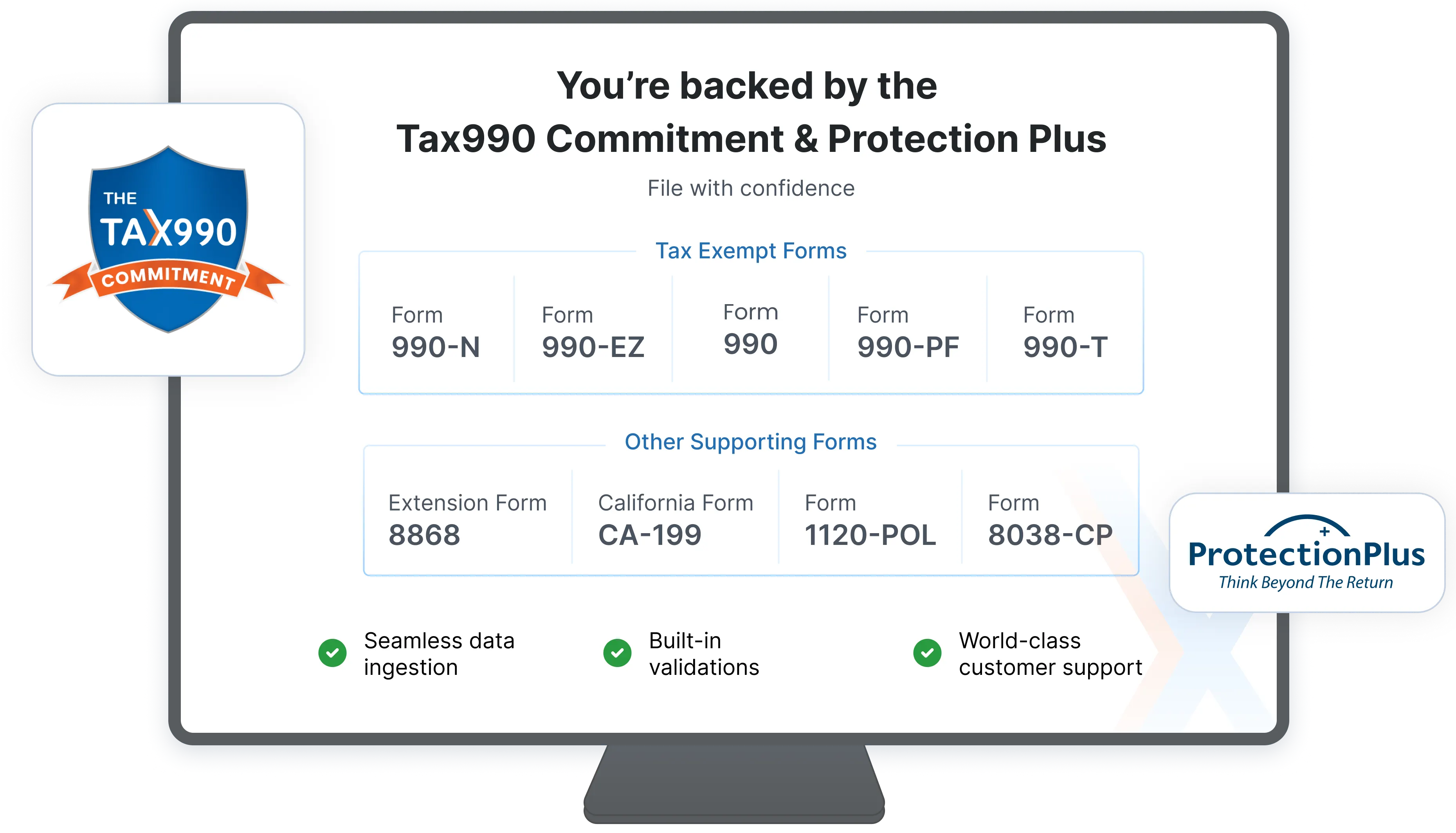

and Audits?

We’ve Got You Protected!

The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your

forms accepted.

Complimentary Extension Requests

Worried about meeting the deadline? If you need more time, you can request an extension via Form 8868 at no extra charge.

Retransmit Rejected Returns

If the IRS rejects your return due to errors, you can fix the errors and retransmit your forms easily at no additional cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If we’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

How Tax990 Works

Our software makes it quick and easy to fill out and file your Form 990 online.

