Let Tax990 Take Care of Your Additional Filing Requirements!

- The IRS requires you to attach the applicable Schedules with your 990, CA 199, and 8038-CP Forms to report additional information.

- To make this easier for you, Tax990 automatically prompts you to include and fill out the required Schedules based on the data you enter on your forms.

- Furthermore, there are no additional charges for the Schedules. They are

completely FREE.

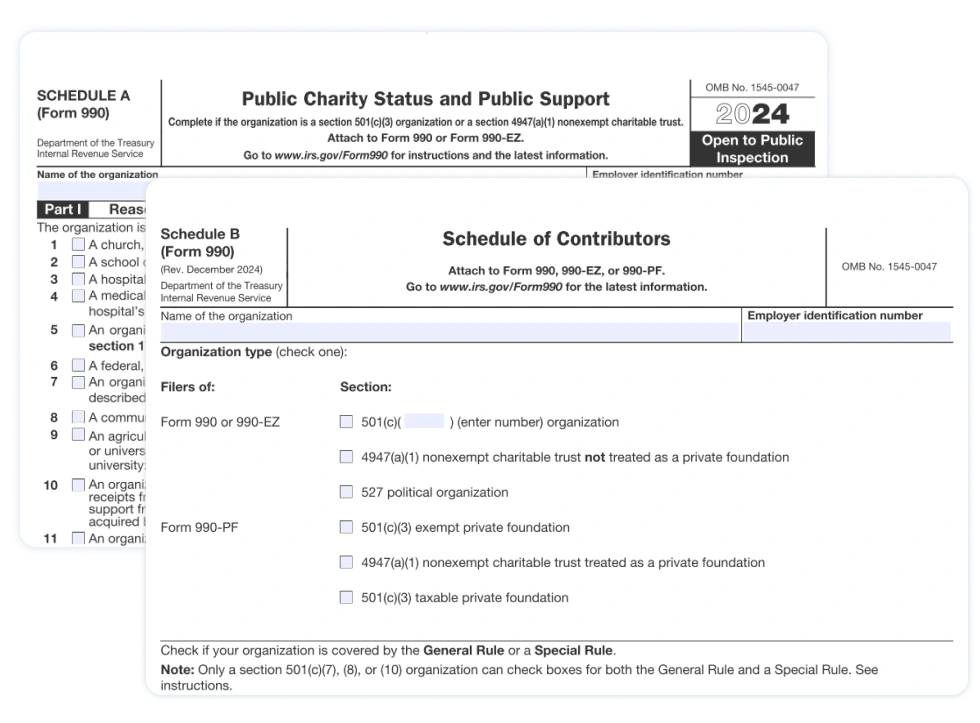

Schedules Supported by Tax990

| Form 990 | Form 8038-CP | Form CA-199 |

|---|---|---|

|

Form 8038-CP Schedule A |

|

Frequently Asked Questions

Yes, you can copy the prior year's information from the Form 990 schedules you attached. Currently, we support copying the information only from Schedule A, Schedule B, and Schedule O.

No. Currently, we do not support this option. Moreover, based on the information provided in your return, we will generate the schedules automatically. This will enable you to provide the required information and e-file your return quickly.

The completion of schedules will vary depending on the filing method you choose. If you choose a Form-based filing method, we will enable the required schedules based on the information you provide on your return.

If you opt for an interview-based method of filing, a series of questions will be asked to generate your return, and based on your answers, the necessary schedules are completed.