The deadline to file 990 series forms is June 16, 2025. E-File Now

The deadline to file 990 series forms is June 16, 2025. E-File Now

The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax

Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? We’ve got your back with a complimentary Form 8868 – simply file it to get extra time.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

No Cost Amendments

Found an error after filing? You can file up to 3 amendments without paying extra.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

The Ultimate 990 Filing Solution Built for Ease and Accuracy

File your 990 easily and accurately using our intuitive features tailored to your needs.

Choose How You Prepare Forms

You can opt to manually complete the form or let our simple Q&A walk you through it step by step.

Copy Prior Year’s Data

Get your returns prefilled with the prior year’s return data instantly from the IRS registry to speed up your filing.

Import Bulk Data in Seconds

Upload your organization data as well as the filing information in bulk as required using our Excel templates.

Built-in Audit Check

Our built-in error check system validates your form against IRS business rules to ensure accuracy before submission.

Instant AI Assistance

Get instant guidance from our AI-powered chatbot whenever you need it.

World-Class Customer Support

Got queries? Reach out to our support team anytime via live chat, phone, or email.

Form 990 filing is no more complicated!

Exclusive Tools for Tax Professionals

Discover our powerful features to simplify the filing workflows for paid preparers and EROs handling high-volume 990 filings

Streamlined Team Collaboration

Invite your team and simplify your 990 workflow by assigning them tasks and roles.

Manage Clients Effortlessly

Manage multiple client filings while facilitating a streamlined review process.

Simple E-Signing Options

Tax990 offers easy e-sign options for Form 8453-TE and Form 8879-TE.

File More, Spend Less

Save more with our volume-based pricing plans for high-volume filers.

