Enhance Accuracy with AI-Powered Internal Audit System

- Reporting accurate information on your nonprofit tax returns is crucial. Filing Form 990 with incomplete or incorrect details can lead to unnecessary penalties.

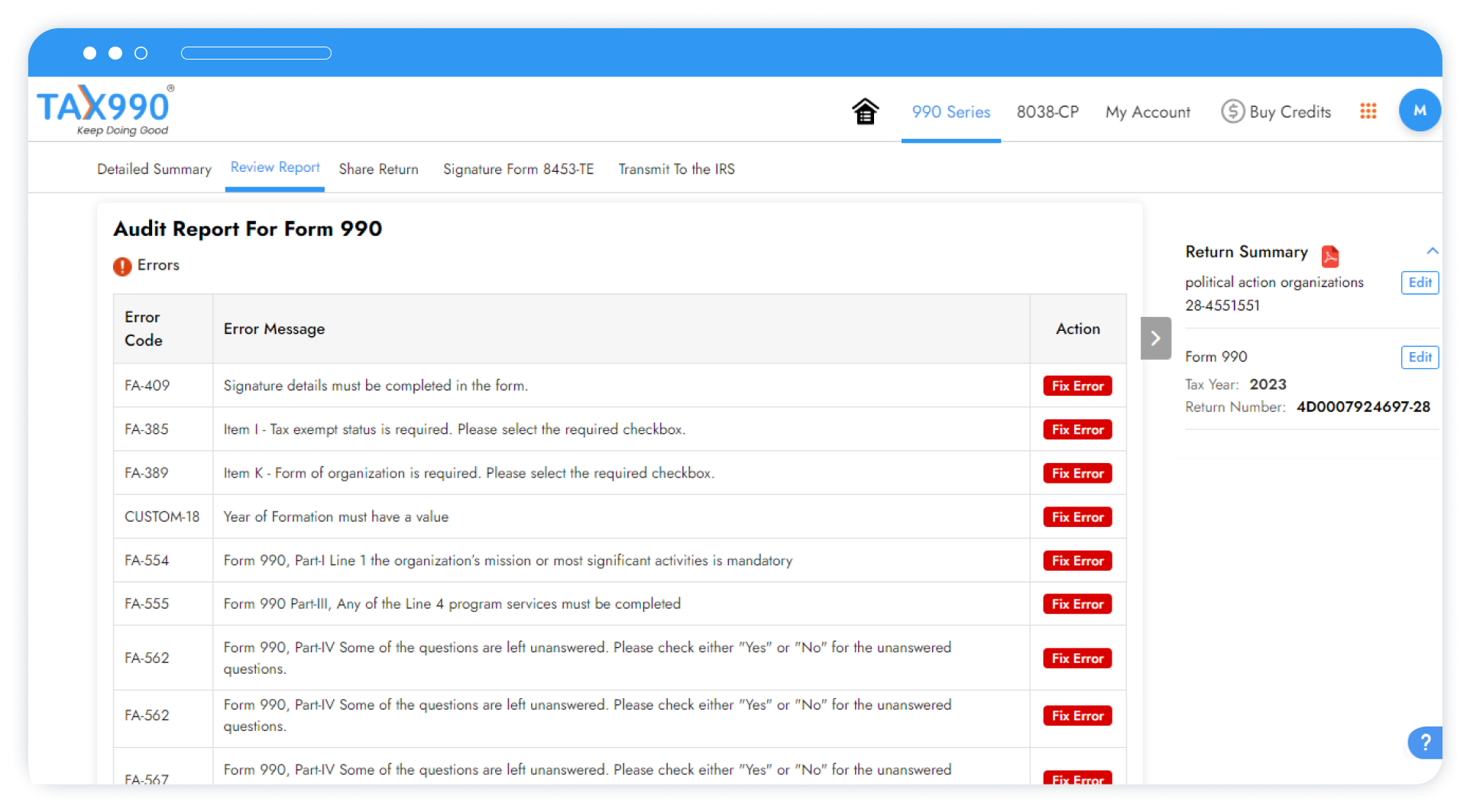

- Tax990’s AI-powered error check system reviews your completed forms against IRS Business Rules and guides you to fix any issues before transmission.

