The Tax990 Commitment

Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Complimentary Extension Requests

Don’t think you’ll meet the deadline? Pay for your 990 return upfront and file your 8868 at no additional cost. Only need an extension for now? File Form 8868 today, and we’ll credit the fee toward your 990 return when you come back to file.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

Retransmit Rejected Returns

If your return is rejected by the IRS due to any errors, you can update and retransmit the form easily, at no extra cost.

Efficient 8868 Filing Solution Tailored for Ease and Accuracy

File your 8868 easily and accurately using our intuitive features.

Direct Form Entry

Enter information directly into each section of Form 8868 using our intuitive interface, designed for clarity and ease.

Get Extension in Minutes

With Tax990, you can file your 990 extension in just a few minutes.

Built-in Audit Check

Our built-in error check system validates your form against IRS business rules to ensure accuracy before submission.

Get Instant Notifications

Receive instant notifications about your filing status and IRS updates as soon as they happen.

Instant AI Assistance

Get instant guidance from our AI-powered chatbot whenever you need it.

World-Class Customer Support

Help help? Reach out to our support team anytime via live chat, phone, or email.

Form 8868 filing doesn’t have to be complicated!

How to E-file Form 8868 with Tax990

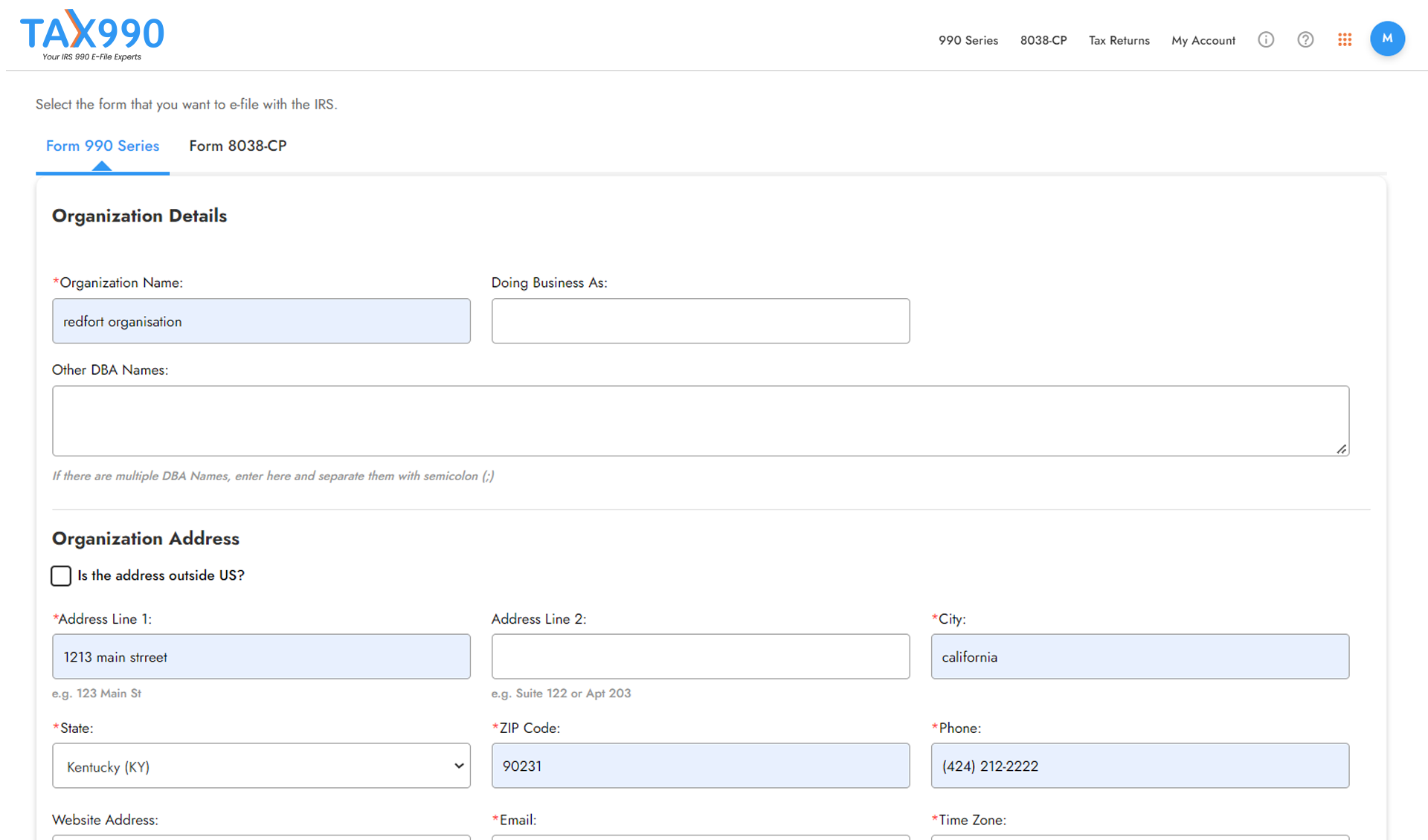

Add organization details

Search for your EIN to import your organization’s data from the IRS or enter your organization’s details manually.

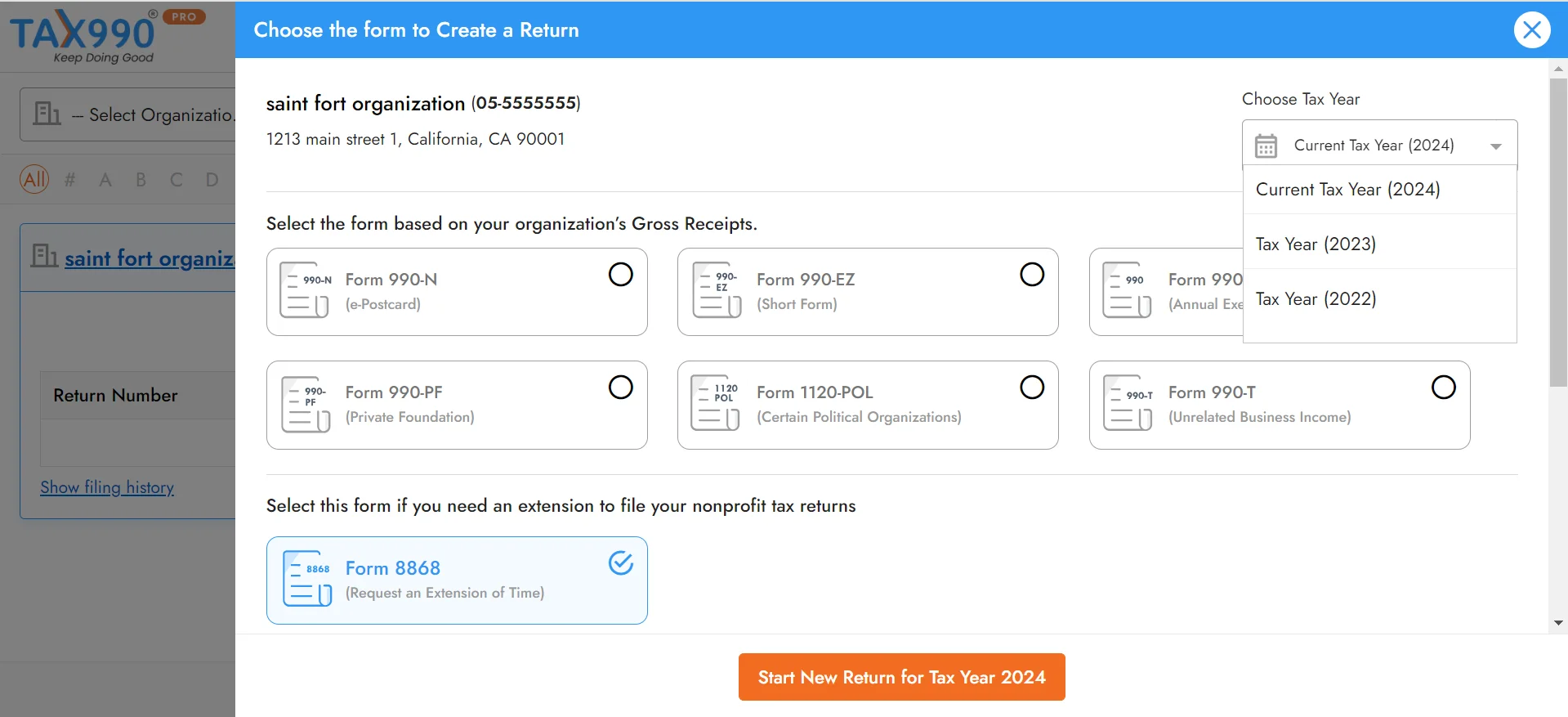

Choose Tax Year and Form

Choose the tax year for which you are required to file, and select Form 8868.

