An Overview of Form 990 Vs Form 990-EZ:

- Updated October 11, 2023 - 2.00 PM - Admin, Tax990

Being a nonprofit organization, you'll likely deal with various 990 forms on an annual basis. It’s crucial to thoroughly comprehend each form to effectively and precisely meet your filing obligations.

Here, you can understand the difference between two of the commonly used forms for nonprofits, Form 990 and Form 990-EZ.

Table of Contents

What is Form 990?

-

Form 990 is an annual information return filed by nonprofit and tax-exempt entities to report their financial details, activities, and other mandated information according to section 6033 to the IRS.

-

Through Form 990 and the data it contains, the IRS verifies organizations' adherence to established regulations, concurrently offering transparency to potential donors.

What is Form 990-EZ?

-

Form 990-EZ is actually a shortened version of the 990 Form, which is filled by nonprofits and tax-exempt entities whose gross receipts and assets are lesser when compared to 990 filers.

-

The type of information reported on 990-EZ is almost the same as the 990 Form. The IRS will use this information to make sure the filing organization stays in line with the guidelines established.

Form 990 Vs Form 990-EZ: What’s the Difference?

Although the purpose of both these forms is nearly the same, there are several significant differences between them that you should be mindful of. Here they are:

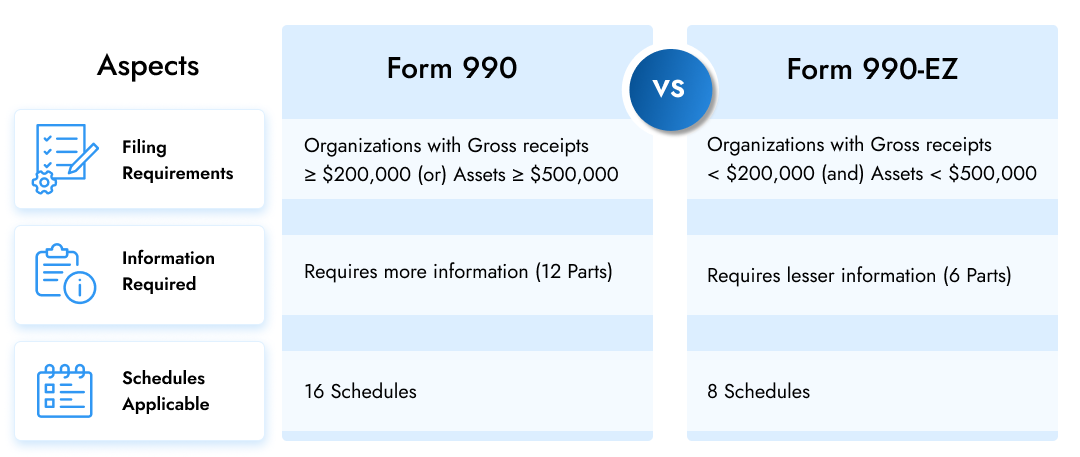

Filing Requirements

Form 990 is for tax-exempt organizations with gross receipts of $200,000 or more (or) total assets of $500,000 or more, whereas Form 990-EZ is for organizations with gross receipts less than $200,000 (and) total assets less than $500,000.

Information Required

Form 990 is a long form comprising 12 parts and thus requires a lot of additional information, such as Statements of revenue, expenses, and reconciliations. Comparatively, Form 990-EZ is shorter, comprising just 6 parts, requires less information, and doesn’t require detailed statements and reconciliations.

Schedules Applicable

The number of Schedules applicable for both these forms is different. There are 16 Schedules applicable for Form 990, whereas for Form 990-EZ, only 8 Schedules are applicable.

Here is the summary of the differences between Form 990 and 990-EZ:

Common Use Cases

1. My organization’s gross receipts are $150,000 and assets are $600,000. Can I still file

Form 990-EZ?

No! Your organization’s gross receipts should be less than $200,000 (and) assets should be less than $500,000 in order to be eligible for filing Form 990-EZ.

Therefore, in this case, you should file Form 990.

2. My organization’s gross receipts are $150,000 and assets are $300,000. Can I file Form 990 instead of 990-EZ?

Of course! You can voluntarily choose and file Form 990 voluntarily instead of 990-EZ in this case.

3. Last year, I filed Form 990-EZ for my organization. Can I repeat the same this year?

Maybe! It depends on the gross receipts and assets of your organization during the respective tax year. So, based on that, you must choose and file the applicable 990 form for each year.