The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing

Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? We’ve got your back with a complimentary Form 8868 – simply file it to get extra time.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

If you discover mistakes after submission, you can file amendments without extra charges.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

A Solution Designed for Faster, Easier 990-PF E-Filing

Tired of complicated tax filing? Tax990 is here to simplify the process, making filing your 990-PF easy and stress-free!

Flexible Form Preparation Options

Fill out the form manually (Form-Based), or answer questions that will fill it out for you (Interview-style).

Copy Data From Last Year’s Return

Import data from last year’s return into this year’s form directly from the IRS.

Built-in Audit Check

Our system automatically reviews your form against IRS business rules to catch errors before submission.

Share Forms for Approval

Easily share your returns with board members for quick collaboration and faster approvals.

Smart AI Assistance

Our AI chatbot is here to guide you 24/7—get quick answers whenever you need help.

World-Class Customer Support

Need help? Connect with our expert support team by live chat, phone, or email—anytime.

Our intuitive features make filing Form 990-PF easier than ever

Tools Built Exclusively for Tax Professionals

Tax990 offers many exclusive features that simplify workflows for paid preparers and EROs who handle 990 filings for their clients! paid preparers and EROs handling a high volume of 990 filings!

Seamless Team Collaboration

Invite your team members and let them prepare and transmit the 990 filings for your clients. You can assign them specific roles and keep track of their activities.

Elevate Client Management

Prepare and manage 990 filings for unlimited clients (multiple EINs) and have your clients review the returns through a secure portal before transmission.

Simple & Secure E-Signing

Obtain your clients; e-signatures in minutes using Form 8453-TE (for Paid Preparers) and Form 8879-TE (for Electronic Return Originators).

Save More as You File More

Our volume-based pricing packages allow you to save more on your filings while ensuring tax compliance for your clients.

Want to discover how Tax990 can enhance your tax practice?

What You’ll Need to File Form 990-PF Online

Here is the list of key information you’ll need to file 990-PF online,

- The organization’s basic information

- Financial information such as revenue, expenses, assets, and liabilities

- Program service accomplishments

- Other IRS filings and tax compliance requirements

- Key personnel, governing body, and management details

Learn more about step-by-step instructions on 990-PF

How to File Form 990-PF Electronically?

Create your free account and follow these simple steps to e-file your Form 990-PF effortlessly!

