IRS Form 990 Schedule C Instructions

- Updated December 02, 2024 - 2.00 PM - Admin, Tax990

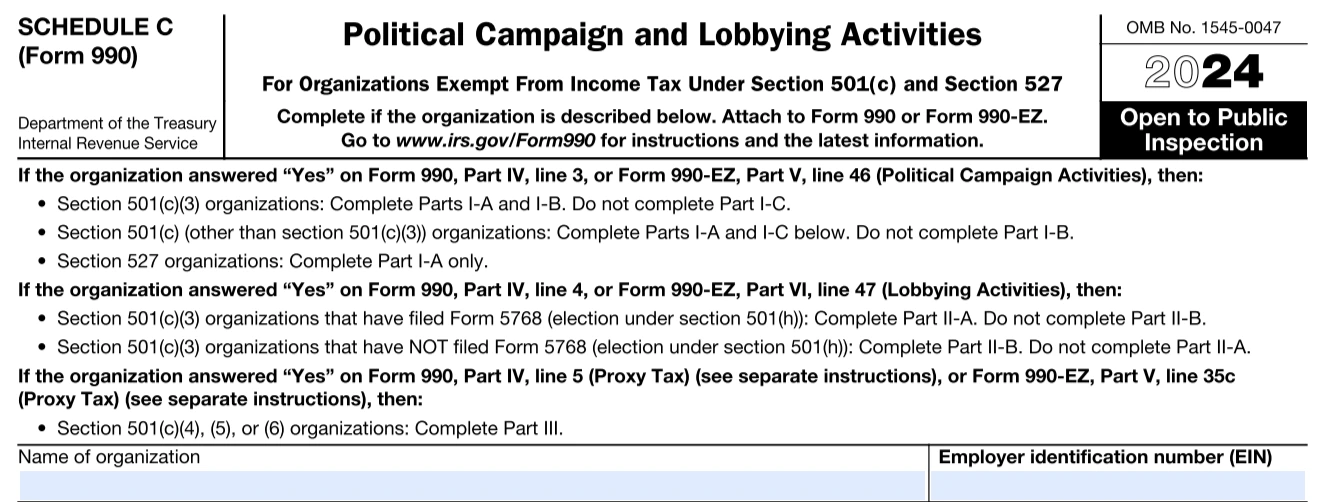

Form 990 Schedule C, political campaign activities or lobbying activities, is used by certain nonprofit organizations filing Form 990 or 990-EZ to report additional information about their political campaign activities or lobbying activities to

the IRS.

It is also used to provide detailed information on membership dues, assessments, or similar amounts received by the organization.

Table of Contents

Who Must File Form 990 Schedule C?

Generally, Schedule C can be filed by the following organizations if they have reported their involvement in political campaign activities and lobbying activities or subjection to section 6033(e) notice and reporting requirements and proxy tax on their Form 990 or 990-EZ.

Section 501(c) organizations

Section 527 organizations

How to Complete Schedule C for Form 990/990-EZ?

There are 4 parts in Schedule C, and some of these parts are divided into multiple sections. Based on the information you report on Form 990-EZ or 990, you are required to complete the applicable sections as described at the top of the form.

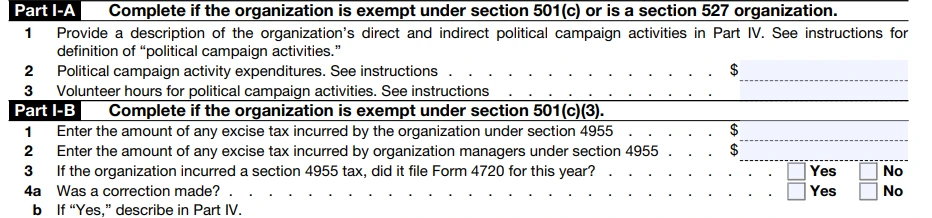

Part I (Political Campaign Activities)

This part requires you to describe your organization’s involvement in political campaign activities directly or indirectly and mention the amount of taxes and expenses incurred, if any.

It is divided into three sections, and the requirements for completing each section depend on the type of IRS section your organization belongs to.