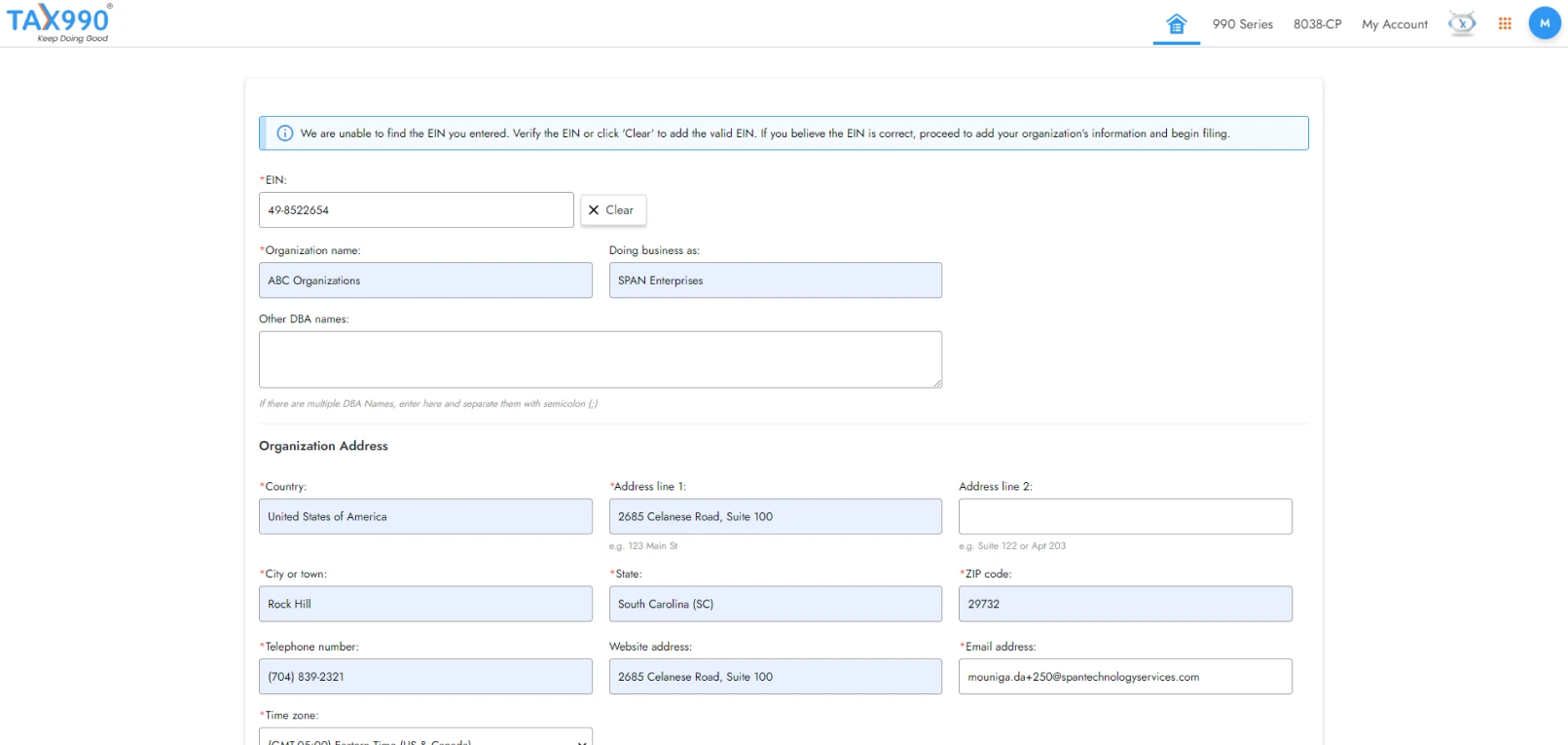

Add the information about your organization

Just enter the EIN—we’ll pull your organization’s details from the IRS registry. Filing for more than one organization? Upload them all at once using our Excel template.

