The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Need more time to file? Submit Form 8868 for an automatic extension for free.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Faster, Easier 990-T E-Filing

Tired of complicated tax filing? Tax990 is here to simplify the process, making filing your 990-T easy and stress-free!

Direct Form Entry

Enter information directly into each section of Form 990-T using our intuitive interface—designed for clarity and ease.

Includes Supporting Forms

Tax 990 Includes supporting forms 4562, 4797, 1120 Schedule D, 1041 Schedule D, 1041 Schedule I, 8949, 8995, and 3800.

Internal Audit Check

Our system reviews your return against IRS business rules and highlights potential errors before submission.

Share Returns for Approval

Share your 990-T return with board members or internal reviewers to gather input and approvals before submission.

Smart AI Assistance

Our AI chatbot is here to guide you 24/7—get quick answers whenever you need help.

World-Class Customer Support

Need help? Connect with our expert support team by live chat, phone, or email—anytime.

Our intuitive features make filing Form 990-T easier than ever

Exclusive Tools for Tax Professionals

Tax990 offers many exclusive features that simplify workflows for paid preparers and EROs who handle 990-T filings for their clients.

Enable Efficient Team Management

Collaborate with your team—invite them to help prepare and transmit returns, assign specific roles, and track their progress.

Manage Clients with Ease

Easily manage 990-T filings for unlimited clients, with secure client review of returns before transmission.

Streamlined E-Signing Options

Tax990 offers simple e-signature options for Form 8453-TE and Form 8879-TE, making your filing process more efficient.

Save More as You File More

Maximize savings on filings with our volume-based pricing plans, while ensuring your clients stay compliant.

Want to discover how Tax990 can help you and your clients?

What You’ll Need to File Form 990-T Online

Here is what you’ll need to file Form 990-T online,

- The organization’s basic information

- Details about the Unrelated Business Income (UBI)

- Tax computations

- Tax dues and payments

- Other activities of the organization

Need more help completing the form? Check out our Form 990-T instructions

How to File Form 990-T Electronically with Tax990

Create your free account and follow these simple steps to e-file your Form 990-T effortlessly!

