- Part II - Reporting Authority

- Part III - Payment of Credit

Check out our step-by-step instructions to understand how to complete Form 8038-CP.

What are the additional filing requirements for Form 8038-CP?

You may be required to file Form 8038-T for paying back arbitrage or paying the penalty instead of arbitrage rebate to the federal government.

Can I paper file Form 8038-CP?

Starting January 1, 2024, the IRS mandates the e-filing of 8038-CP for most filers. You must file 8038-CP electronically if you are required to file 10 or more returns of any type in a calendar year.

If you are eligible for paper filing, you can complete and mail Form 8038-CP to the below address.

Internal Revenue Service Center,

Ogden, UT 84201-0050.