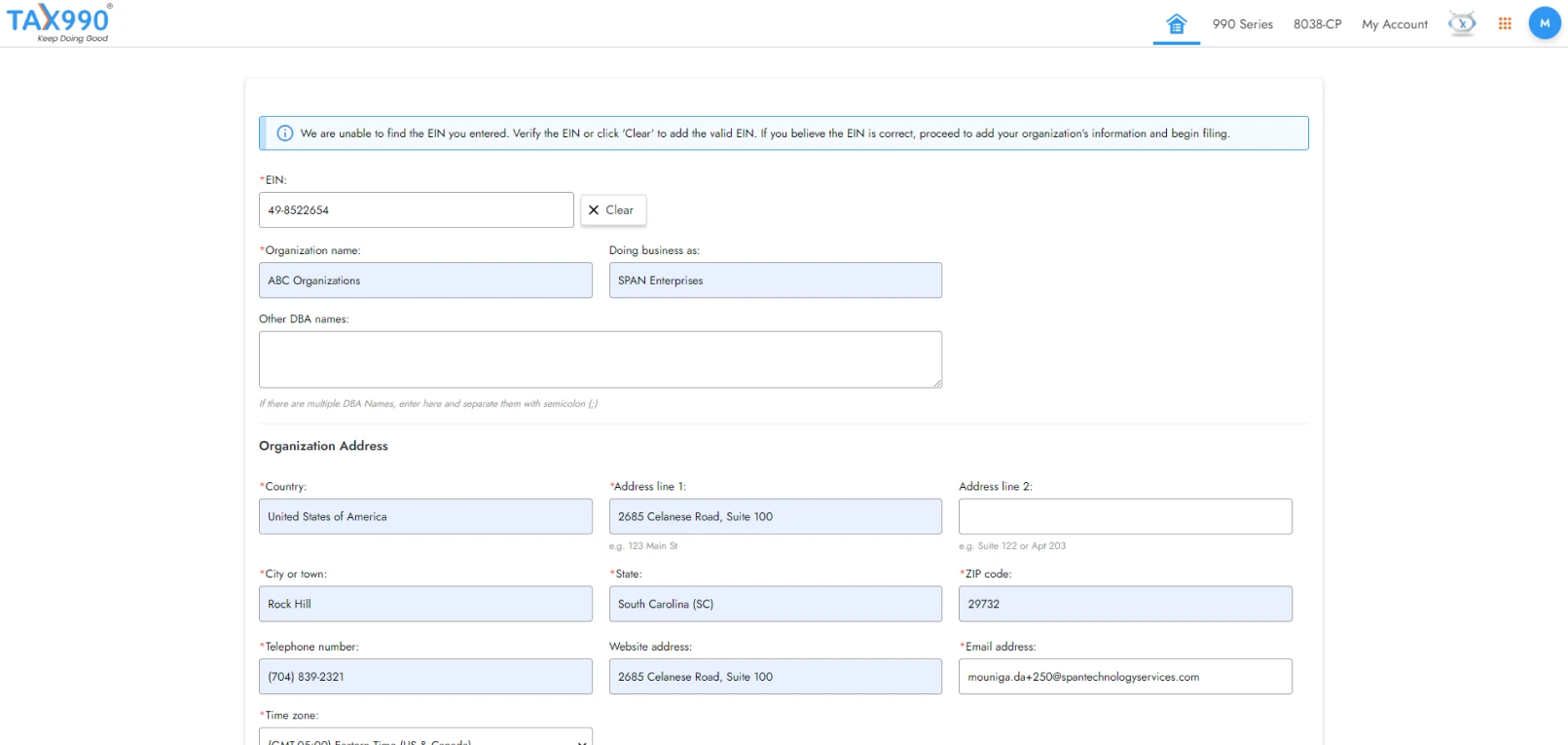

Add Organization Details

Search for your EIN to auto-fill foundation details or enter them manually.

