The deadline to file 990 series forms is July 15, 2025. E-File Now

The Tax990 Commitment

Accepted, Every Time–Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? We’ve got your back with a complimentary Form 8868 – simply file it to get extra time.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

Found an error after filing? You can file up to 3 amendments without paying extra.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

Efficient 990-T Filing Solution Tailored for Ease and Accuracy

File your 990-T easily and accurately using our intuitive features.

Direct Form Entry

Enter information directly into each section of Form 990-T using our intuitive interface, designed for clarity and ease.

Includes Supporting Forms

Tax 990 includes supporting forms 4562, 4797, 1120 Schedule D, 1041 Schedule D, 1041 Schedule I, 8949, 8995, and 3800.

Import Bulk Data in Seconds

Upload your organization’s info and return data in bulk using our Excel templates.

Built-in Audit Check

Our built-in error check system validates your form against IRS business rules to ensure accuracy before submission.

Instant AI Assistance

Get instant guidance from our AI-powered chatbot whenever you need it.

World-Class Customer Support

Help help? Reach out to our support team anytime via live chat, phone, or email.

Form 990-T filing doesn’t have to be complicated!

Exclusive Tools for Tax Professionals

Discover powerful features that simplify the filing workflows for paid preparers and EROs handling multiple 990-T filings.

Streamlined Team Collaboration

Invite your team and simplify your 990-T workflow by assigning them tasks and roles.

Manage Clients Effortlessly

Manage multiple clients while facilitating a streamlined review process.

Simple E-Signing Options

Tax990 offers easy e-sign options for Form 8453-TE and Form 8879-TE.

File More, Save More

Save more with our volume-based pricing plans for high-volume filers.