- With this feature, you can easily identify and correct IRS instruction errors, ensuring your returns are accurate and error-free.

How Internal Audit Check Works?

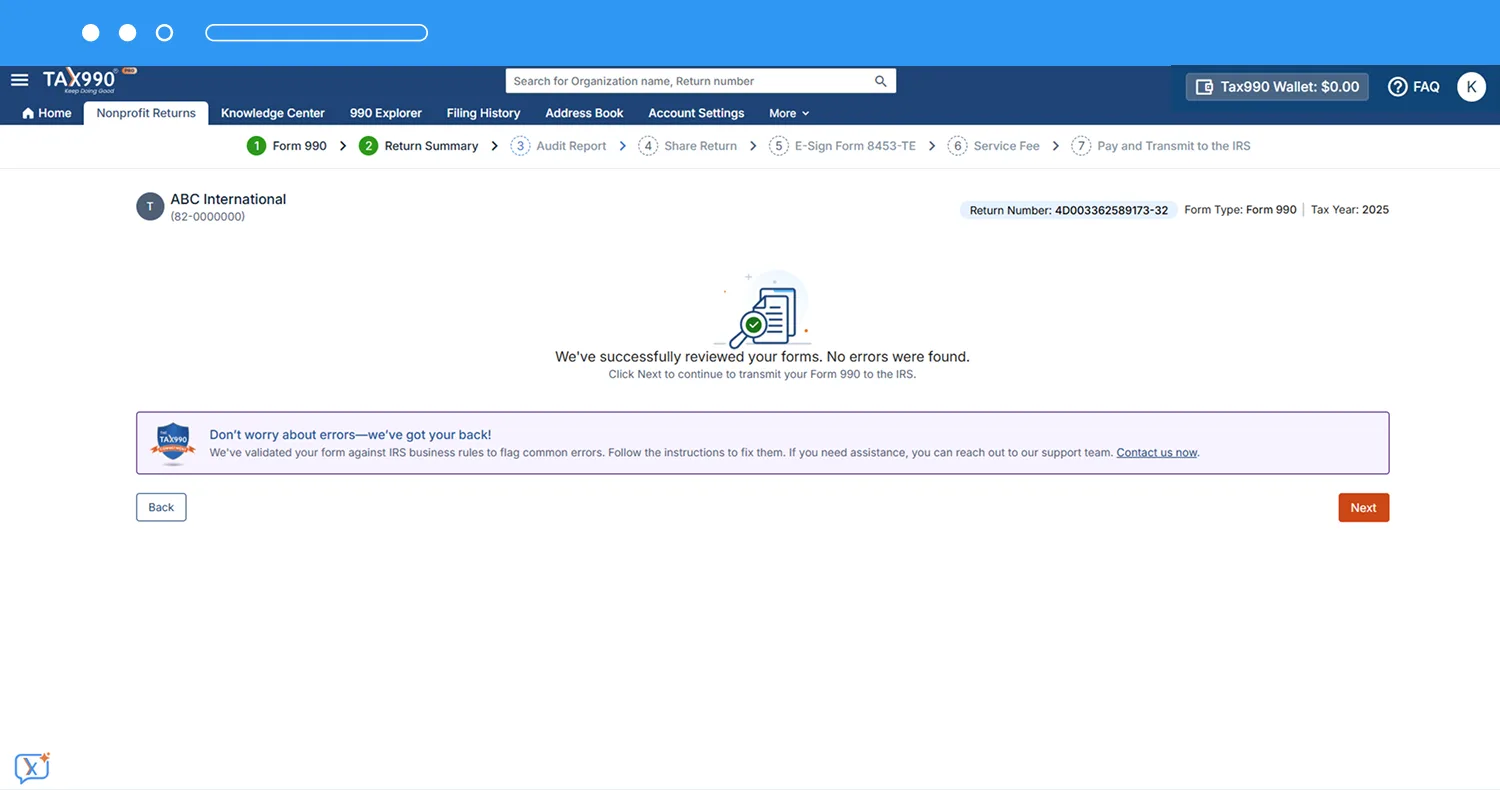

Let our system audit your return

Once you’ve completed your form, run our system audit to review your return against IRS Business Rules. It checks for missing details, inconsistencies, and compliance issues before you file.