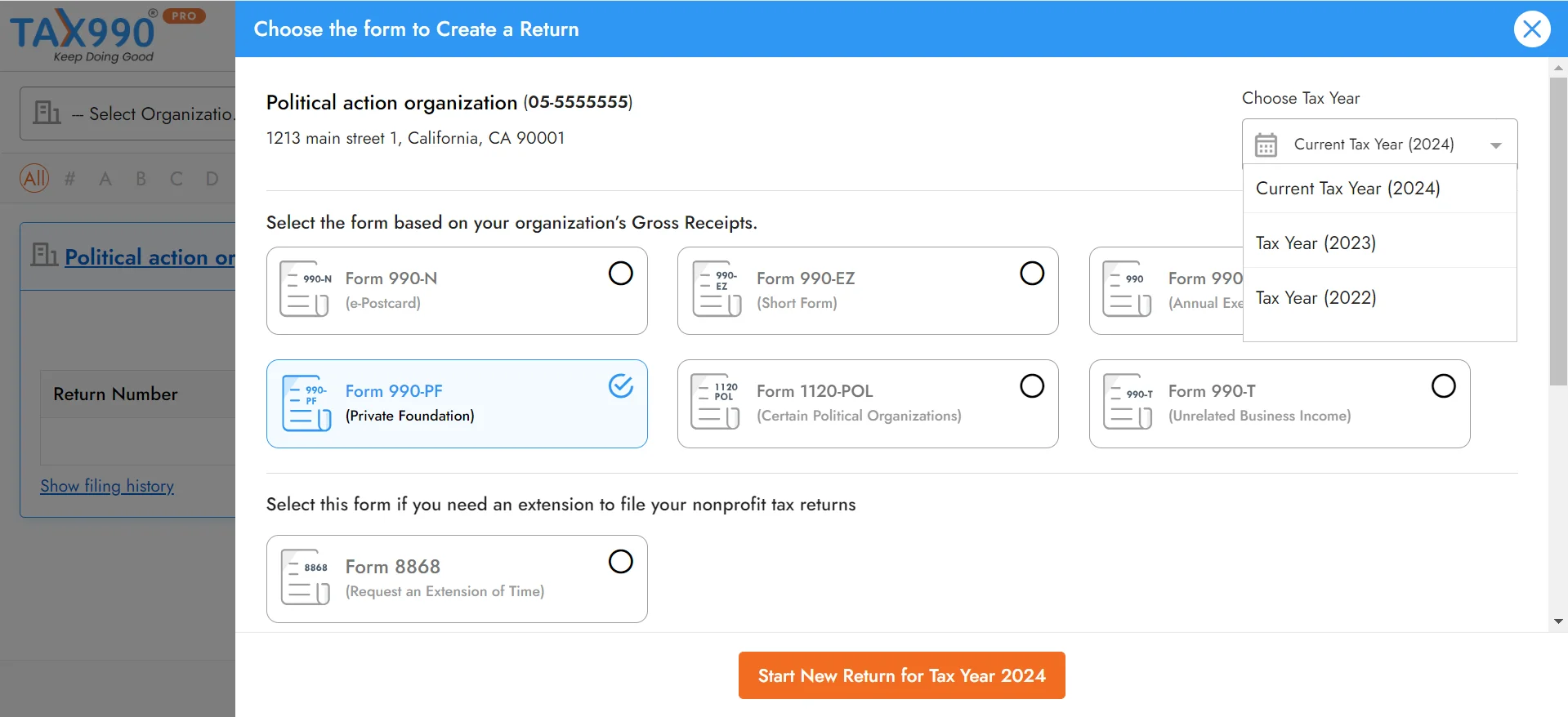

Choose Tax Year and Form

Select Form 990-PF for the current or prior tax year

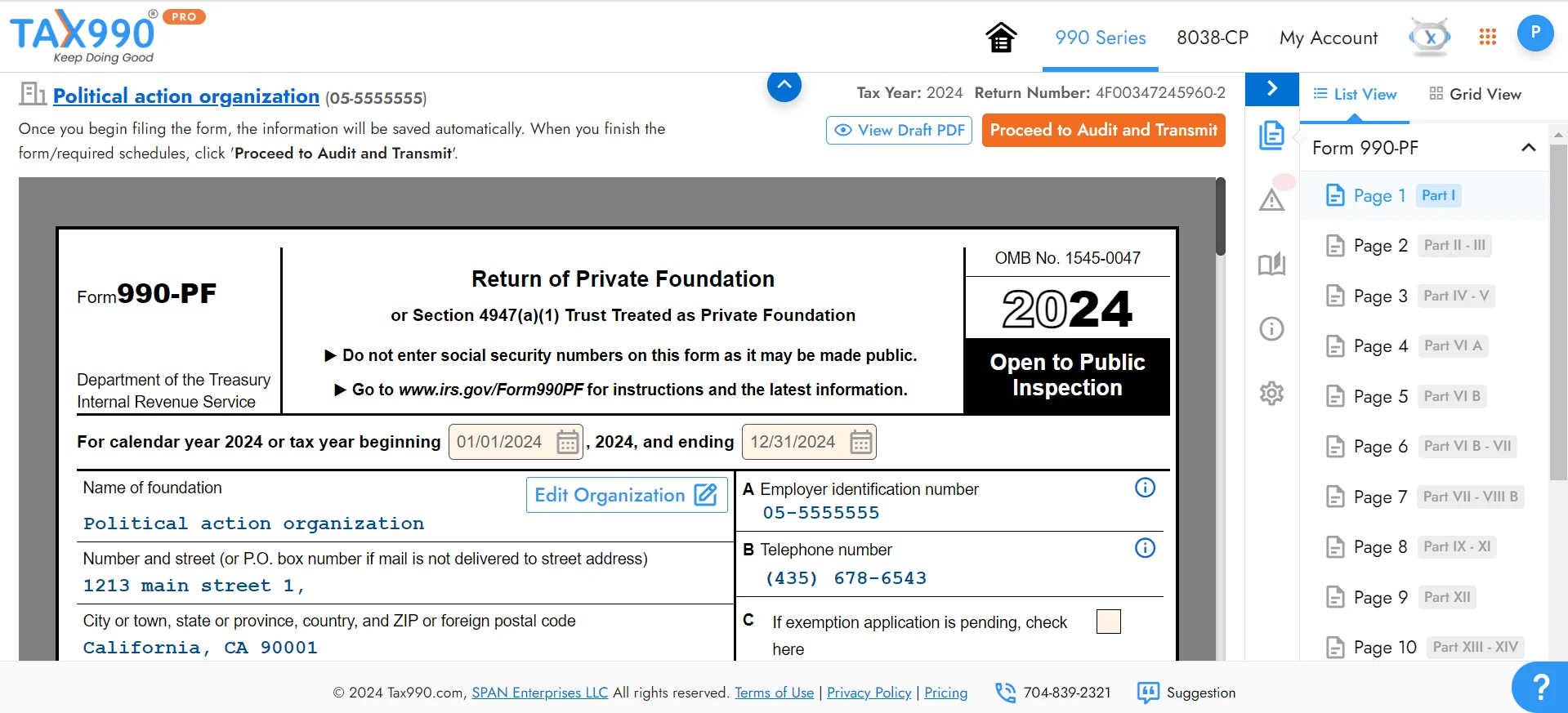

Enter Form 990-PF Data