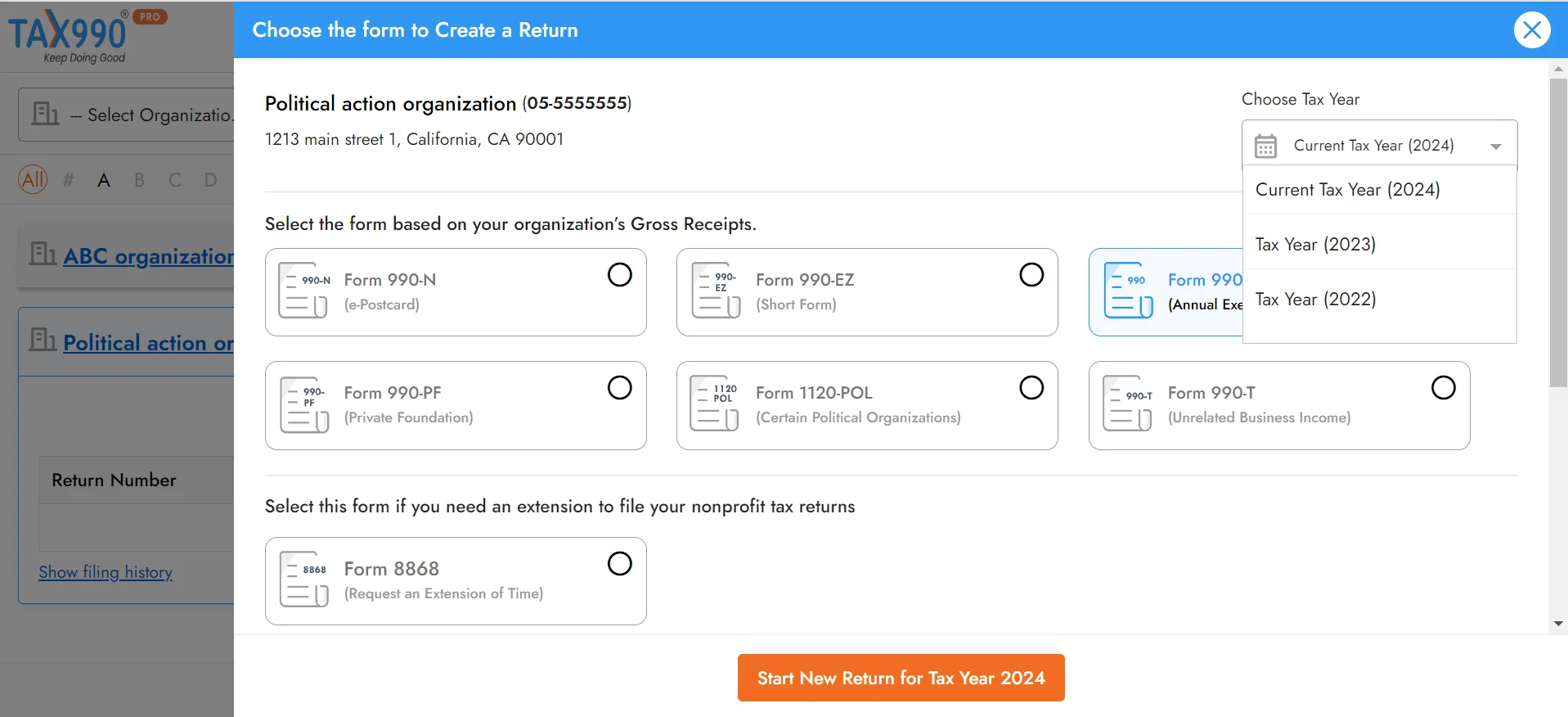

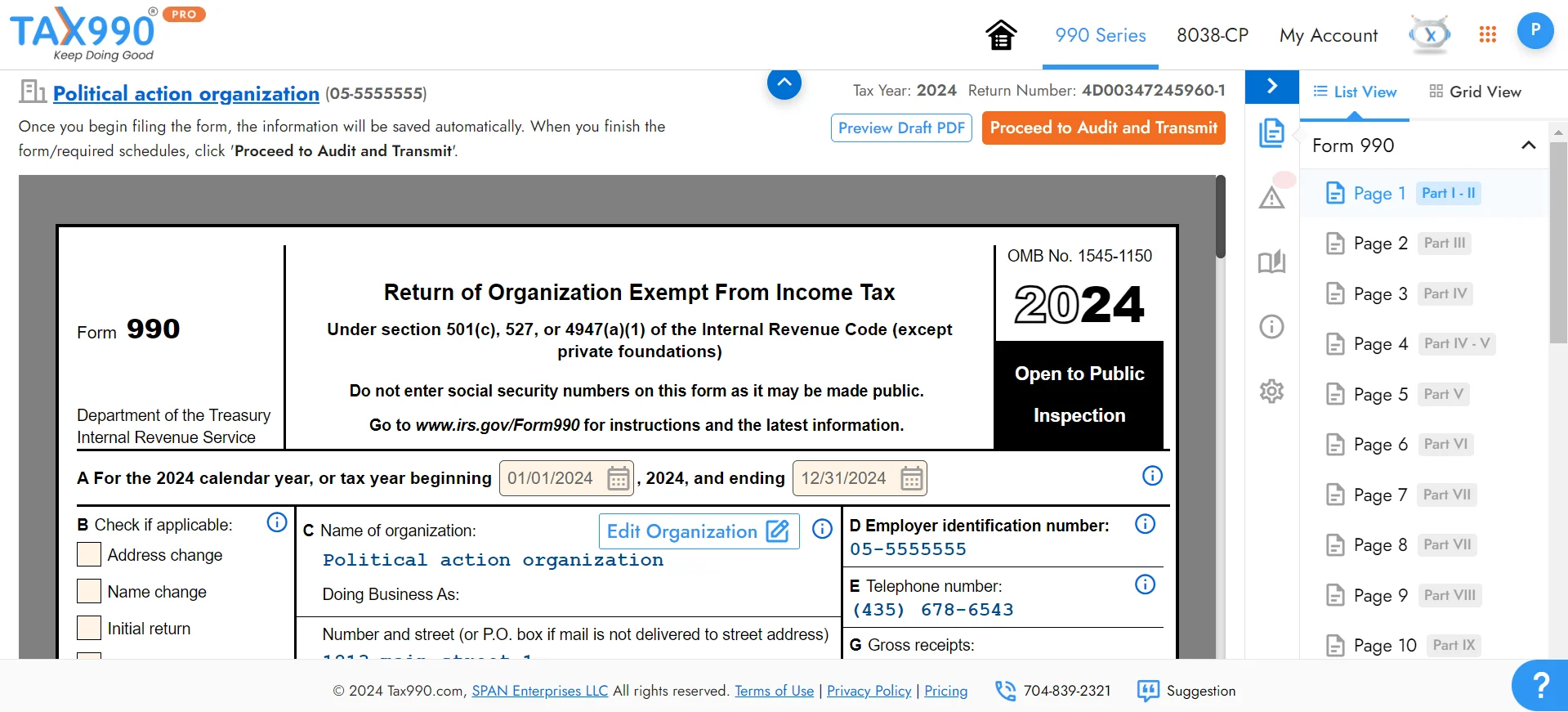

Complete the form that is right for your organization

Pick the 990 you need and choose how to complete it—import data from the IRS, answer guided questions, or fill it out manually.