How to E-file Form 990 with Tax990

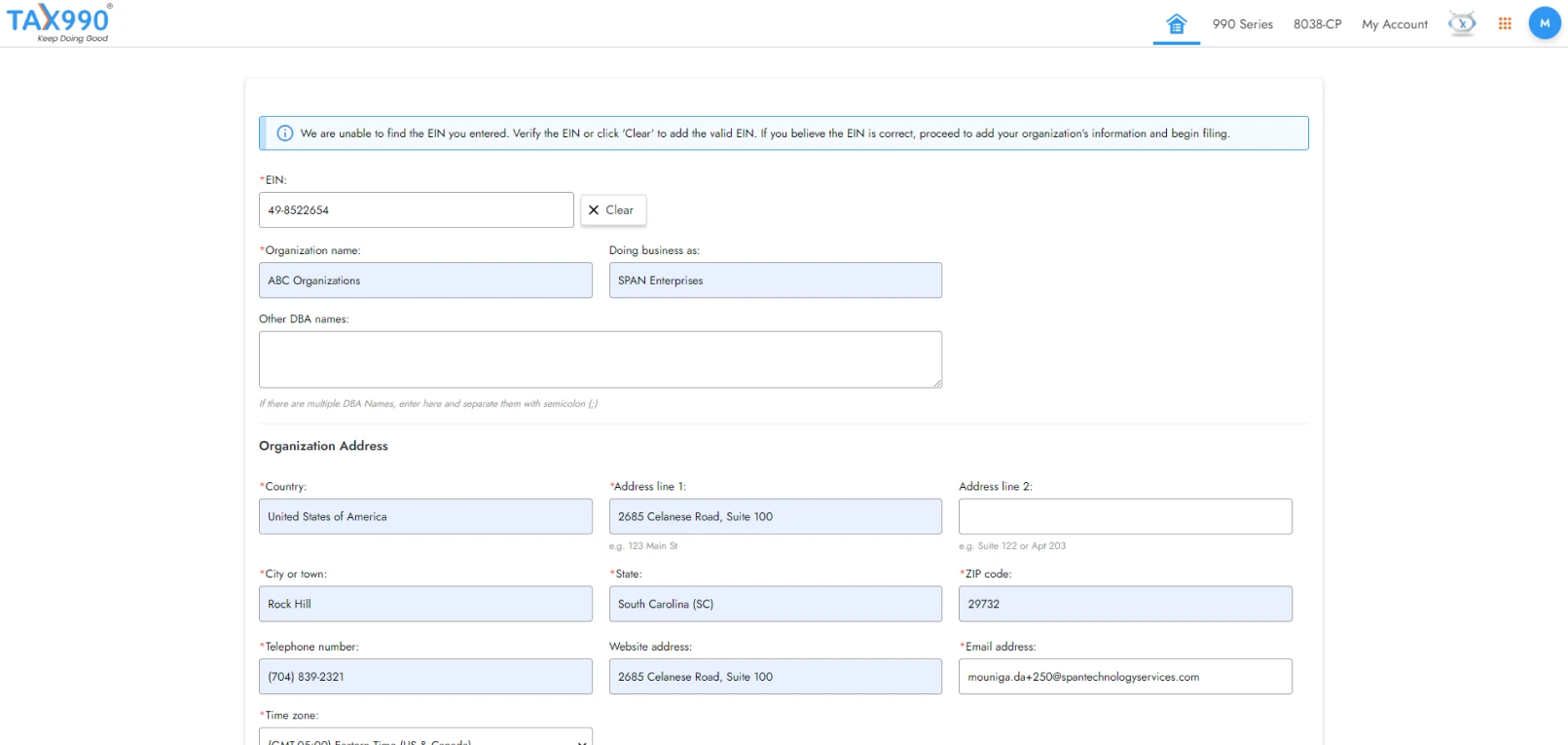

Add organization details

Search for your EIN to auto-fill foundation details or enter them manually.

