An Overview of Form 990-N Vs Form 990-EZ:

- Updated on June 12, 2024 - 2.00 PM - Admin, Tax990

As a nonprofit organization, ensuring 990 compliance is inevitable. With different versions of 990 forms available, it is important that you have a clear-cut understanding of each form to fulfill your filing requirements accurately and comply with the IRS.

Here, you can understand the difference between two of the commonly used forms for nonprofits, Form 990-EZ and Form 990-N.

Table of Contents

What is Form 990-N?

- Form 990-N, known as an e-postcard,, is for small tax-exempt organizations to file their annual filing requirements.

- By filing Form 990-N every year, the organizations can indicate to the IRS that they were operating during the corresponding tax year.

What is Form 990-EZ?

Form 990-EZ, known as Short Form (midsized tax-exempt organizations), is an IRS form filed by certain tax-exempt entities, nonexempt charitable trusts, and section 527 political organizations to report their financial information, activities, and more to the IRS every year.

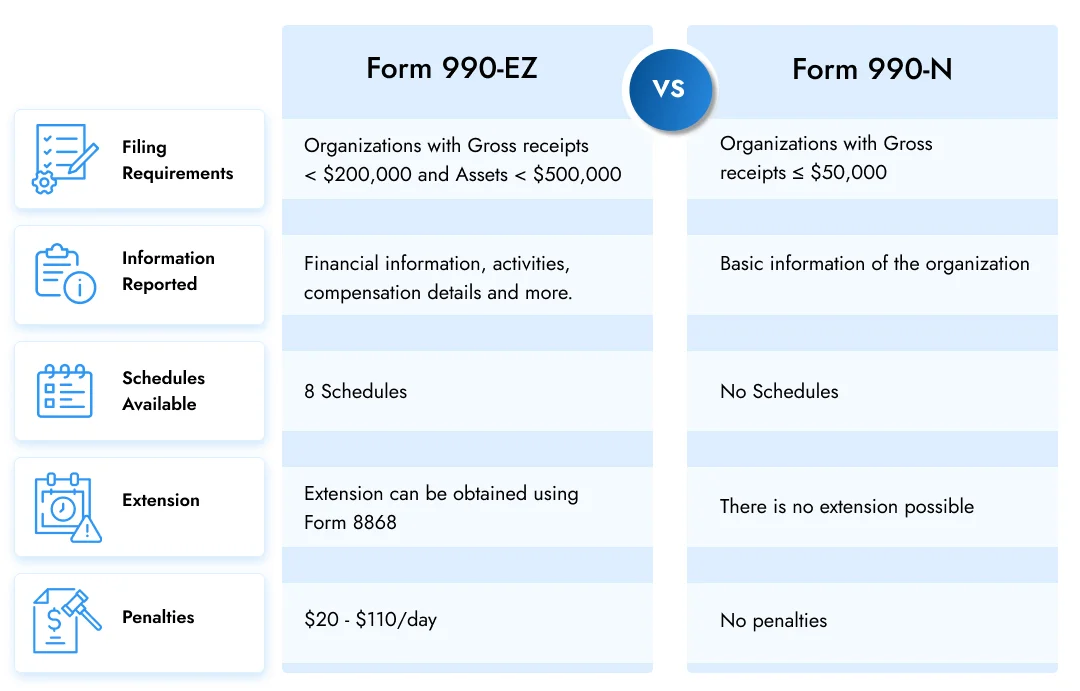

Form 990-N Vs Form 990-EZ: What’s the Difference?

Though the purpose for these forms is almost the same, there are many notable differences between them that you should be aware of. Here are they:

-

Filing Requirements

- Form 990-N: This form can be filed by organizations whose gross receipts are $50,000 or less.

- Form 990-EZ: This form can be filed by organizations whose gross receipts are < $200,000 and assets < $500,000.

Note:

Organizations that are eligible to file Form 990-N can choose to file 990-EZ voluntarily. However, 990-EZ filers cannot choose to file 990-N instead.

-

Information Reported

Form 990-N: The organization must have the following basic information available to file Form 990-N.

- Organization’s EIN

- Organization’s accounting period

- Legal name and mailing address

- Principal officer details

- Confirmation that the organization's annual gross receipts are $50,000 or less

- Statement of termination (if applicable)

Form 990-EZ: This form requires the organization to provide a lot of information. Primarily, the organization will need to have the following information available for filing 990-EZ.

- The organization’s basic information

- Financial information such as revenue, expenses, assets, and liabilities

- Program service accomplishments

- Principal officer details

- Other IRS filings and tax compliance requirements

- Compensation details of the organization’s key members

-

Schedules Required

- Form 990-EZ: There are 8 Schedules available for Form 990-EZ, ie (Schedule A, B, C, E, G, L, N, and O)

- Form 990-N: On the other hand, for Form 990-N, there are no additional Schedules required.

-

Extension

- Form 990-N: The deadline to file Form 990-N cannot be extended.

- Form 990-EZ: The deadline for filing 990-EZ can be extended for 6 months by filing Form 8868.

-

Penalties

- Form 990-N: There are no penalties if the organization fails to file 990-N within the deadline. However, the IRS will revoke the organization’s tax-exempt status if it fails to file 990-N for 3 consecutive years.

-

Form 990-EZ: Failing to file a 990-EZ return on time will lead to penalties of $20/day - $120/day. Also the automatic revocation will also apply if the organization fails to file 990-EZ for 3

consecutive years.

Due Date:

Both 990-EZ & 990-N Forms are due on the 15th day of the 5th month after their organization's

tax year ends.

Here is the summary of differences between Form 990-N and 990-EZ:

Common Use Cases

1.

My organization’s gross receipts are less than $50,000. Can I Still File Form 990-EZ

instead of 990-N?

Yes, you can! Even if your organization’s gross receipts are less, you can choose to file Form 990-EZ (or Form 990) voluntarily.

2.Can I file both 990-N and 990-EZ?

No! An organization can just file any one of these 990 Forms to meet annual filing requirements.

3.My organization’s gross receipts are $100,000. But assets are greater than $500,000. Can I still file Form 990-EZ?

No! In order to be eligible for filing Form 990-EZ, your organization’s gross receipts should be less than $200,000 (and) assets should be less than $500,000.

In this case, you must file Form 990 to fulfill your annual filing requirements.

4.The gross receipts of my organization are $75,000. Can I File Form 990-N

instead of 990-EZ?

No! You cannot file 990-N since your organization’s gross receipts are higher. However, you can choose to file Form 990 instead of 990-EZ voluntarily.

5.The gross receipts of my private foundation are less than $50,000. Can I file Form 990-N?

No! Private foundations are required to file Form 990-PF irrespective of their gross receipts. So, in this case, you must file Form 990-PF to meet your annual filing requirements.