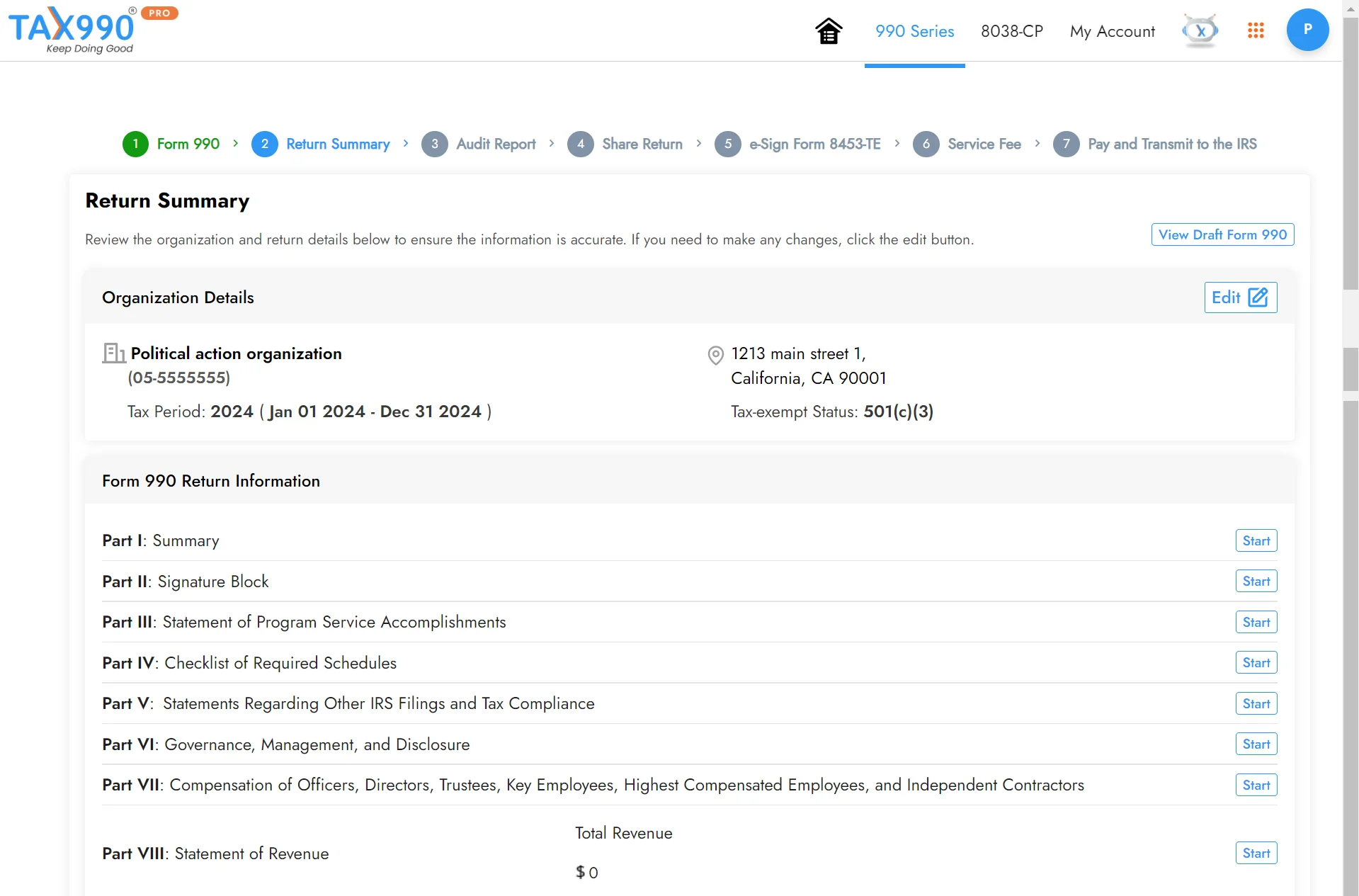

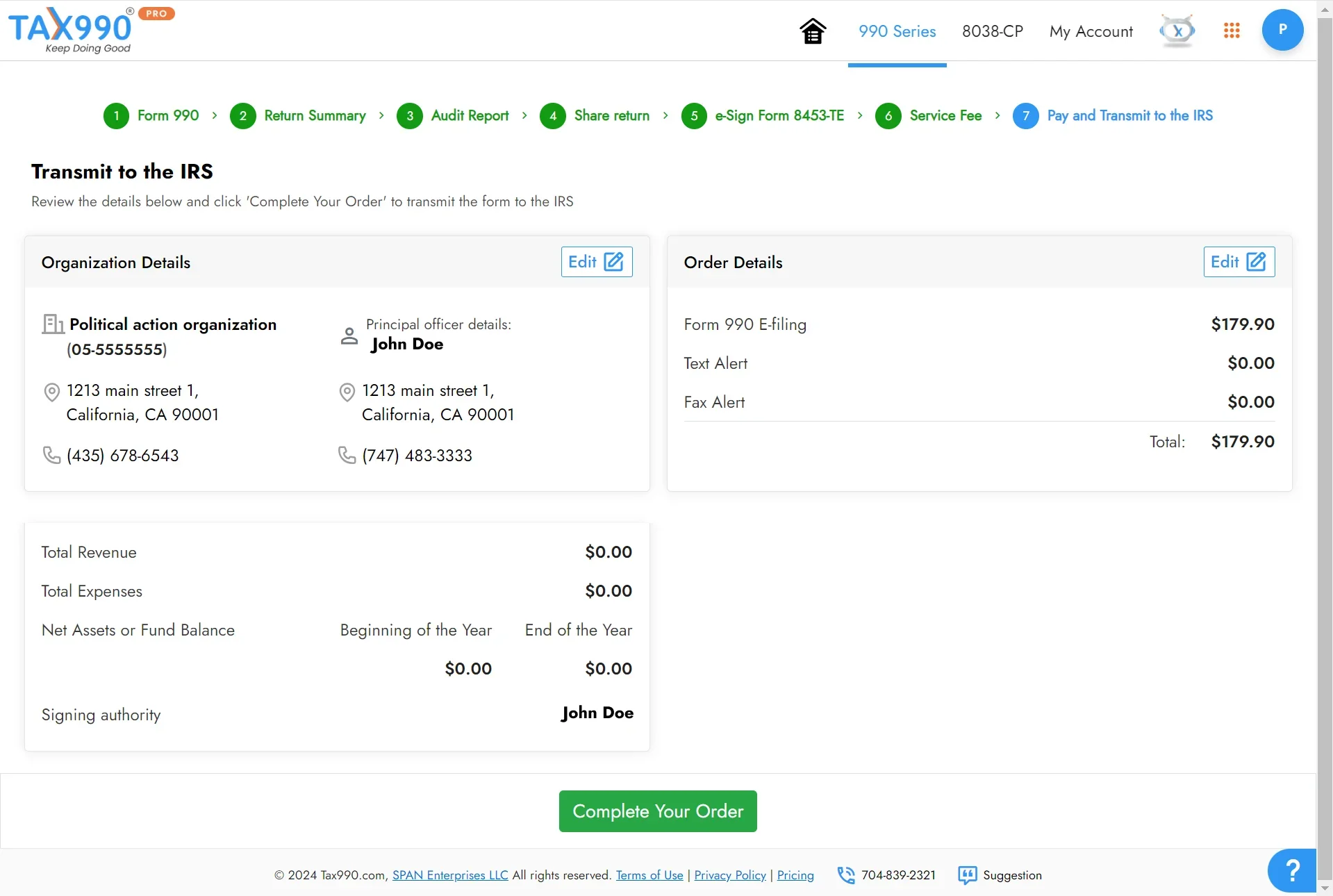

Review and transmit your form to

the IRS

Review your form, share it with your board for approval if needed, and transmit it to the IRS. We’ll keep you updated with real-time status alerts.

Forms Supported by Tax990

Our software supports the e-filing of a wide range of nonprofit tax forms along with the necessary schedules and supporting forms.

Form 990-N

Small nonprofits with Gross receipts ≤ $50,000

Form 990-EZ

Gross receipts < $200,000 and total assets < $500,000

Form 990

Gross receipts ≥ $200,000 or Total assets ≥ $500,000

Form 990-PF

Private foundations regardless of financial status

Form 990-T

To report unrelated business taxable income

990 Amendments

To correct your previously filed Nonprofit tax returns

Form 8868

Tax Extension Form for Nonprofit tax returns

CA Form 199

Annual Information Return for California nonprofits

Form 1120-POL

Income Tax Return for Certain Political Organizations

Form 8038-CP

Return for Credit Payments to Issuers of Qualified Bonds

Why Tax990 is the Best Choice for Your 990 Filing Needs?

It’s simple–Our user-friendly software brings you a perfect solution to take all the

complexities out of your 990 filings with numerous time-saving features.

Seamless Form Preparation – Your Filing,

Your Way

When we say we make your 990 filing easy, we mean it! Enjoy a flexible, streamlined form preparation that saves you time and hassle.

-

Choose How You Prepare

Directly enter data on a digitalized form or answer simple questions for automatic form creation. -

Bring in Last Year’s Data

Instantly import data from previous filings onto current returns from the IRS registry. -

Import Bulk Data in a Snap

Upload your organization data as well as the filing information in bulk using our Excel templates.

Stay Informed and In Control

We've got your back at every step—real-time updates and seamless collaboration keep you in control and on track.

-

Draft Forms for Review

Generate and review draft copies of your forms, giving you complete control to perfect every detail before submitting. -

Easy Review & Approval

Share returns with board members or higher authorities for smooth collaboration and quick approvals. -

Instant Status Updates

Get instant updates on the IRS status of your filings via email, text, or fax notifications, so you’re always in the loop.

Tools Built Exclusively for Tax Professionals

Tax990 comprises various exclusive features that are tailored to simplify the filing workflows for

paid preparers and EROs handling a high volume of 990 filings!

Seamless Team Collaboration

Invite your team members and let them prepare and transmit the 990 filings for your clients. You can assign them specific roles and keep track of their activities.

Enhance Client Management

Prepare and manage 990 filings for unlimited clients (multiple EINs) and have your clients review the returns through a secure portal before transmission.