Fix errors seamlessly with AI assistance

If any errors are found, our AI-powered assistant guides you through the corrections. It interprets IRS instructions, explains the issue, and suggests the right fix—helping you resolve errors quickly and accurately.

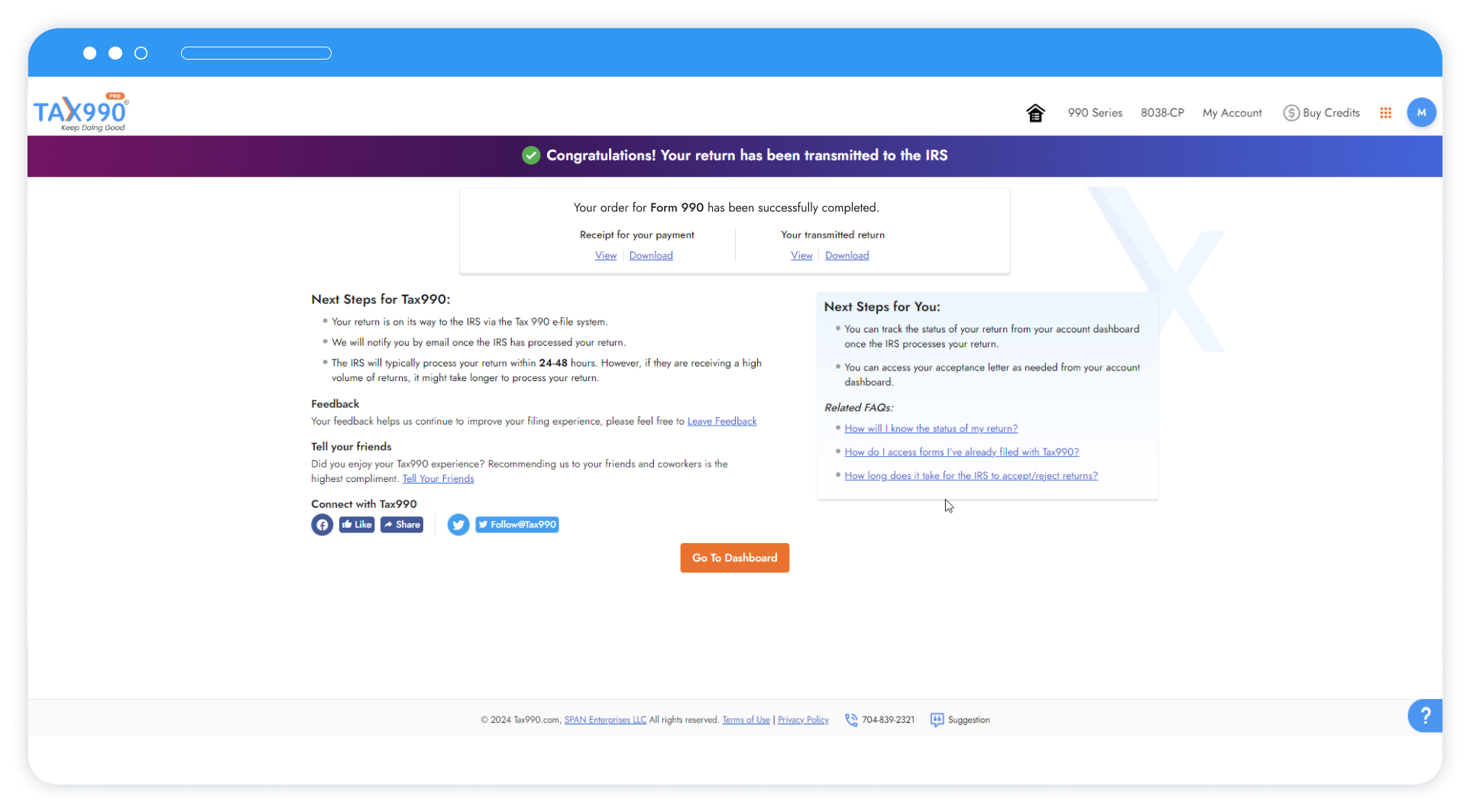

Transmit to the IRS Accurately

After reviewing and correcting your return, you can confidently transmit it to the IRS. With every error addressed, your form will be complete, compliant, and ready for smooth acceptance.

Frequently Asked Questions