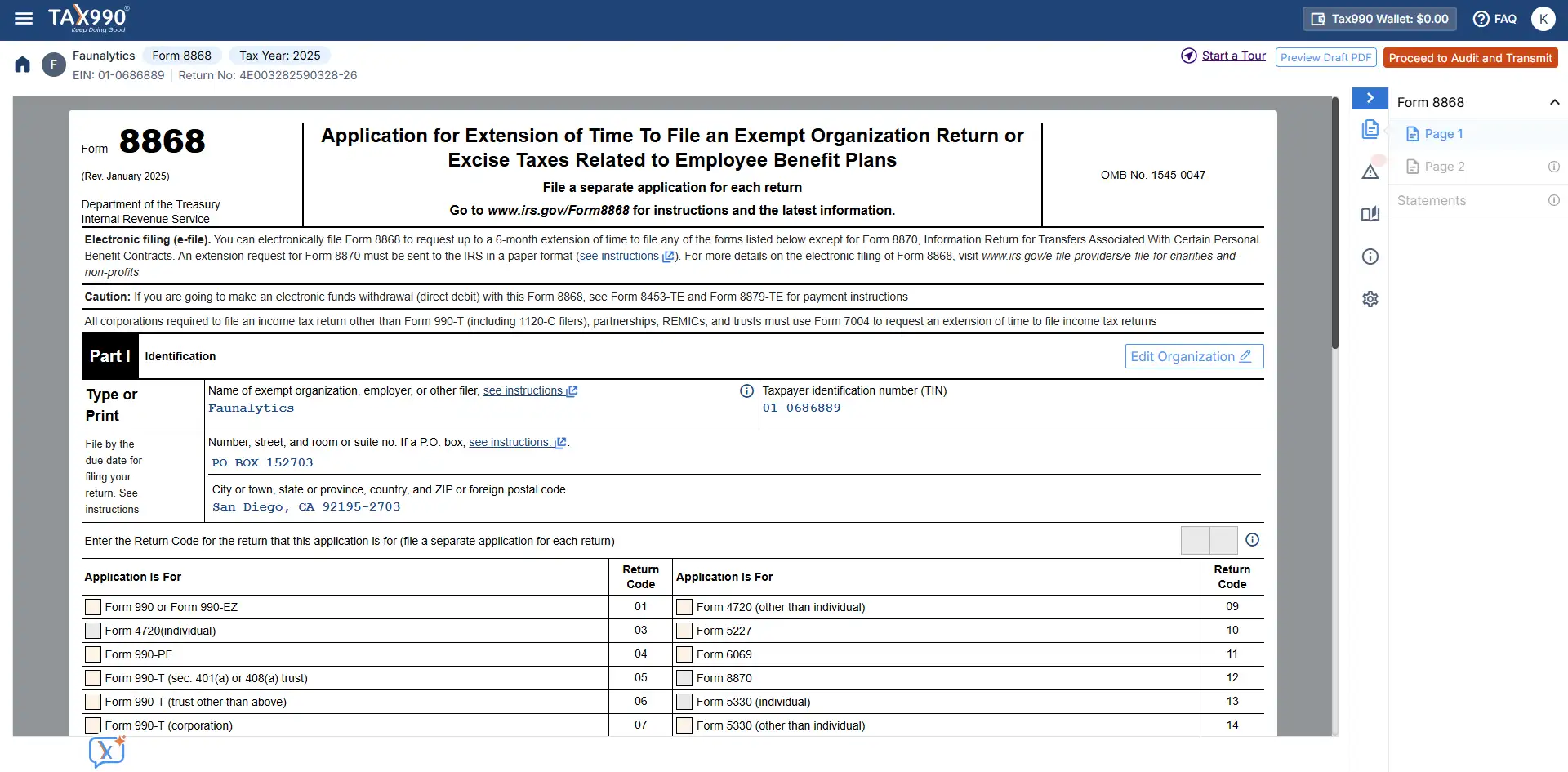

Enter Required Details

Select the return for which you need to file an extension and provide the required information for your Form 8868 extension.