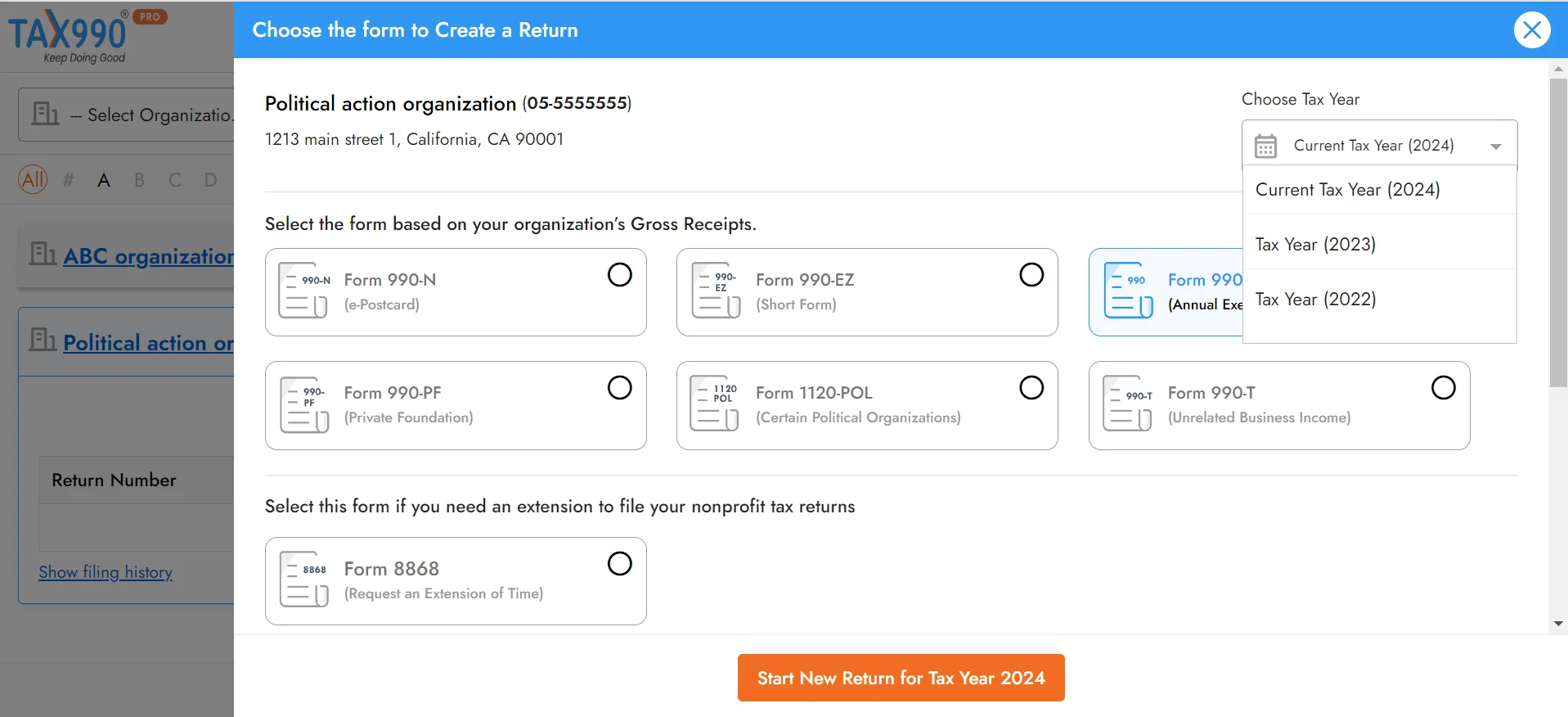

Choose tax year and form

Select Form 990 for the current or prior tax year and proceed.

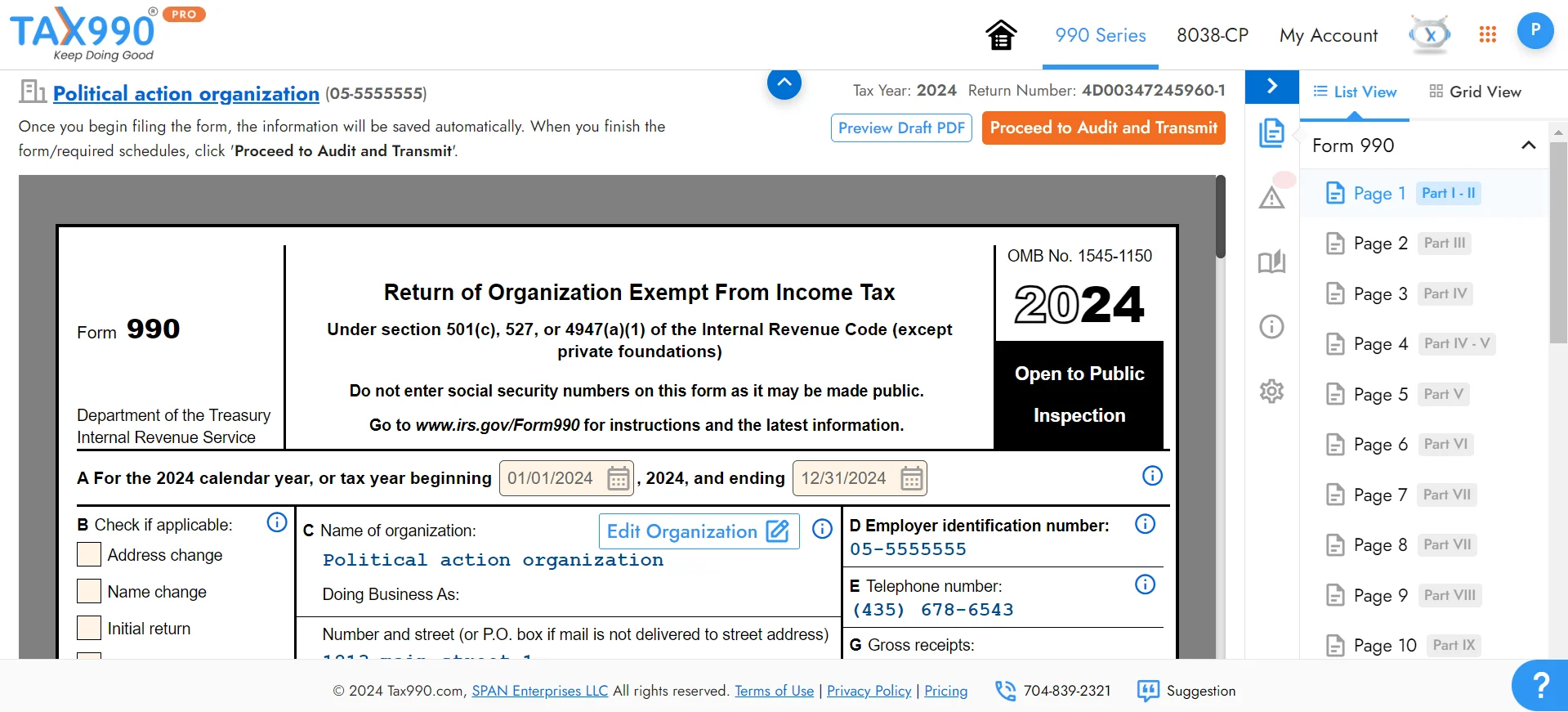

Enter Form 990 data

Use Form-based or interview-based Style filing to complete your 990.