Use Form-Based or Interview-Style filing to complete your

990-PF

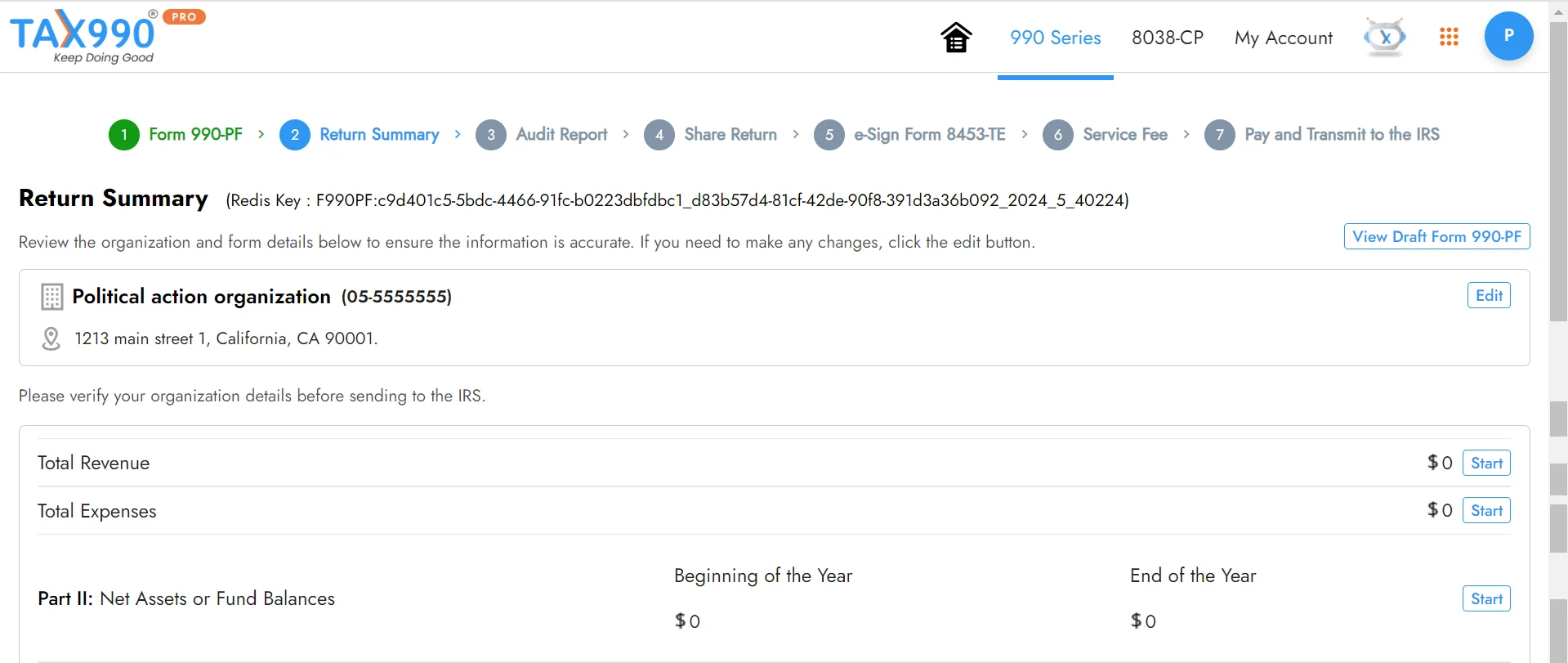

Review your Form Summary

Check over your return, edit if needed, and share for review/approval