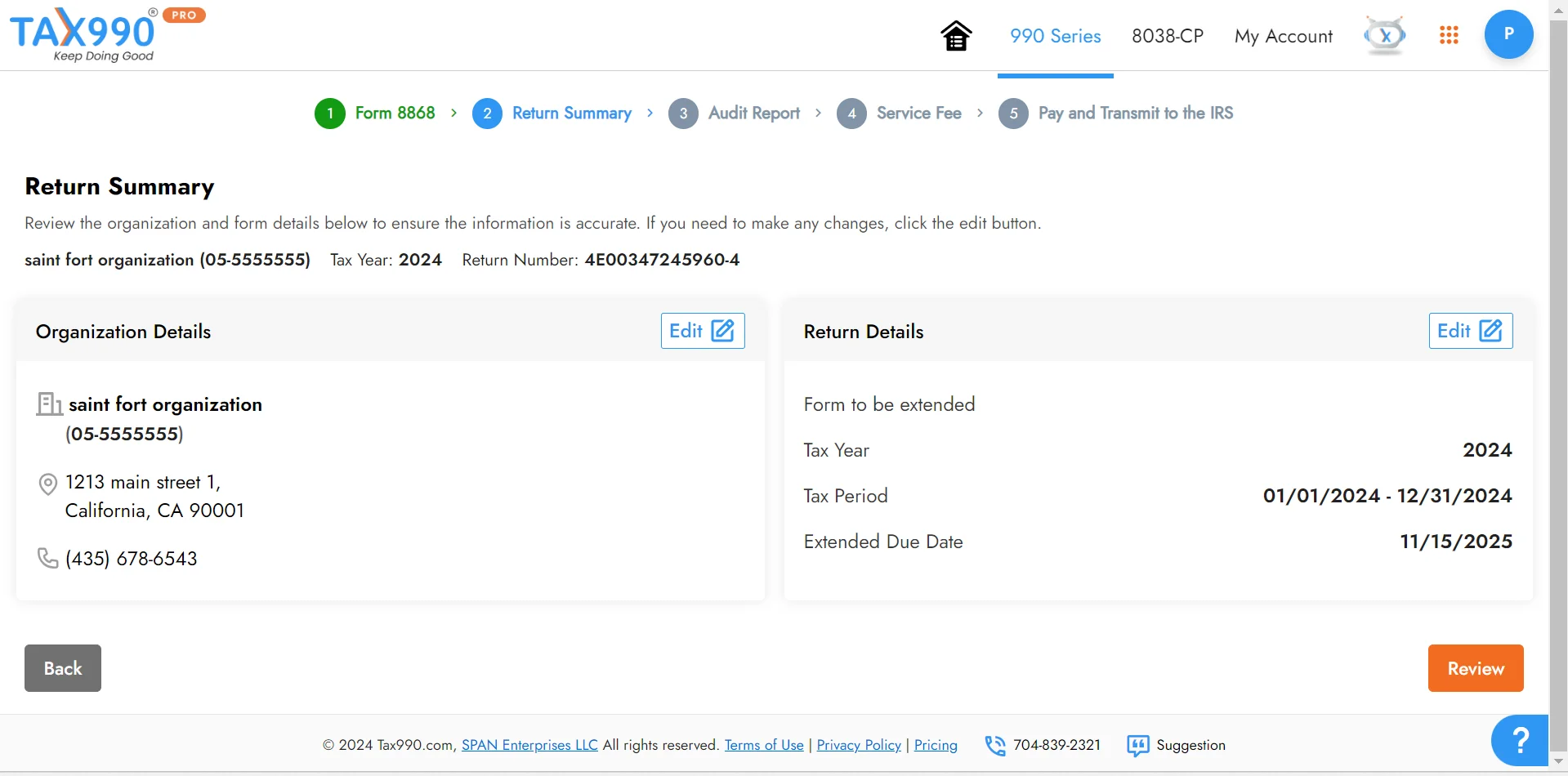

Review your form summary

Review your form summary. You also have the option to share your form with foundation members for review and approval.