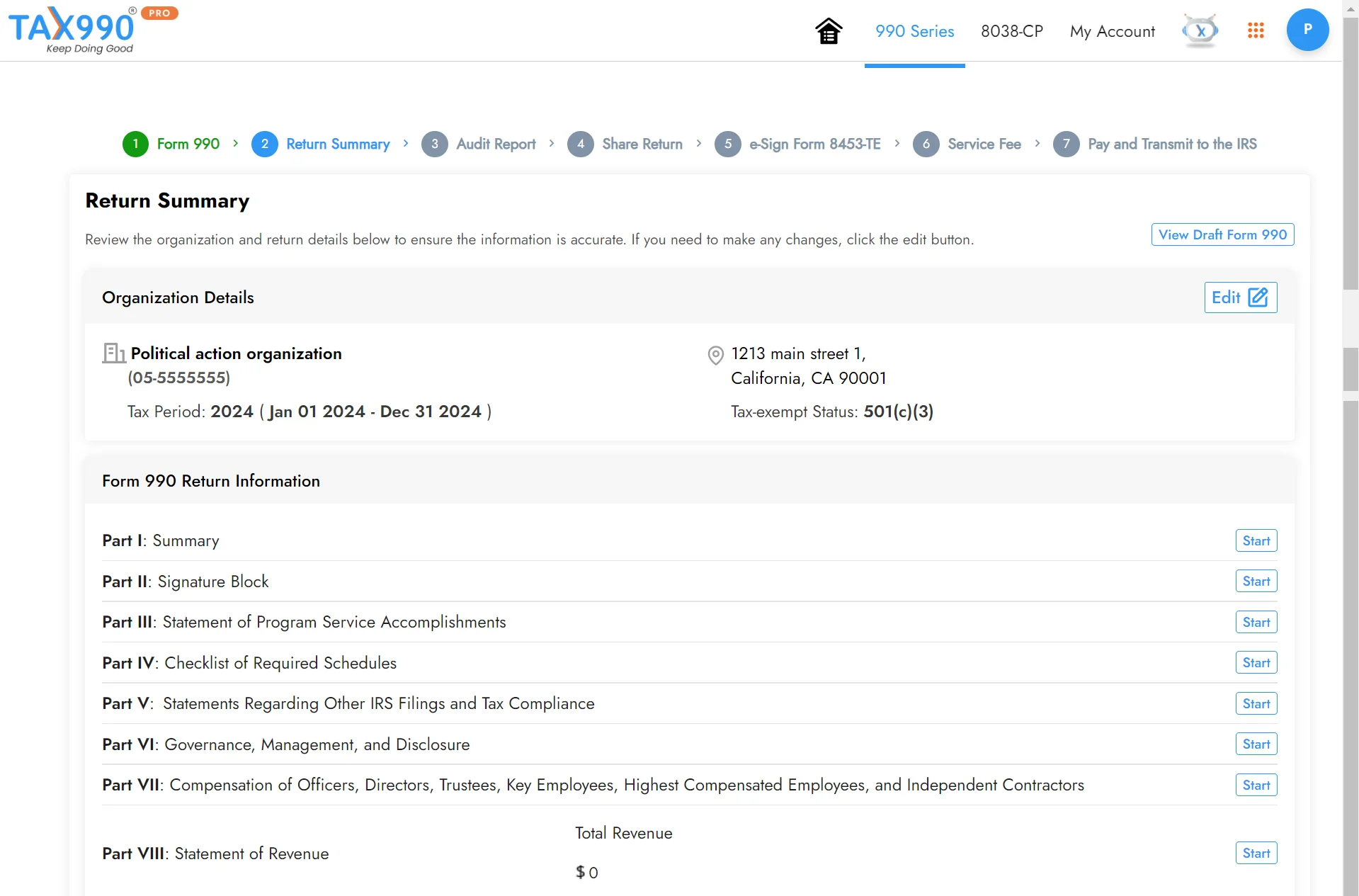

Review your form summary

Check your form summary, edit if needed, and share for review/approval.