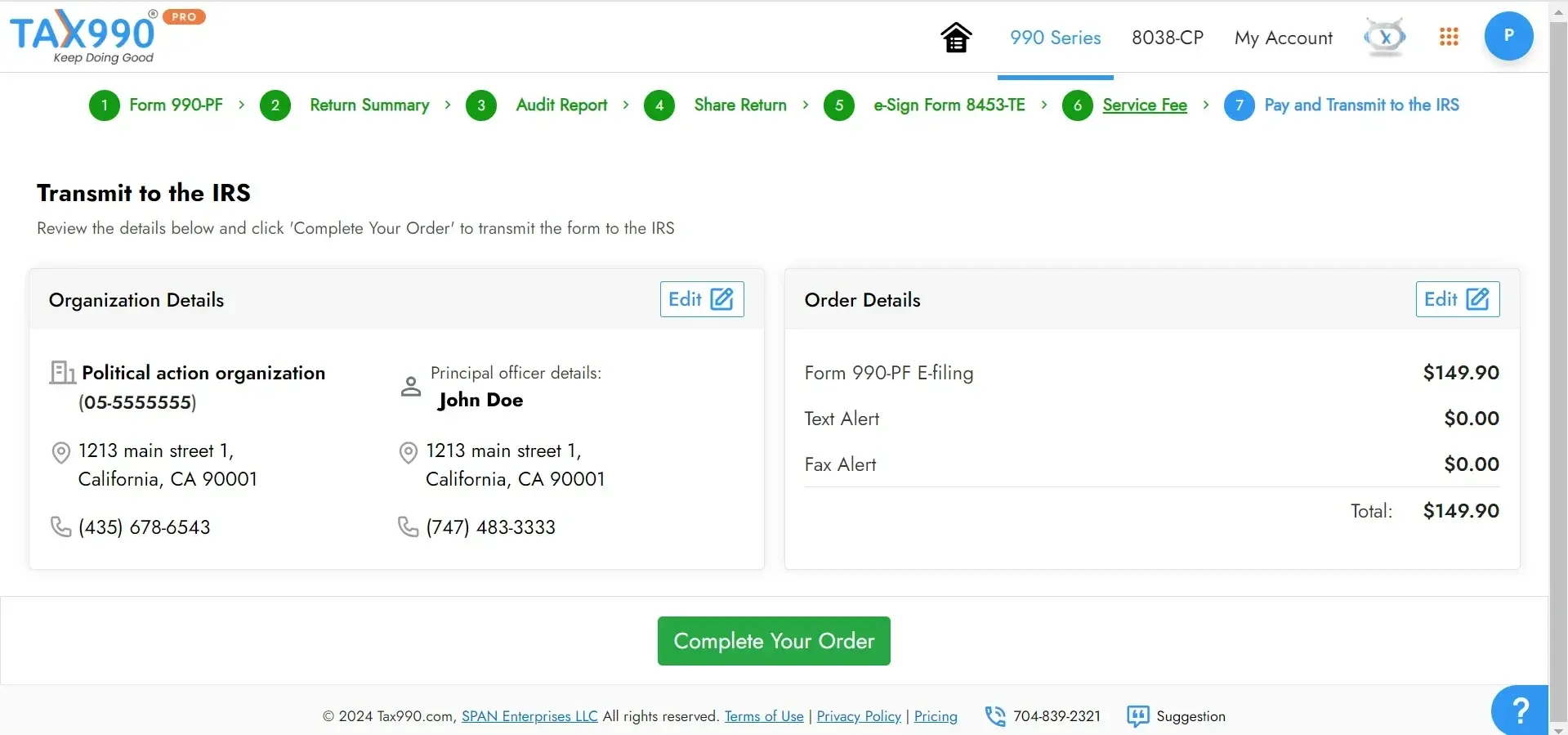

Transmit your Return to the IRS

Transmit your return and get instant IRS status updates

Ready to file 990-PF online?

