Form 990 Schedule J Instructions

- Updated August 21, 2024 - 2.00 PM - Admin, Tax990

Nonprofit organizations that file Form 990 may also be required to include Schedule J for reporting more details regarding their members’ compensation to the IRS.

Table of Contents

What is the Purpose of Form 990 Schedule J?

Schedule J is used by organizations to provide a detailed summary of compensation offered to certain officers, directors, individual trustees, key employees, and highest compensated employees.

It is also used to elaborate on certain compensation practices that are followed by the organization.

Who Must File Form 990 Schedule J?

Schedule J must be included by organizations that answered "Yes" on Form 990, Part IV (Checklist of Required Schedules), Line 23. This includes

Organizations that reported the compensation of any former officer, director, trustee, key employee, or highest compensated employee on Part VII, line 1a.

Organizations that listed an individual on Part VII, line 1a, whose sum of reportable and other compensation from the organization and related organizations is greater than $150,000.

Organizations that listed an individual on Part VII, line 1a who receives or accrues compensation from any unrelated organization or individual for services provided to the organization.

How to Complete Form 990 Schedule J?

Schedule J has just 3 parts in total, and each of them should be completed by all the applicable organizations.

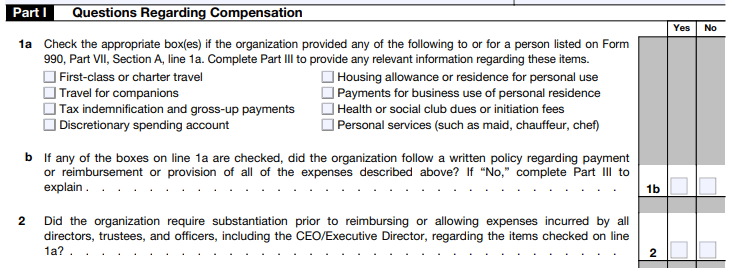

Part I - Questions Regarding Compensation

In this part, there are a series of "Yes" or "No" questions regarding the compensation practices followed by your organization.

Mention if your organization has offered benefits such as First-class or charter travel, Housing allowance, or residence for personal use, etc., to any of the members you have listed on your Form 990.

Indicate how the compensation of the organization’s CEO or Executive Director is established. (Example: Compensation committee, Written employment contract, etc.)

Report whether any of the members listed have received payment from change-of-control payment or been part of a supplemental nonqualified retirement plan or an equity-based compensation arrangement.

Only for organizations described under sections 501(c)(3), 501(c)(4), and 501(c)(29)

- Mention if your organization has paid or accrued compensation contingent on the revenues or net earnings of the organization or related organizations to the members listed.

- Also, mention if your organization follows the rebuttable presumption procedure described in Regulations section 53.4958-6(c).

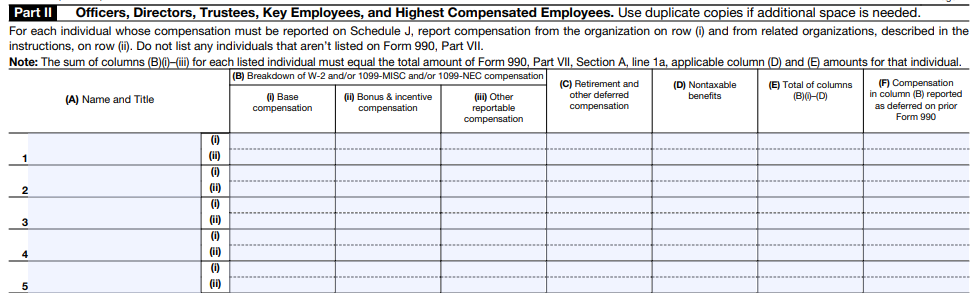

Part II - Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

This part comprises a table that requires you to report the compensation details of certain organization members listed on 990 returns, Part VII, Section A.

Note:

You aren’t required to report the compensation of

Individuals who aren’t listed on Form 990, Part VII, Section A

Management companies or other organizations providing services to the organization

Highest compensated independent contractors who are listed on Form 990, Part VII, Section B

The details you are required to report include

A.

Name and Title

B.

Breakdown of W-2 and/or 1099-MISC and/or 1099-NEC compensation

- Base compensation

- Bonus & incentive compensation

- Other reportable compensation

C.

Retirement and other deferred compensation

D.

Nontaxable benefits

E.

Total of columns (B)(i)–(D)

F.

Compensation in column (B) reported as deferred on prior Form 990

Part III - Supplemental Information

In this part, you are required to provide additional information for some of the answers you have given on the previous parts.

You can also provide a description for any other questions if required.

Tax 990 Includes Your Required Schedules for Free

When you e-file with Tax 990, our system auto-generates Schedule J and other required 990 Schedules onto your form based on the information you provide.

Additionally, Tax 990 offers multiple features to simplify your filing process, including

Form-Based and Interview-Style filing options to prepare your 990 forms.

Built-in error check system to make sure that your returns are error-free.

Multi-user access to invite team members for preparation, review, and approval.

Dedicated support team to assist with your questions via live chat, phone, and email.