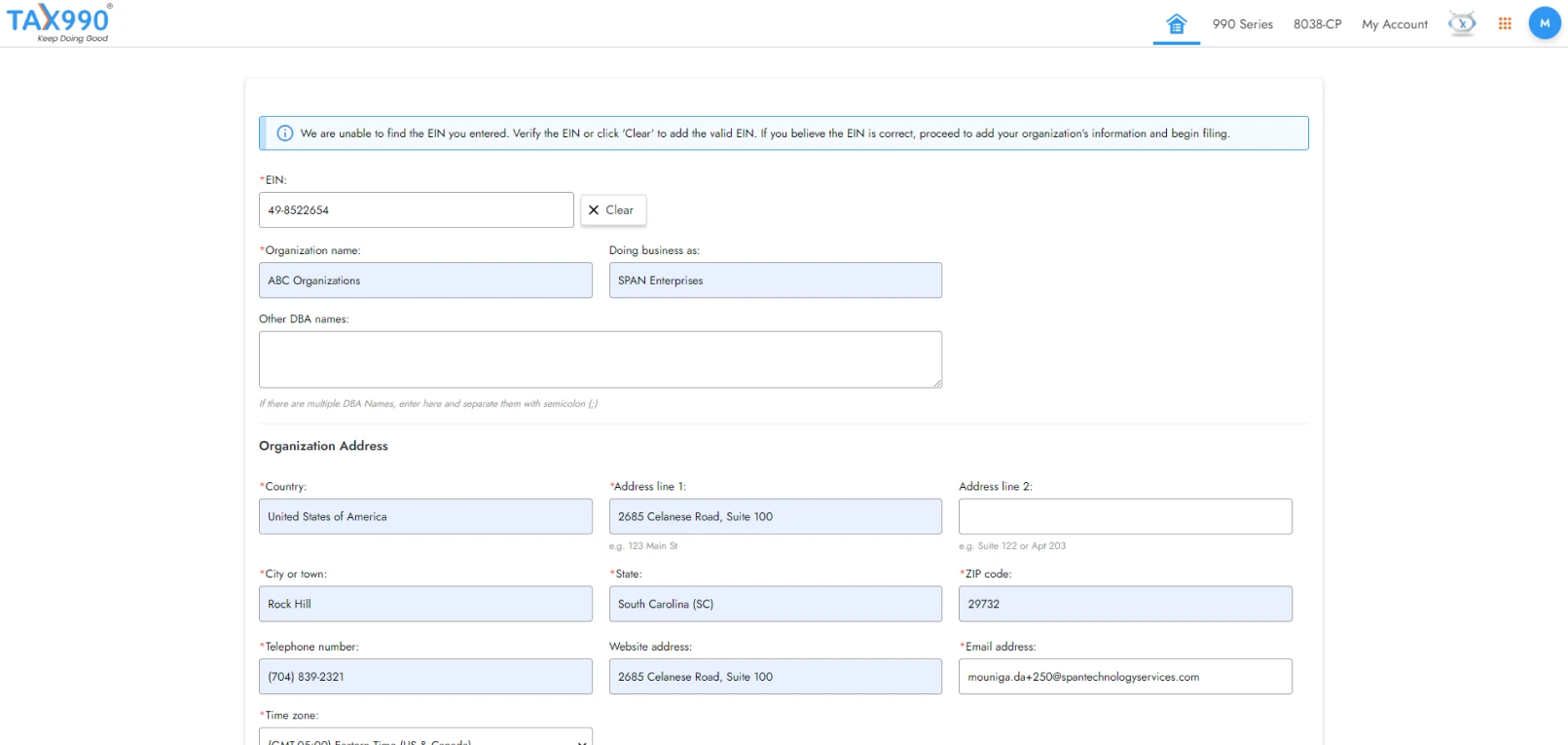

Add Organization Details

Search for your EIN to auto-populate organization details or enter them manually.

Choose Tax Year and Form

Select Form 990-T for the current or prior tax year and proceed.