Form 990-PF Pricing

$169.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back

File easily and get back to what matters most!

Frequently Asked Questions

Are there additional filing requirements for Form 990-PF?

- Private foundations that file Form 990-PF may be required to attach Schedule B, depending on the data they reported.

- Schedule B is typically filed when a private foundation has received contributions of $5000 or more from any one contributor during the corresponding tax year. Learn more about Schedule-B

Should Form 990-PF be filed electronically?

Yes! The IRS mandates that Form 990-PF must be filed electronically for tax years ending on or after July 31, 2020 (per the Taxpayer Act of 2019).

Get Started with Tax990 and file your Form 990-PF electronically with the IRS. We support current (2024) and prior tax year filings (2022 & 2023).

Can I get an extension to file Form 990-PF?

- Yes! If your foundation needs more time to file Form 990-PF, you can file Form 8868 to extend your 990-PF deadline. Upon filing Form 8868 on or before the original deadline, the IRS will grant an automatic 6-month extension.

- This means if your organization follows the calendar tax year and files an extension, your extended 990-PF deadline will be November 15.

What are the penalties for filing Form 990-PF late?

- For smaller organizations with gross receipts < $1,274,000, the penalty for late filing Form 990-PF is $25/day. The maximum penalty is $12,500 or 5% of the foundation’s gross receipts (whichever is less).

- For larger organizations with gross receipts > $1,274,000, the penalty for late filing Form 990-PF is $125/day. The maximum penalty is $63,500 or 5% of the foundation’s gross receipts (whichever is less). Learn more about 990-PF penalties.

Can I file Form 990 or 990-EZ instead of Form 990-PF?

No, a private foundation cannot choose to file Form990 & Form 990-EZ. They are required to file Form 990-PF, regardless of their gross receipts and assets.

If my organization has zero gross revenue, do I still need to complete the 990-PF?

Yes, Even if the foundation has no gross income in the tax year and has incurred losses on investments, it is still required to file Form 990-PF annually.

Do Private Foundations that file Form 990-PF Need to pay taxes?

Generally, Private foundations that obtain exempt status from the IRS are not required to pay federal income taxes. However, a domestic exempt private foundation, a domestic taxable private foundation, or a nonexempt charitable trust treated as a private foundation must make estimated tax payments for the excise tax based on investment income if it can expect its estimated tax to be $500 or more.

Do Private Foundations that file Form 990-PF Need to pay taxes?

Generally, Private foundations that obtain exempt status from the IRS are not required to pay federal income taxes. However, a domestic exempt private foundation, a domestic taxable private foundation, or a nonexempt charitable trust treated as a private foundation must make estimated tax payments for the excise tax based on investment income if it can expect its estimated tax to be $500 or more.

What is a no-cost amendment?

At Tax990, we know that mistakes can occasionally happen when filing your 990. That’s why, as part of the Tax990 Commitment to accuracy, transparency, and peace of mind, we offer No-Cost Amendments.

If you filed your original Form 990 with us and later discover an error after the IRS has accepted it, you can file a corrected return without paying any additional fees—up to 3 times.

Helpful Resources

Form 990-PF Instructions

Explore the step-by-step instructions to complete Form 990-PF

Form 990-PF Schedule B

Find out more about Form 990-PF Schedule B

Form 990 Due Date

Learn more about the deadlines to file 990 forms and how to avoid penalties.

Form 990 Due Date Calculator

Find out when 990-PF is due for your organization

Form 990 Finder

Find out the right 990 Form for your organization

Form 990-PF Penalties

Check out the penalty rates for late filing of 990-PF

Helpful Videos