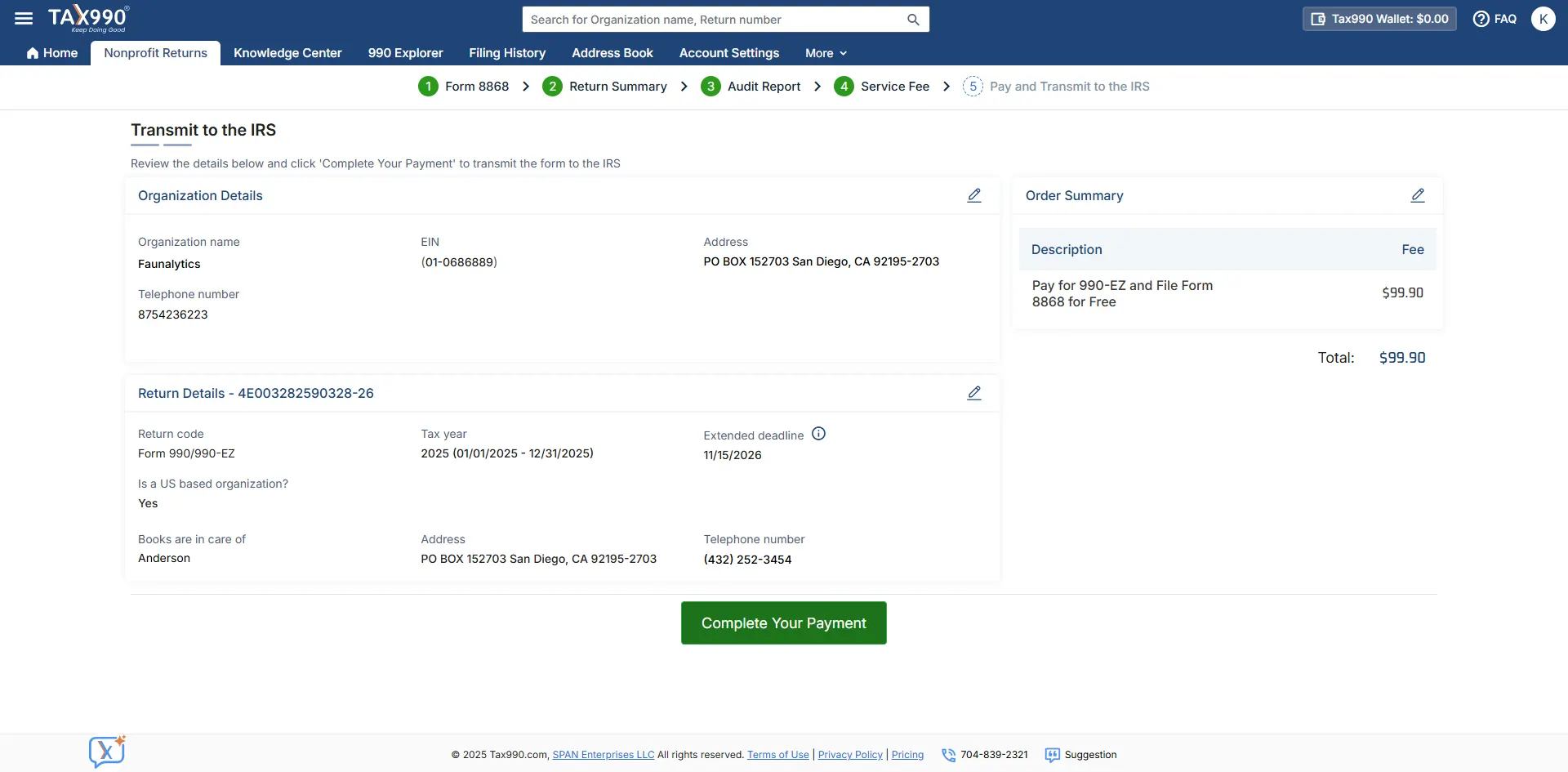

Transmit your return to the IRS

Once you have reviewed the form, you can transmit it to the IRS. The IRS will provide you with a 6-month automatic extension.

Ready to file Form 8868 online?

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Form 8868 Pricing with Tax990

$14.90/ Form

- Complimentary Extension Requests

- Retransmit Rejected Returns

- Money-Back Guarantee