How to E-file Form 990-T with Tax990

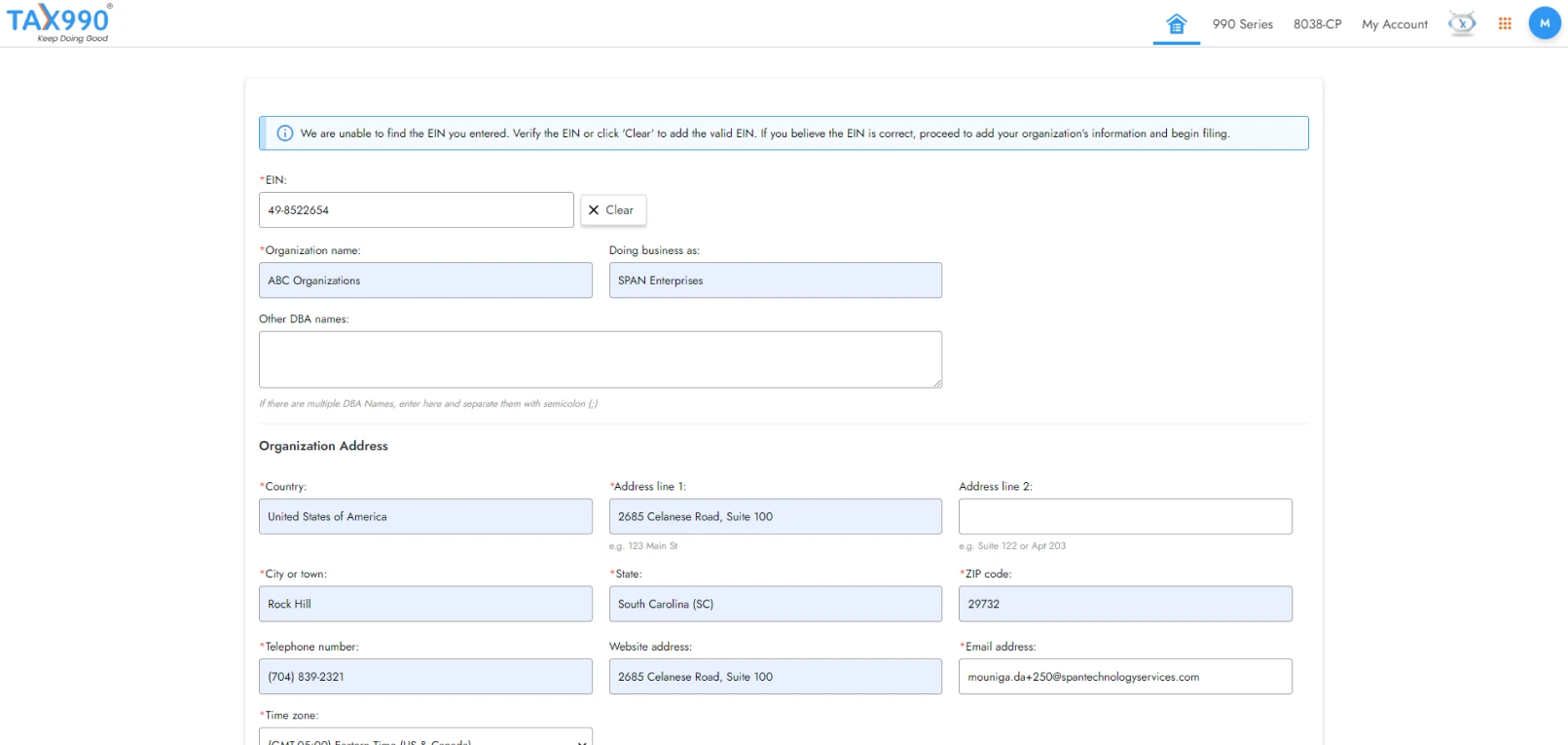

Add Organization Details

Search for your EIN to auto-fill organization details or enter them manually.

Choose Tax Year and Form

Select Form 990-T for the current or prior tax year and proceed.

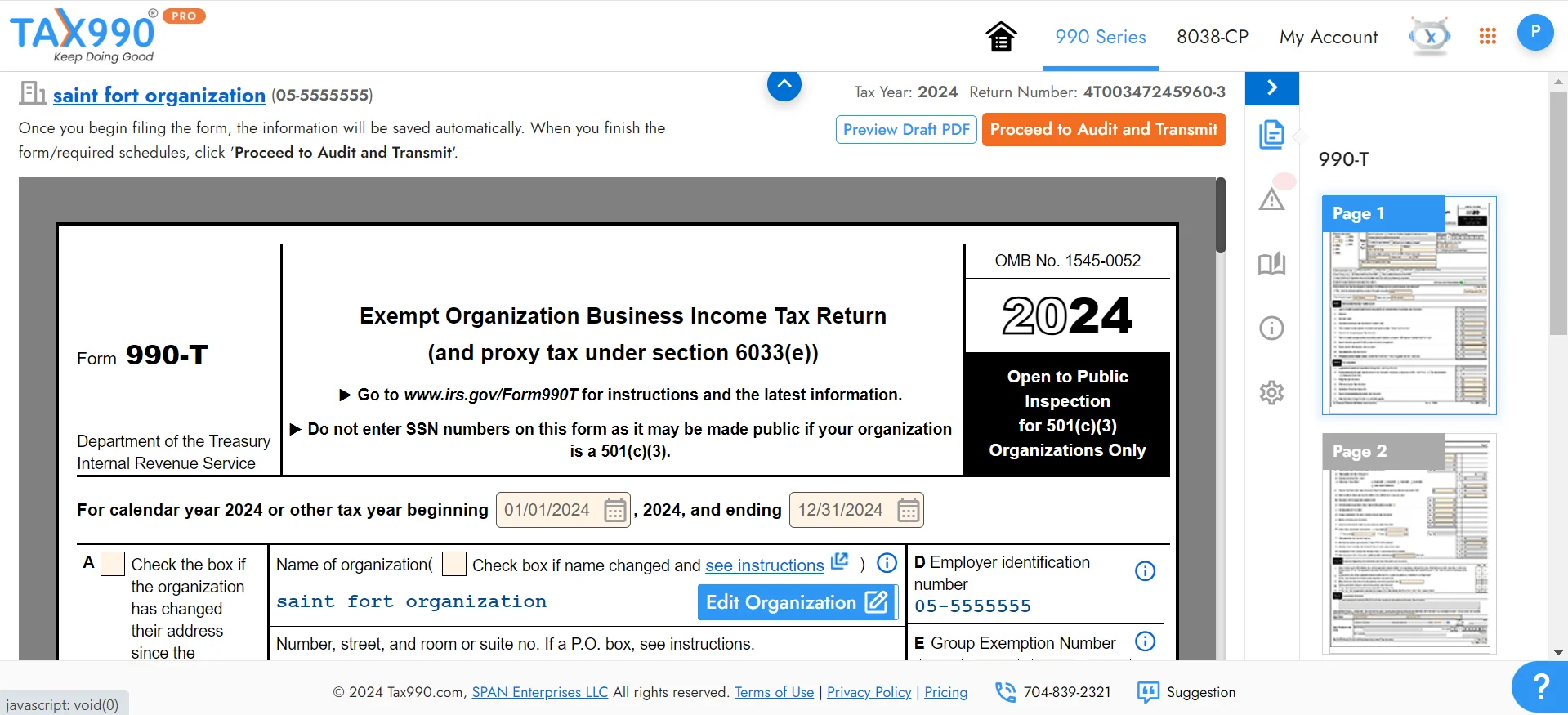

Enter Form 990-T Data

Use Form-based filing to complete your 990-T.

