How to Fill Out your Form 8038-CP: Step-by-Step Instructions

- Updated February 27, 2024 - 2.00 PM - Admin, Tax990

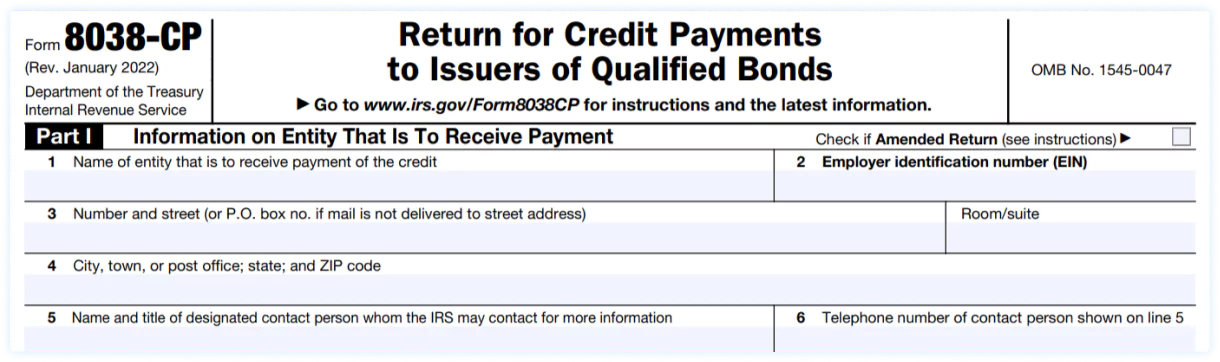

Form 8038-CP is an IRS form that the issuers of certain tax bonds can file to claim the refundable credit from the federal government, which is equivalent to a specified percentage of interest payments on those bonds.

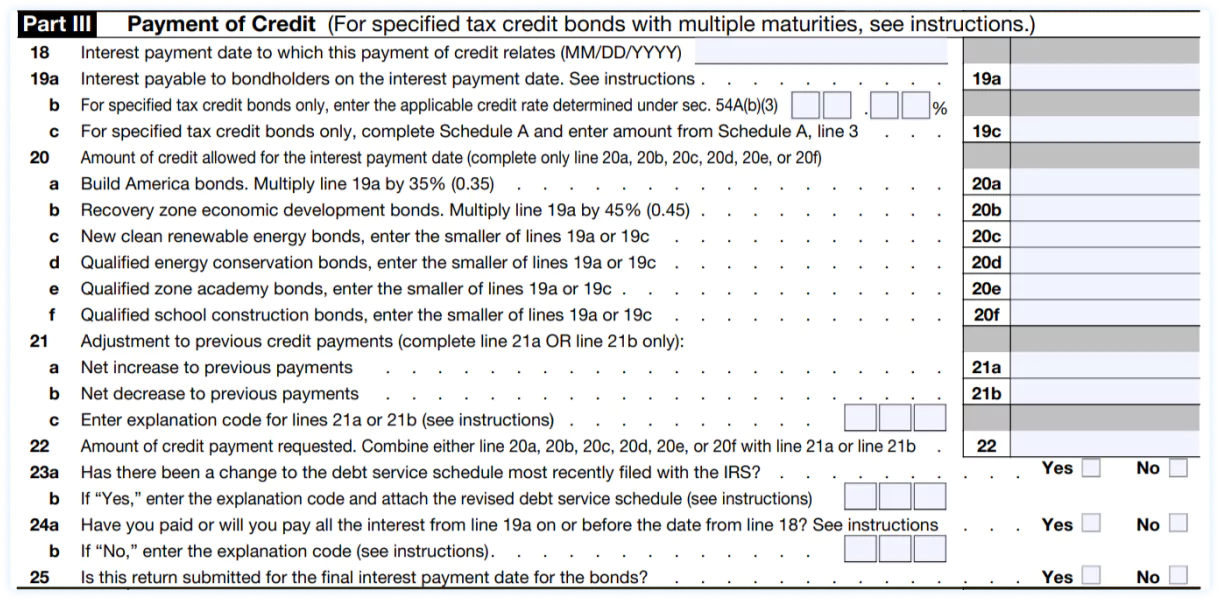

Generally, Form 8038-CP is filed by the issuers of Build America bonds (BABs), Recovery Zone Economic Development Bonds (RZEDBs), New Clean Renewable Energy Bonds (NCREB), Qualified Energy Conservation Bonds (QECB), Qualified Zone Academy Bonds (QZAB) and Qualified School Construction Bonds (QSCB).

If you are required to file Form 8038-CP, here are the step-by-step instructions for completing the form.

Are there any additional requirements for filing 8038-CP?

Yes, based on the type of bond for the refundable credit payment is requested, you may have to attach Form 8038-CP Schedule A.

Schedule A is required to be attached if you are requesting credit payment allowed under section 6431(f) for the following tax credit bonds:

New Clean Renewable Energy Bonds (NCREB)

Qualified Energy Conservation Bonds (QECB)

Qualified Zone Academy Bonds (QZAB)

Qualified School Construction Bonds (QSCB)

Simplify Your Form 8038-CP filing with Tax 990!

Tax 990, the IRS-authorized e-file provider, provides you with a comprehensive e-filing solution to prepare and e-file your 8038-CP return easily, securely and accurately. We include Form 8038-CP Schedule A for free as well.

Steps to File Form 8038-CP:

Follow these simple steps to file your Form 8038-CP electronically with Tax990

Step 1

Add organization Details

Enter your organization’s EIN and the basic information such as name, address, and principal

officer details.

Step 2

Choose Tax Year and Form 8038-CP

Choose the tax year for which you are required to file, select Form 8038-CP and proceed.

Step 3

Provide the required form information

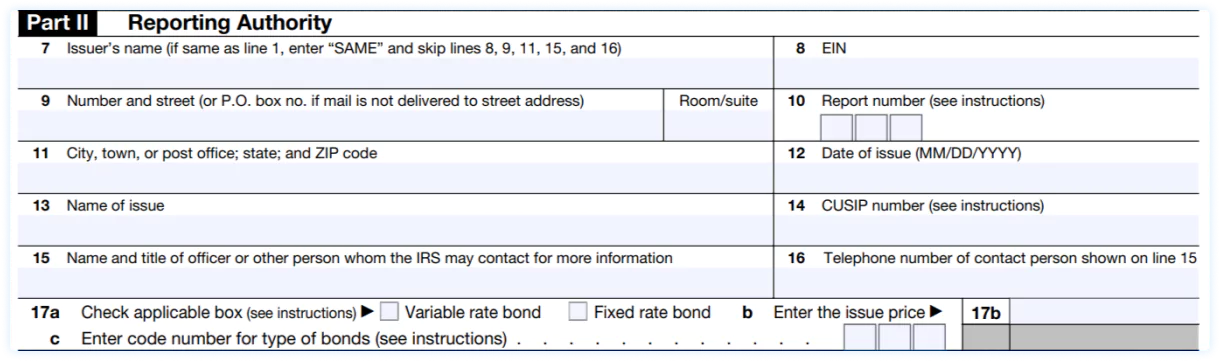

Provide information about the reporting authority, recipient, and bond, and subsequently, utilize our Form-based filing method to input all the necessary data on your Form 8038-CP.

Step 4

Review Your Form 8038-CP

After providing all the required information, review your form and proceed.

Step 5

Transmit it to the IRS

Once you have reviewed your form and verified your information, you can transmit 8038-CP

to the IRS.