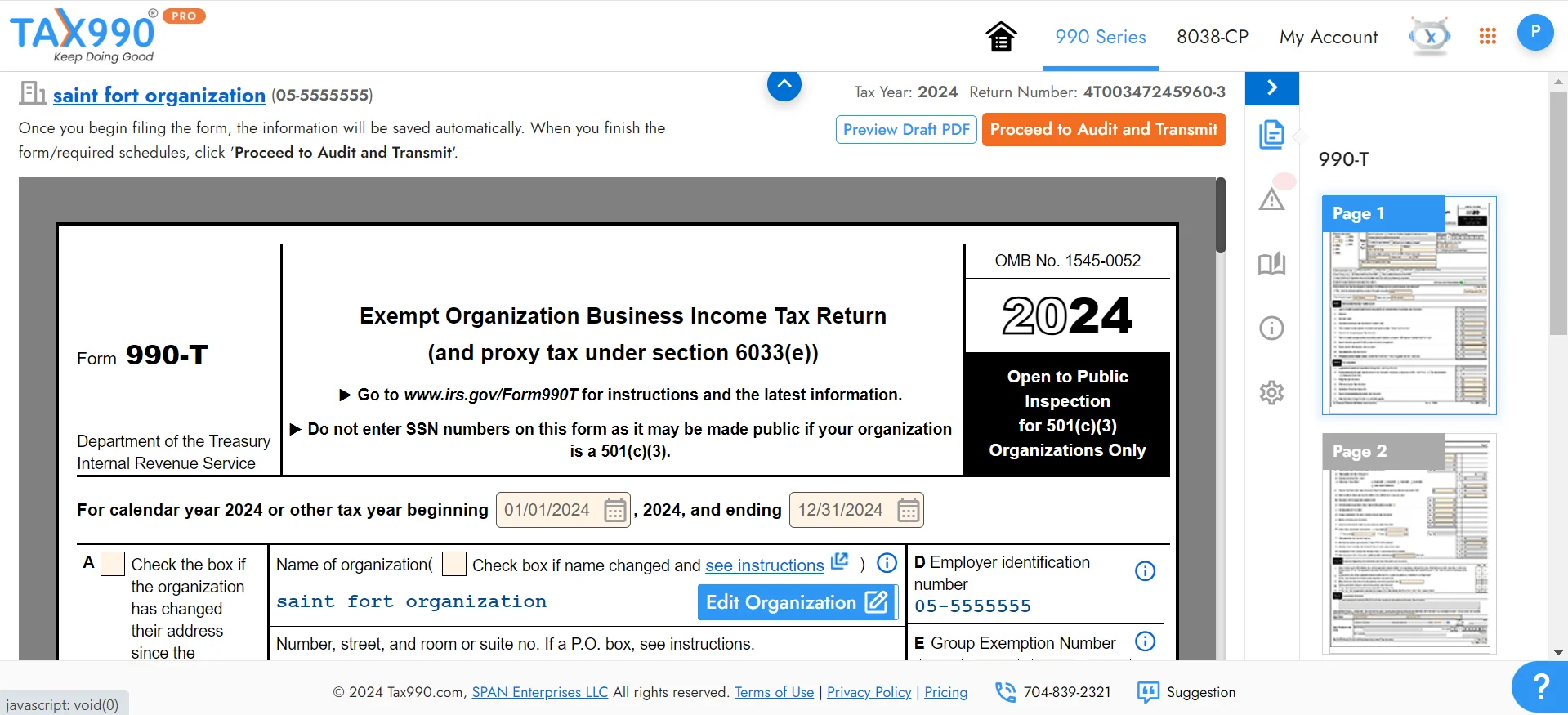

Enter Form 990-T Data

Easily fill out your 990-T with our step-by-step guidance.

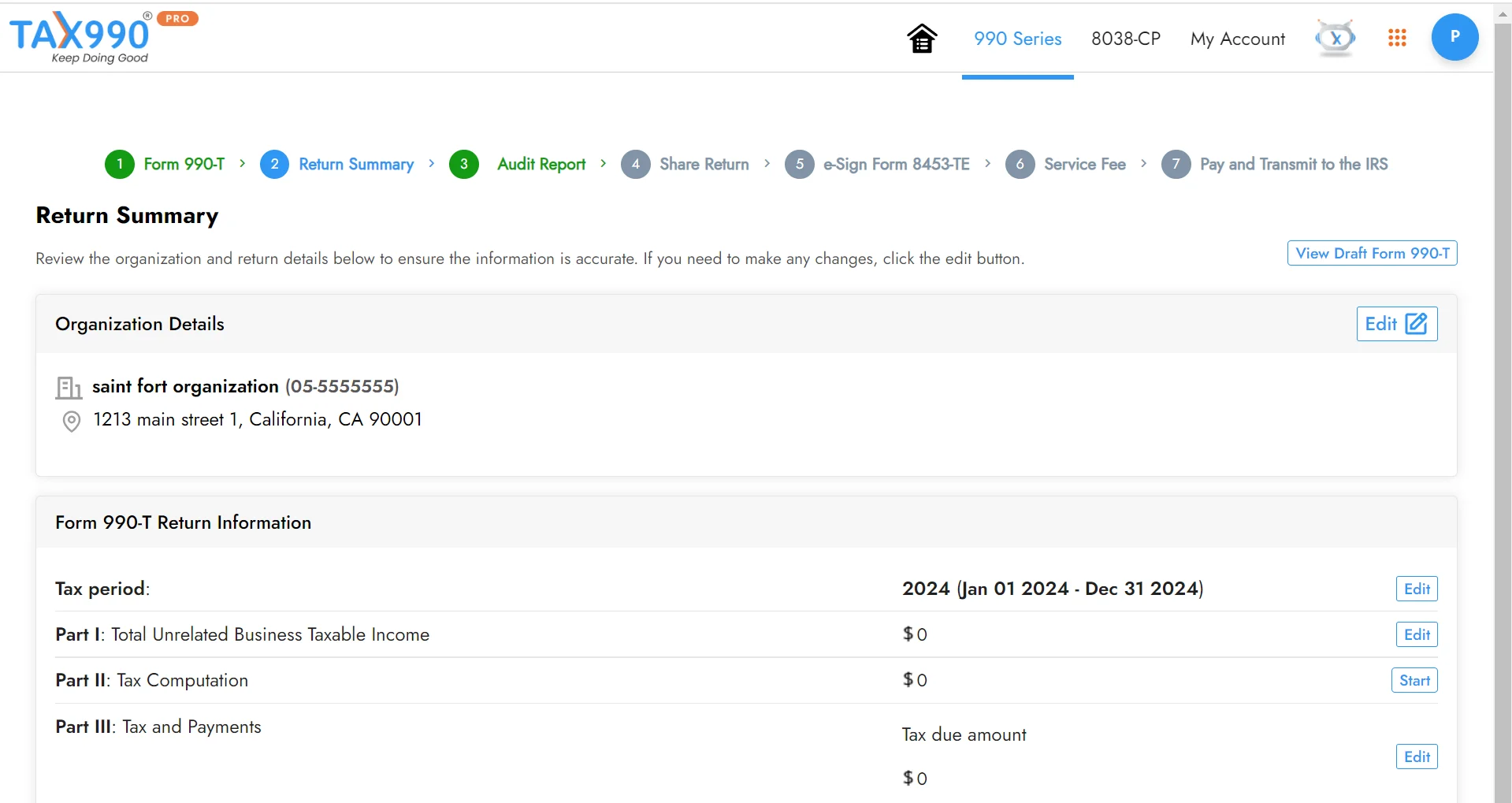

Review your Form Summary

Check your form summary, edit if needed, and share for review/approval.