Secure & Simple

E-Signing

Obtain your clients; e-signatures in minutes using Form 8453-TE (for Paid Preparers) and Form 8879-TE (for Electronic Return Originators).

Save More as You File More

Our volume-based pricing packages allow you to save more on your filings while ensuring tax compliance for your clients.

Want to discover how Tax990 can enhance your tax practice?

Trusted by Nonprofits Everywhere

Tax990 revolutionizes the tax filing process for nonprofits like yours!

TESTIMONIALS

Hear From Our Happy Clients

Need Assistance

Our team of experts is here for you!

Live Chat Support

Live chat support is available from 8:30am - 5:30pm EST Monday through Friday. We offer extended live support hours during peak filing times.

Email support is available from 8:30am - 5:30pm EST Monday through Friday. We offer extended email support hours during peak filing times. [email protected]

Call Us

Live support is available from 8:30am - 5:30pm EST Monday through Friday. We offer extended live support hours during peak filing times. 704.839.2321

Forms Available from Tax990

Trusted by Nonprofits Everywhere

Tax990 Revolutionizes the Tax Filing Process for Nonprofits like Yours!

Hear From Our Happy Clients

Streamlined Form 990 E-filing Software for Nonprofits

Direct-Form &

Interview-Style

Filing

990 Schedules

Included

Safe and

Secure Filing

Internal

Audit Check

Amend

Returns

Copy

Information

Exclusive PRO Features Optimize Form 990 Filing for Tax Professionals

Effortlessly manage multiple clients with Tax 990. Coordinate an unlimited number of organizations and their tax filings—all

from one account

Team Management

Invite your team members and let them prepare and transmit the 990 filings for your clients. You can assign them specific roles and keep track of their activities

Client Management

Prepare and manage 990 filings for unlimited clients (multiple EINs) and have your clients review the returns through a secure portal before transmission.

E-Signing Options

Get returns e-signed in minutes using Form 8453-TE (for Paid Preparers) and Form 8879-TE (for Electronic

Return Originators).

Flexible Pricing

Our volume-based pricing packages allow you to save more on your filings while ensuring tax compliance for your clients.

How to File Form 990 Electronically?

-

Search for your EIN to automatically import your organization’s data from the IRS or enter manually.

-

Tax 990 supports filing for the current and previous tax years. Select the tax year for which you are required to file, select Form 990, and proceed.

-

Choose from Form-based or Interview-style, depending on how you would like to provide the form information.

-

Review your form summary and make any necessary changes. You can also share your form with team members for review and approval.

-

After you review your form, you can pay and transmit it to the IRS. Our system will provide status updates for your form via email or text.

File Form 990 Electronically with Tax990!

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Frequently Asked Questions

Why are nonprofits required to file IRS Form 990?

The IRS requires nonprofits to file IRS Form 990 each year to maintain their tax-exempt status and fulfill their legal reporting requirements. These 990 returns are available to the public to promote transparency in nonprofit financial operations.

Can I file nonprofit state tax returns with Tax990?

Tax990 currently supports e-filing of the California state tax return, CA Form 199, with the Franchise Tax Board (FTB).

Does Tax990 support all the 990 schedules?

Tax990 supports almost all the 990 schedules required for Form 990, Form 990-EZ, Form 990-PF, and Form 990-T. These schedules are automatically generated based on the data you enter on your main form.

Note: No schedules are required when filing Form 990-N.

Can I bulk import Form 990 data to Tax990?

Yes! Tax990 offers exclusive Excel templates to minimize manual data entry. Our templates allow you to import specific form data, such as contributions and grants, streamlining the completion of your 990 returns and saving you time.

How do I determine my organization’s 990 deadline?

Form 990 is due on the 15th day of the 5th month following the end of your organization's tax year. For organizations using the calendar tax year, this deadline is typically May 15th. If you follow a fiscal tax year, you can use our due date calculator to determine your deadline.

Can I file the prior year's return with Tax990?

Yes! Tax990 offers the option to file prior-year returns, enabling you to catch up on missed filings or amend previous submissions.

Need Assistance?

Our team of experts is here for you!

Live Chat Support

Connect with our excellent support team for instant answers to your questions.

Chat with us

Reach out to our team by email for answers to your questions, we’re ready to help. [email protected]

Call Us

Phone support is available from 8:30 am - 5:30 pm EST Monday through Friday. We offer extended live support hours during peak filing times.

(704) 839-2321