and Audits?

We’ve Got You Covered!

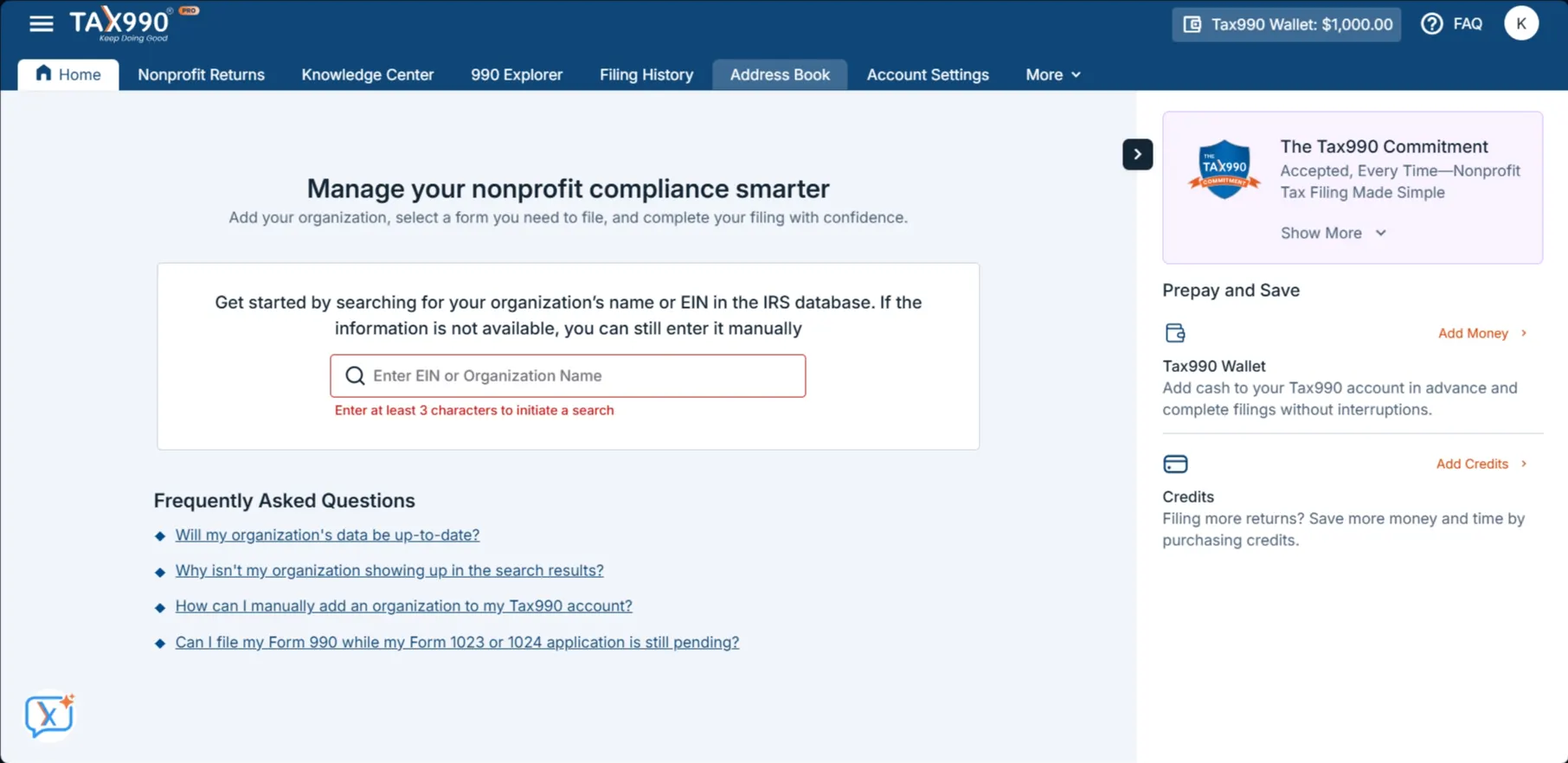

The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to get your forms accepted.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

Retransmit Rejected Returns

If the IRS rejects your return, you can fix and retransmit the return at no additional cost.

The Ultimate 990-N Filing Solution Built for Ease and Accuracy

File your 990-N easily and accurately using our intuitive features.

3-Step Filing

You can complete and e-file your e-postcard in just 3 simple steps with Tax 990.

File From Any Device

E-file Form 990-N from any device, including desktop, mobile, or tablet.

View Filing History

Tax990 provides you with the option to view and access the filing history of your organization.

Get Instant Notifications

Receive instant notifications about your filing status and IRS updates as soon as they happen.