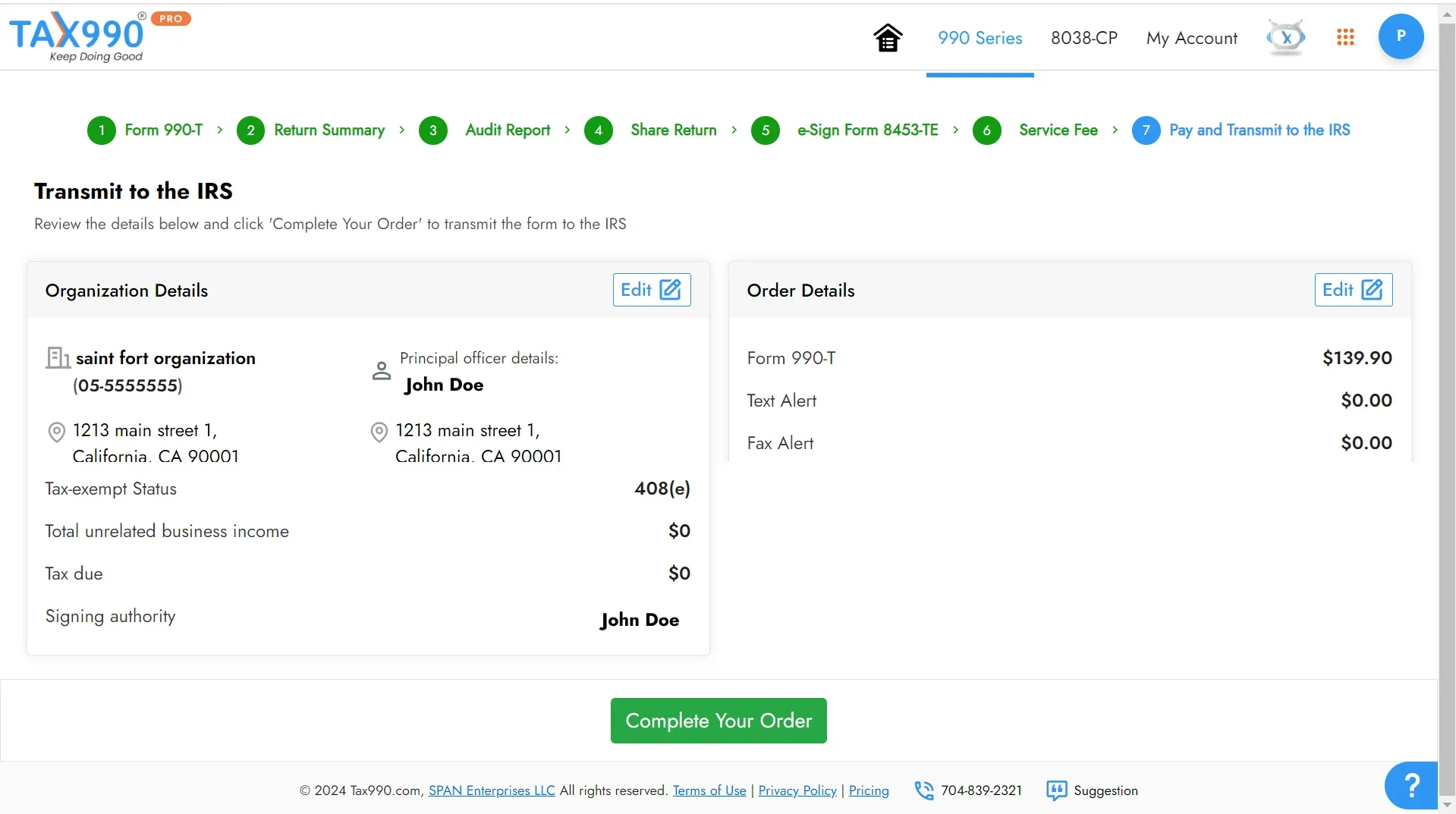

Transmit your Return to the IRS

Transmit your return and get real-time IRS status updates.