| Organization Type | Part I-A | Part I-B | Part I-C |

|---|---|---|---|

| Section 501(c)(3) Organizations | N/A | ||

| Section 501(c) Organizations | N/A | ||

| Section 527 Organizations | N/A | N/A |

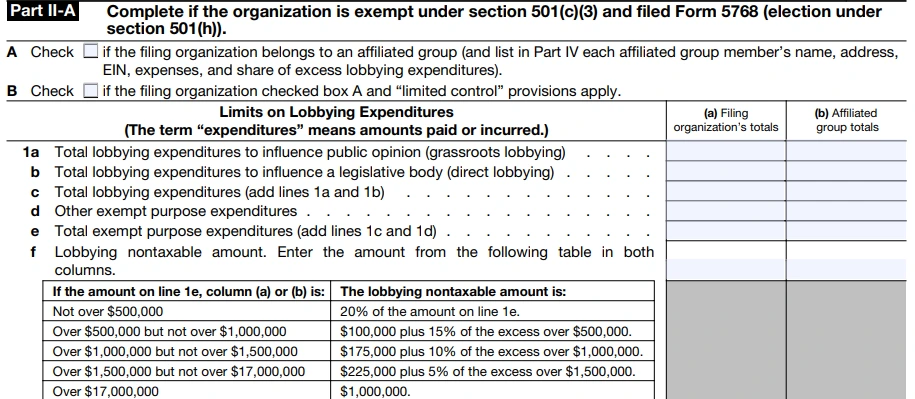

Part II (Lobbying Activities)

In this part, you are required to provide a detailed description of all lobbying activities carried out by your organization and report all the lobbying expenditures.

This part is split into two sections, and at least one of them should be completed by section 501(c)(3) organizations.

Part II-A: For 501(c)(3) Organizations that filed Form 5768 (Election under

Section 501(h))

Indicate if your organization belongs to an affiliated group and enter the amount of lobbying expenditures made through direct and grassroots lobbying.

Note:

Attempting to influence legislation through direct communication with any member of a legislative body is called Direct Lobbying.

Influencing the general public opinion is called Grassroots lobbying.

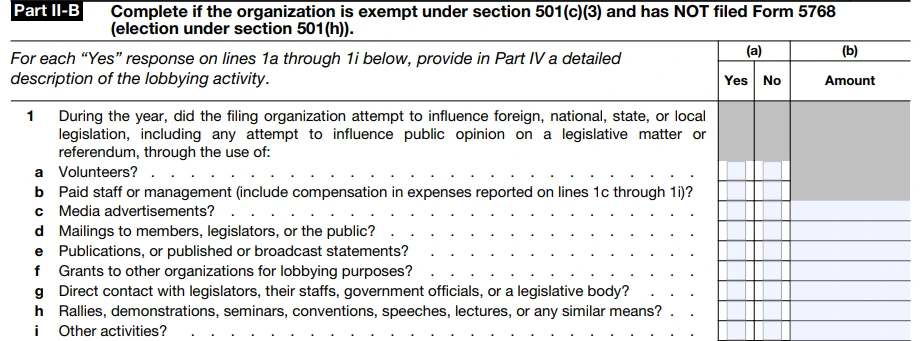

Part II-B: For 501(c)(3) Organizations that have not filed Form 5768 (Election under

Section 501(h))

Indicate if your organization has attempted to influence foreign, national, state, or local legislation through volunteers, media advertisements or other activities.

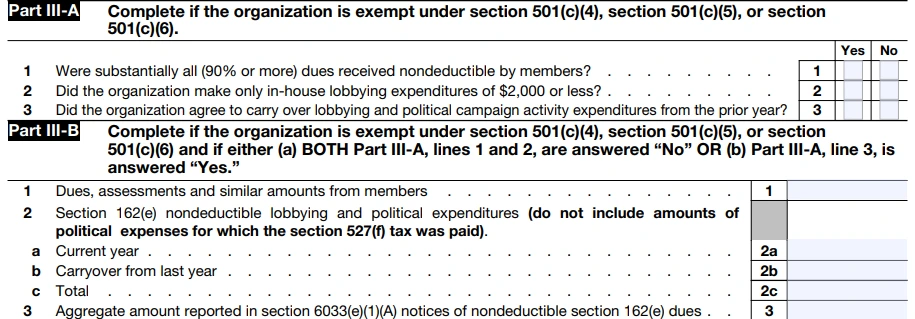

Part III (Section 6033(e) Notice and Reporting Requirements and Proxy Tax)

This part only needs to be completed by section 501(c)(4), section 501(c)(5), and section 501(c)(6) organizations that received membership dues, assessments, or similar amounts.

This part is divided into two sections. The requirement to complete the section may vary based on the answers you provide in the first section.

Part IV - Supplemental Information

This part requires you to provide a description for the information you reported on some of the lines in previous parts.

You can also use this space to provide any additional information regarding the answers you provided on the previous parts of Schedule C.

Tax 990 Auto-Includes Schedules C with your 990 Form for Free!

You never have to worry about meeting your additional filing requirements when filing your 990 returns with Tax 990. Our system automatically includes the required Schedules based on the data you enter on your main form at no extra cost.

A few more exclusive features of Tax 990 that make your 990 filings effortless include.

Form-Based and Interview-Style filing options to prepare forms.

Internal audit checks to ensure an error-free 990 returns.

Multi-user access to invite more members for preparation, review, and approval.

Our 24/7 live support team will assist with your questions via live chat, phone, and email.