File Up to 3 Amendments at no cost, if the original 990 return was filed with us.

Amend Nonprofit Tax Returns Quickly with Tax 990

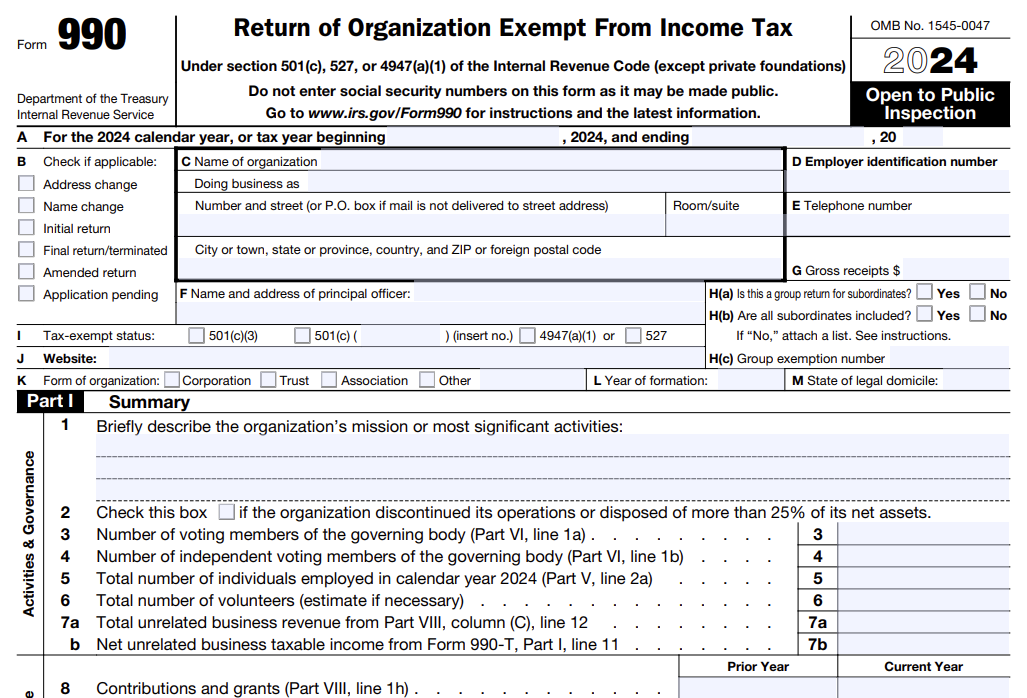

Tax 990 supports the filing of amended returns for Forms 990, 990-EZ, 990-PF, and 990-T. Clients can also amend other forms such as CA-199, 1120-POL and 8038-CP. Amendments should be filed only if the return has been accepted by the IRS.

- If the original return was filed elsewhere, choose the respective 990 forms, select the ‘Form-based filing’ method, check ‘Amended return’ in the form, provide a reason and enter the correct information.

- If the original return was filed with Tax 990, select ‘Amend this Return’ for the form you need to amend in your Dashboard, mention the reason for the amendment and proceed with the changes.

Tax 990 automatically copies all the information from the original return (if filed with us) to the amended return. You can just make the changes and e-file it.

How to Electronically Amend a Return with Tax 990

Step 1

Select the Form

Step 2

Provide Reason

Step 3

Make Changes

Step 4

Review Your Form

Step 5

Pay and transmit to the IRS

Ready to E-file an amended return?

Amended Return Fees

- Available for 990, 990-EZ, 990-PF, 990-T, 1120-POL, CA-199 and

8038-CP - File Up to 3 Amendments at no cost, if the original 990 return was filed with us. (This does not apply to Form 8038-CP).

Ready to e-file an amended return?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions

What forms can I amend with Tax 990?

Tax 990 supports amendments for the following forms:

- Form 990

- Form 990-EZ

- Form 990-PF

- Form 990-T

- Form CA-199

- Form 1120-POL

- Form 8038-CP

Can I amend a return that wasn’t originally filed with

Tax 990?

Yes! You can file an amendment for every form besides the 1120-POL using our form-based filing method, even if the form wasn’t originally filed with Tax 990.

Note: The actual fee of the form will apply.

What Information Can I Correct with the Amended Return?

With Tax 990, you can amend any information reported on your original form, such as Name, EIN, financial information, activities, etc., and file a corrected return quickly and effortlessly.

The amended return should include all the required form information and not just the information which is corrected.

Should I include Schedules with Amended Returns?

Yes! All the applicable Schedules should also be included with the amended returns.

Should I make the 990 amended returns available for public inspection?

Yes! The amended returns of 990 forms should be made available for public inspection for 3 years from the filing date or 3 years from the original due date (whichever is later).

How long do I have to file an amended return?

The organizations can file an amended return for 990 forms at any time to report the corrected information on previously filed returns for a 3-year period.