Are you ready to file 990-T online?

What We Charge to File Form 990-T Online with Tax990

$99.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back

File easily and get back to what matters most!

Frequently Asked Questions

What is IRS Form 990-T?

Form 990-T is an annual return used by certain tax-exempt organizations and nonprofits to report details regarding unrelated business income to the IRS.

- Reporting proxy tax liability.

- Claiming the refund credit of taxes paid by a regulated investment company (RIC).

- Requesting a credit for certain federal excise taxes or small employer health insurance premiums paid.

Who must file Form 990-T?

Organizations that file Form 990, 990-PF or 990-EZ and also have unrelated business income of $1000 or more must also file Form 990-T.

When is the due date to file Form 990-T?

Form 990-T due date depends upon the organization type:

| Type of organizations | Due Dates |

|---|---|

|

For Employees' trusts, defined in section 401(a), IRAs (including SEPs and SIMPLEs), Roth IRAs, Coverdell ESAs, or an Archer MSA |

Form 990-T must be filed on or before the 15th day of the 4th month. |

|

All other organizations |

Form 990-T must be filed on or before the 15th day of the 5th month. |

Not sure about your 990-T deadline? Use the 990 Due Date Calculator.

How many parts are there in Form 990-T?

IRS Form 990-T consists of 5 different parts, here is the breakdown:

- Part I - Total Unrelated Business Taxable Income

- Part II - Tax Computation

- Part III - Tax and Payments

- Part IV - Statements Regarding Certain Activities and Other Information

- Part V - Supplemental Information

Check out our Form 990-T instructions.

What are the additional filing requirements for Form 990-T?

Organizations filing Form 990-T are required to attach Form 990-T Schedule A. Form 990-T Schedule A is an additional document that the organizations must include to report income and allowable deductions for each of the unrelated businesses or trades they have reported.

A separate Form 990-T Schedule A must be attached for each business or trade.

Should Form 990-T be filed electronically?

Yes! Form 990-T must be filed electronically for tax years ending on or after December 31, 2020.

Get Started with Tax990 and file your Form 990-T electronically with the IRS. Supports current (2024) and prior year

filings (2023, 2022).

Can I get an extension to file Form 990-T?

Yes, you can file Form 8868 to extend your 990-T deadline. The IRS will provide an automatic extension of 6 months upon successful filing of Form 8868.

What are the penalties for filing Form 990-T late?

Organizations that fail to file Form 990-T on time may be subject to penalties equivalent to 5% of the unpaid tax for each month or part of a month that Form 990-T is late. The maximum penalty is 25% of the unpaid tax.

What is the difference between Form 990 and 990-T?

| Form 990 | Form 990-T |

|---|---|

|

Form 990 is an IRS form filed by organizations with gross receipts value higher than or equal to $200,000 (or) total assets higher than or equal to $500,000 for their corresponding tax year to fulfill their annual reporting requirements. |

Form 990-T is a supporting form that is filed by nonprofits that file 990, 990-EZ, or 990-PF only when they have an unrelated business income of $1000 or more during the corresponding tax year. |

Can Form 990-T be filed using my Social Security Number?

No! None of the 990 Forms can be filed using a Social Security number (SSN).

Form 990-T and other 990 forms should be filed using EIN (Employer Identification Number). SSNs are the Taxpayer Identification Numbers (TIN) for individuals, and EINs are for businesses/organizations.

What supporting forms for Form 990-T does Tax990 offer?

Tax 990 offers supporting forms 4562, 4797, 1120 Schedule D, 1041 Schedule D, 1041 Schedule I, 8949, 8995, and 3800.

What is a no-cost amendment?

At Tax990, we know that mistakes can occasionally happen when filing your 990. That’s why, as part of the Tax990 Commitment to accuracy, transparency, and peace of mind, we offer No-Cost Amendments.

If you filed your original Form 990 with us and later discover an error after the IRS has accepted it, you can file a corrected return without paying any additional fees—up to 3 times.

Helpful Resources

Form 990-T Instructions

Learn how to complete Form 990-T step-by-step.

Form 990-T Schedule A

Find out more about Form 990-T Schedule A

Form 990-T Due Date

Learn more about the deadlines to file 990-T forms and how to avoid penalties.

Form 990-T Due Date Calculator

Find out when 990-T is due for your organization

Form 990 Finder

Find out the right 990 Form for your organization

Form 990-T Penalties

Checkout the penalty rates for late filing of

990-T

Helpful Videos