Smart AI Assistance

Our AI-powered assistant is available around the clock to answer your questions and guide you through the process.

World-Class Customer Support

Need help? Our experienced support team is ready via chat, phone, or email whenever you need it.

Form 990-N filing doesn’t have to be complicated!

Exclusive Tools for Tax Professionals

Tax990 offers many exclusive features that simplify workflows for paid preparers and EROs who handle 990-N filings for their clients!

Streamlined Team Collaboration

Invite your team and simplify your 990-N workflow by assigning them tasks and roles.

The More You File, the More You Save

Maximize savings on filings with our volume-based pricing plans, while ensuring your clients stay compliant.

How to E-file Form 990-N with Tax990

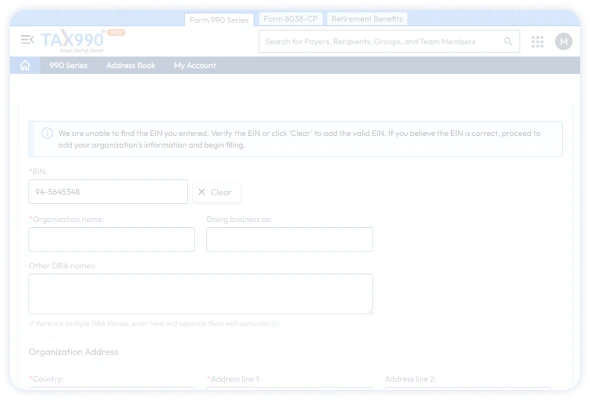

Search the Organization’s EIN

Just search for your EIN, and our system will automatically import your organization’s data from the IRS.