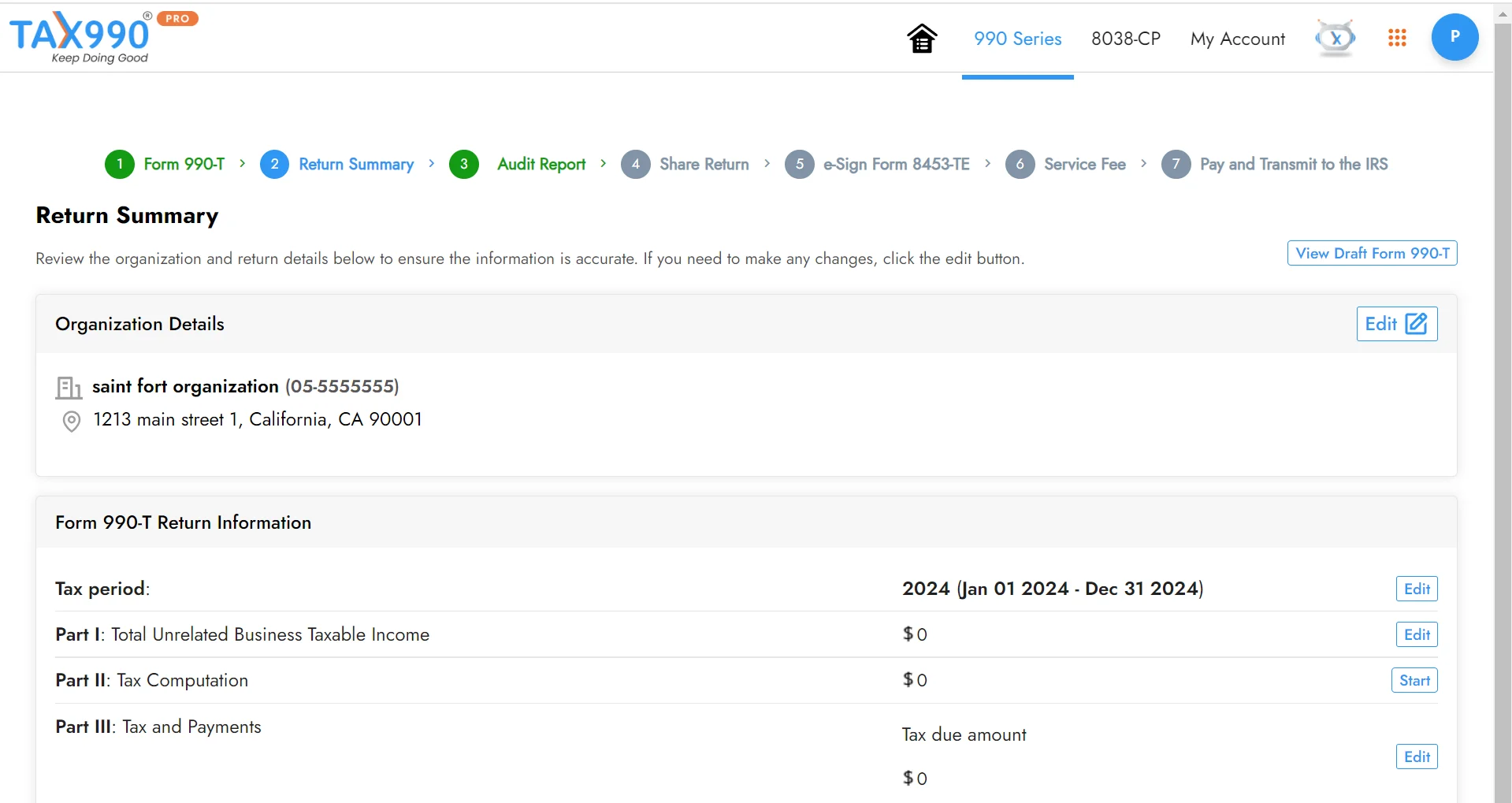

Review your Form Summary

Check your form summary, edit if needed, and share for review/approval.