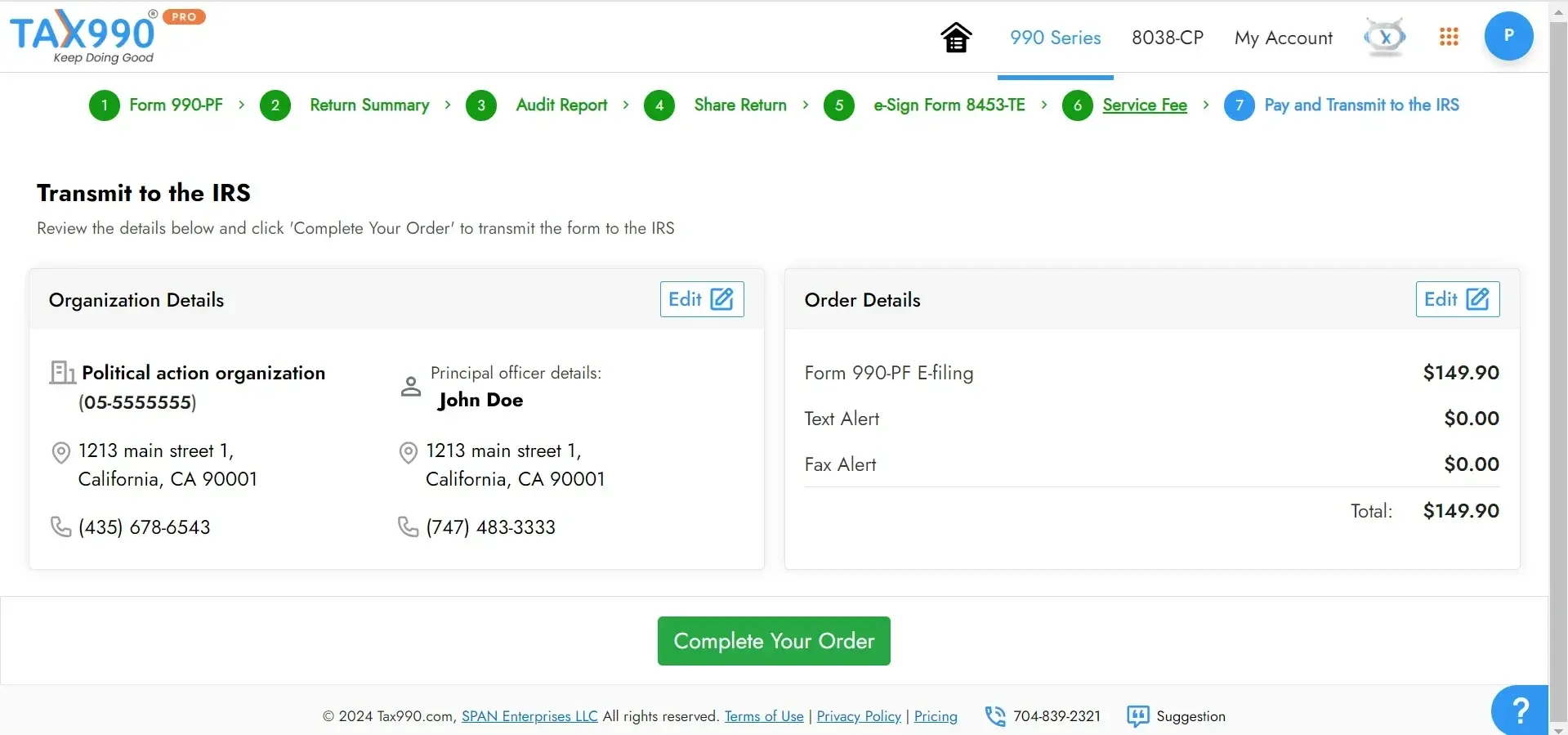

Transmit your return to the IRS

Transmit your return to the IRS and get real-time status updates.

Are you ready to file 990 online?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Pricing to E-File 990 with Tax990

$199.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- No Cost Corrections

- Guaranteed approval or money-back