IRS Form 990 Schedule K Instructions

- Updated August 21, 2024 - 2.00 PM - Admin, Tax990

Nonprofit organizations that file Form 990 and are involved in issuing tax-exempt bonds should attach Schedule K to their form.

Here, you can find more details about Schedule K and its filing requirements.

Table of Contents

What is the purpose of Form 990 Schedule K?

Schedule K is used by Nonprofit organizations that e-file Form 990 to provide information on its outstanding liabilities associated with tax-exempt bond issues.

Generally, a bond issue associated with a tax-exempt organization includes qualified 501(c)(3) bonds. However, the reporting should be completed for all types of tax-exempt bonds that benefit the organization.

A qualified 501(c)(3) bond issue comprises bonds, the profits of which are utilized by a section 501(c)(3) organization to extend its charitable purpose.

What is a Tax-Exempt Bond?

A tax-exempt bond is an obligation issued by or on behalf of a governmental issuer for which the interest paid is excluded from the holder's gross income under section 103.

A bond can be in any form of indebtedness under federal tax law (including a bond, note, loan, or lease-purchase agreement).

Who must file Form 990 Schedule K?

Schedule K must be attached by organizations that reported an outstanding tax-exempt bond issue that:

Had an outstanding principal amount in excess of $100,000 as of the last day of the

tax year, and

Was issued after December 31, 2002.

These organizations must answer “Yes” on Form 990, Part IV, Checklist of Required 990 Schedules, Line 24a.

Note:

Up to four separate outstanding tax-exempt liabilities can be reported on each Schedule K (Form 990).

How to complete Form 990 Schedule K?

Schedule K has 6 parts in total. The requirements for completing some of these parts depend on your bond proceeds.

Part I - Bond Issues

This part requires you to provide the following information for each outstanding tax-exempt bond issue

Issuer Name

Issuer EIN

Committee on Uniform Securities Identification Procedures (CUSIP) number (The CUSIP number should be identical, and it is listed on Form 8038, Part I, line 9, filed for the bond issue)

Date of Issued

Issue Price

Describe the purpose of the bond issue

Part II - Proceeds

This part consists of 17 lines, and it is used to report the amount of proceeds of the bond issue.

Report details regarding how the bond proceeds were spent by providing the following details:

Cumulative principal amount of bonds of the issue that have and haven’t been retired

Total amount of proceeds of the bond issue as of the end of the 12-month period

Amount of gross proceeds held in a reasonably required sinking fund, pledged fund, or reserve or replacement fund as of the end of the 12-month period

Cumulative amount of proceeds used, as of the end of the 12-month period

The amount of proceeds held in a refunding escrow as of the end of the 12-month period

Cumulative amount of proceeds used to finance working capital expenditures (Capital expenditures generally include costs incurred to acquire, construct, or improve land, buildings, and equipment)

The amount of unspent proceeds as of the end of the 12-month period

Enter the year in which construction, acquisition, or rehabilitation of the financed project was substantially completed.

Provide details regarding the refunding issue of tax-exempt bonds and the final allocation of proceeds

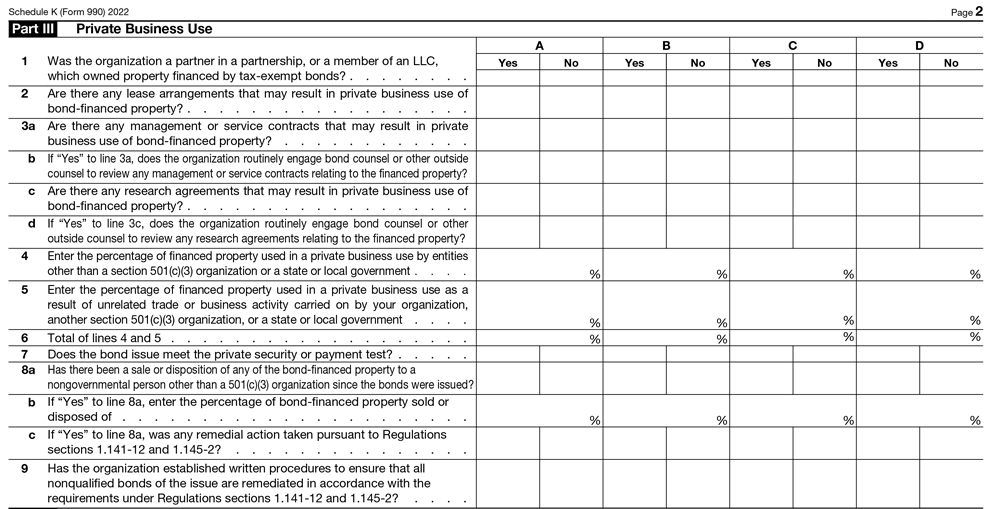

Part III - Private Business Use

This part is comprised of “Yes” or “No” questions and the percentage of financial property used in private businesses.

A Few of the questions include

Is your organization partnered with a partnership or a member of an LLC, which owned property financed by tax-exempt bonds?

Are there any lease arrangements that may result in private business use of the bond-financed property?

Are there any management or service contracts that may result in private business use of the bond-financed property?

Does the bond issue meet the private security or payment test?

Note:

The organization isn’t required to complete this part with respect to any bond issue reported in Part I that is a qualified private activity bond other than a qualified 501(c)(3) bond.

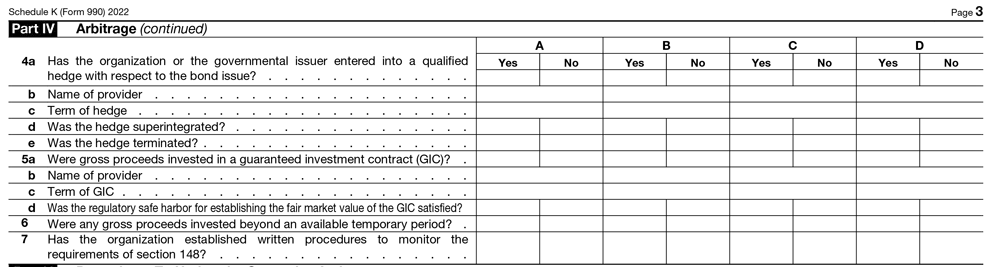

Part IV - Arbitrage

This part requires you to report information on the bond issuer and their gross proceeds invested details.

Some of the questions in this part are

Has the issuer filed Form 8038-T?

Has the organization or the governmental issuer entered into a qualified hedge with respect to the bond issue?

Were gross proceeds invested in a guaranteed investment contract?

Were any gross proceeds invested beyond an available temporary period?

Part V - Procedures To Undertake Corrective Action

This part represents whether the organizations have the written statement to ensure they follow the federal tax requirements.

In the written statement, you should confirm any violations are quickly identified and corrected by your organization through the voluntary closing agreement program.

Part VI - Supplemental Information

Use this part to provide additional information for the issuer price and purpose of the bond, which is reported in Part I, lines a to d.

Tax990 Includes Form 990 Schedule K!

- When you file your Form 990 with Tax 990, our system auto-generates Schedule K and all other required Schedules onto your form based on the information you provide on Form 990 at no extra cost.

- Additionally, Tax 990 offers multiple features designed to ease your filing experience, including Form-Based filing options to prepare forms.

- Internal audit check to ensure the accuracy of returns before transmission.

- Multi-user access to invite team members for preparation, review, and approval.

- US-based support team to assist with your questions via live chat, phone, and email.