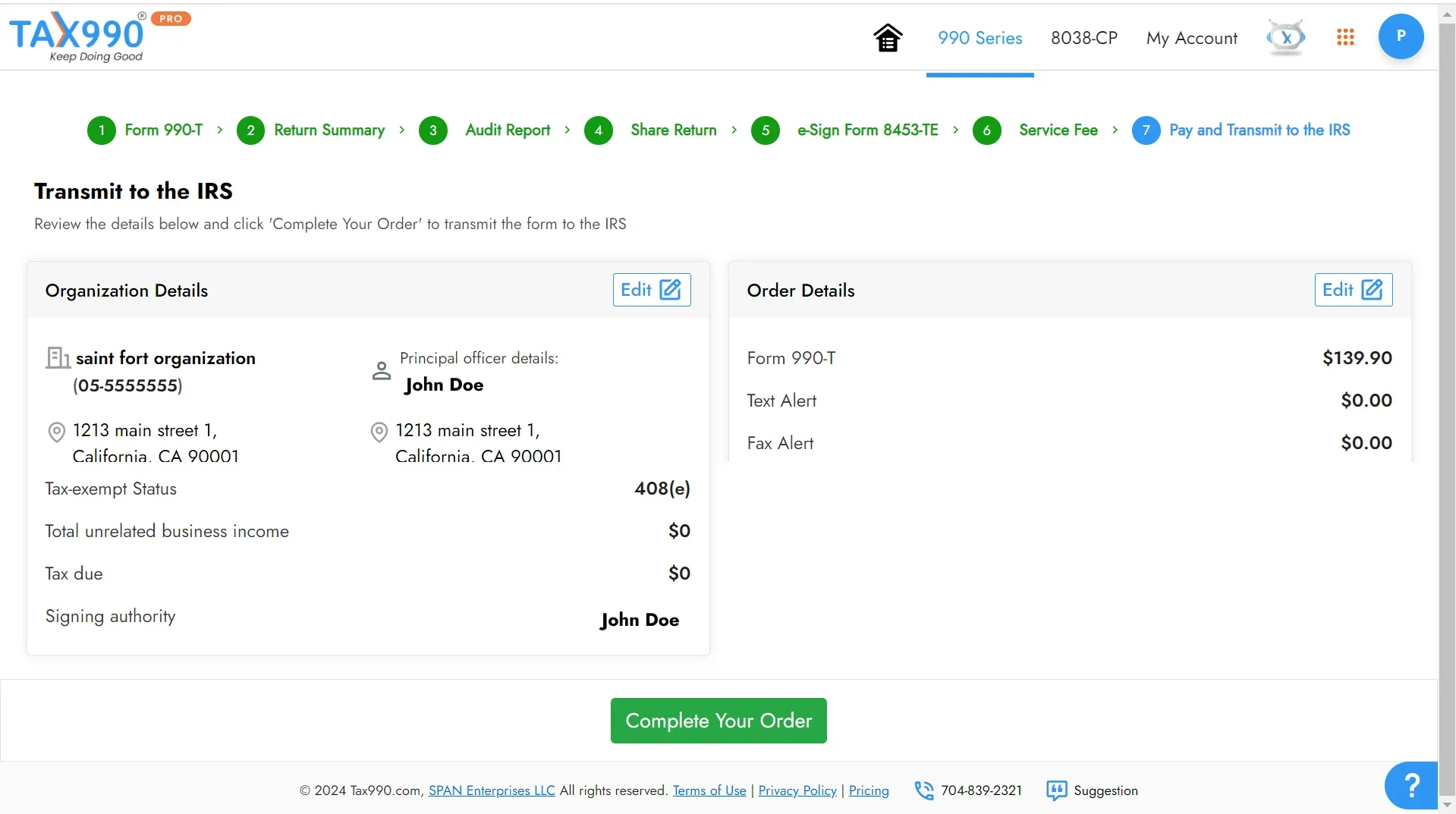

Transmit your Return to the IRS

Transmit your return and get real-time IRS status updates.

Are you ready to file 990-T online?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Form 990-T Pricing with Tax990

$99.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back