Form 990-PF, 990-EZ and 990 Schedule B Instructions for 2024

- Updated December 04, 2024 - 2.00 PM - Admin, Tax990

Nonprofits Organizations who file Form 990, 990-EZ, or 990-PF may be required to attach Form 990 Schedule B to report additional information about contributions in accordance with IRS filing requirements.

Here, You can learn more about 990 Schedule B Instructions and its filing requirements.

Table of Contents

What is IRS Form 990 Schedule B?

IRS Form 990 Schedule B is a supplementary filing requirement of nonprofit organizations used to report details regarding the contributions they received during the corresponding tax year.

This provides the IRS with a detailed breakdown of contributions reported by the organizations on their

Form 990,

Form 990-EZ or Form 990-PF.

Who needs to File 990 Schedule B?

The organizations that are required to complete 990 Schedule B must meet either the 'General Rule' or one of the

'Special Rules’'

General Rule:

Organizations that are required to e-file Form 990-PF, 990-EZ, or 990-PF and have received contributions of $5,000 or more from any one contributor during the tax year - Should Complete Part I and Part II.

Special Rules:

| Section 501(c)(3) organizations | Section 501(c)(7), (8), or (10) organizations | Section 501(c)(7), (8), or (10) organizations |

|---|---|---|

|

Organizations that file 990 or 990-EZ while meeting 33 ⅓ % support test and have received $5000 or 2% of the total contributions (greater) from any one contributor - Should Complete Part I and II. |

Organizations that file 990 or 990-EZ and have received contributions of more than $1,000 from any one contributor specifically for religious, charitable, scientific or educational purposes, or for the prevention of cruelty to children or animals - Should Complete Part I, II, and III. |

Organizations that file Form 990-EZ or 990 and have received contributions of less than $1,000 from any one contributor specifically for religious, charitable, and similar purposes - Should enter the amount and complete the parts only upon meeting the |

What Contributions are Reported on 990 Schedule B?

Contributions reportable on Form 990 Schedule B include:

- Contributions

- Grants

- Bequests

- Devises

- Gifts of money or property

These contributions should be reported regardless of whether they are designated for

charitable purposes.

How to Complete Schedule B for Form 990,

990-EZ, 990-PF?

Initially, Form 990 Schedule B requires organizations to provide basic information, including:

Name of the organization

Employer identification number (EIN)

Organization type

Also required to indicate whether the organization is covered by the general rule or a special rule

Following this, organizations must provide detailed information about the contributions they received in three distinct sections:

Part I: Contributors

Part II: Noncash Property

Part III: Exclusively Religious, Charitable, etc.

The specific requirements for completing each part will depend on the applicable rules for

your organization.

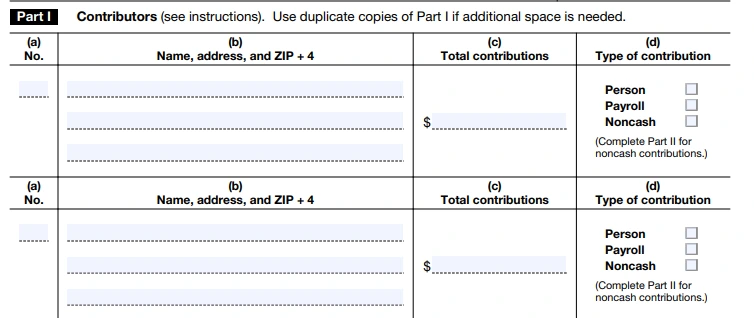

Part I - Contributors

Who are Contributors?

A contributor is an individual or entity that provides financial support or assets to an organization. Contributors include individuals, fiduciaries, partnerships, corporations, associations, trusts, exempt organizations, or governmental units.

In this section, you are required to report details for contributors who have given $5,000 or more in the form of contributions, grants, bequests, devises, or gifts of money or property. This includes:

- Name and Address

- Total contributions

- Type of contribution (Person, payroll, Noncash)

Organizations other than Section 501(c)(3) organizations (including Section 4947(a)(1) nonexempt charitable trusts and nonexempt private foundations described in Section 6033(d)) and Section 527 political organizations are not required to report the names and addresses of the contributors and can enter “N/A” instead.

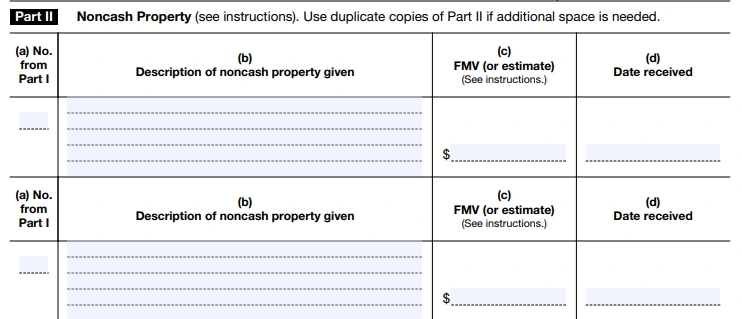

Part II - Noncash Property

What is a Noncash property?

Noncash property refers to assets other than cash that are donated to an organization. This can include tangible items such as real estate, equipment, vehicles, artwork, and other physical goods, as well as intangible assets like stocks or intellectual property.

This part requires you to report information regarding the noncash properties your organization received as contributions during the tax year.

The details required to be reported in this part include:

- Description of the noncash property given

- Fair Market Value (FMV) of the property

- Date when the property was received

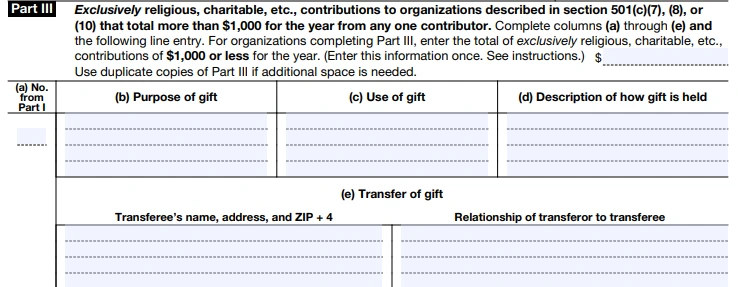

Part III - Exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from anyone contributor

What are exclusively religious, charitable contributions?

These are contributions or gifts to a corporation, trust, community chest, fund, or foundation organized and operated exclusively for religious and charitable purposes. Such contributions are intended to support activities aligning with the organization's mission of providing the community with religious, charitable, or similar benefits.

This part requires you to report contributions exceeding $1,000 your organization has received exclusively for religious, charitable, or similar purposes.

Here are the details you need to enter:

- Purpose of gift

- Use of gift

- Description of how the gift is held

- Transfer of gift (If you have transferred the gift to another organization)

- Transferee’s name, address, and ZIP

- Relationship between transferor and transferee

Tax990 Includes Form 990, 990-EZ, and 990-PF Schedule B for Free!

By e-filing with Tax 990, Form 990 Schedule B will be automatically included with your submission at no extra cost, based on the information you provide.

Tax990 makes filing easier with these prominent features:

Flexible Filing Options: Choose between traditional form entry or an easy interview-style process.

Bulk Upload Templates: Quickly import your contributions and grant data with our

user-friendly templates.

Built-In Error Check: Our automatic error check system ensures that your 990 returns are accurate and compliant with the IRS rules.

24x7 Live Support: Get help anytime via live chat, phone, or email from our dedicated

support team.