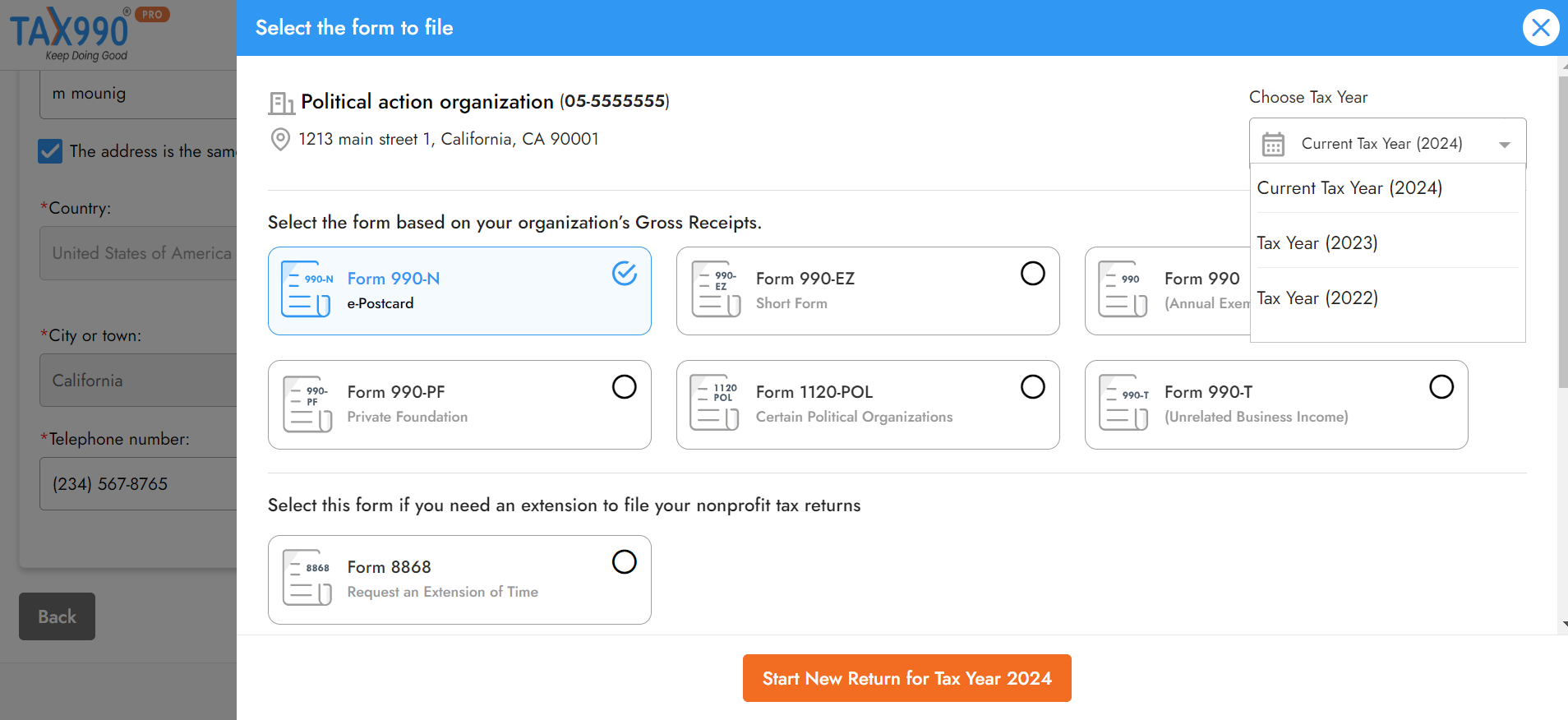

Choose Tax Year and Form

Tax 990 supports 990-N filing for the current and previous tax years. Choose the applicable tax year, select Form 990-N, and proceed.

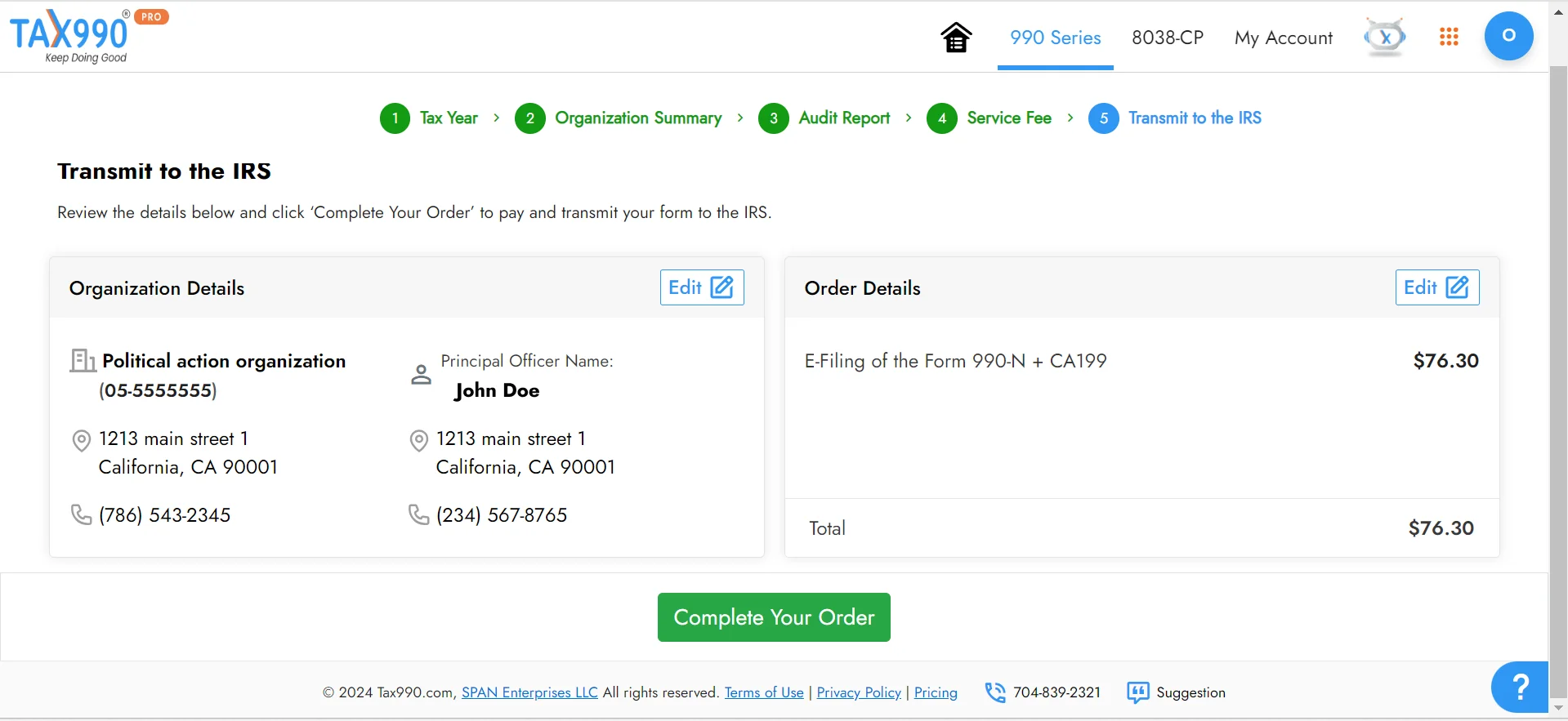

Review and transmit it to the IRS

Once you have reviewed your form, you can transmit it to the IRS. Our system will update you on your form status via email or text.

Ready to file 990-N online?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Form 990-N Pricing with Tax990

$19.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back